Don't sell your crypto, borrow against it.

since 2018

client care 24/7

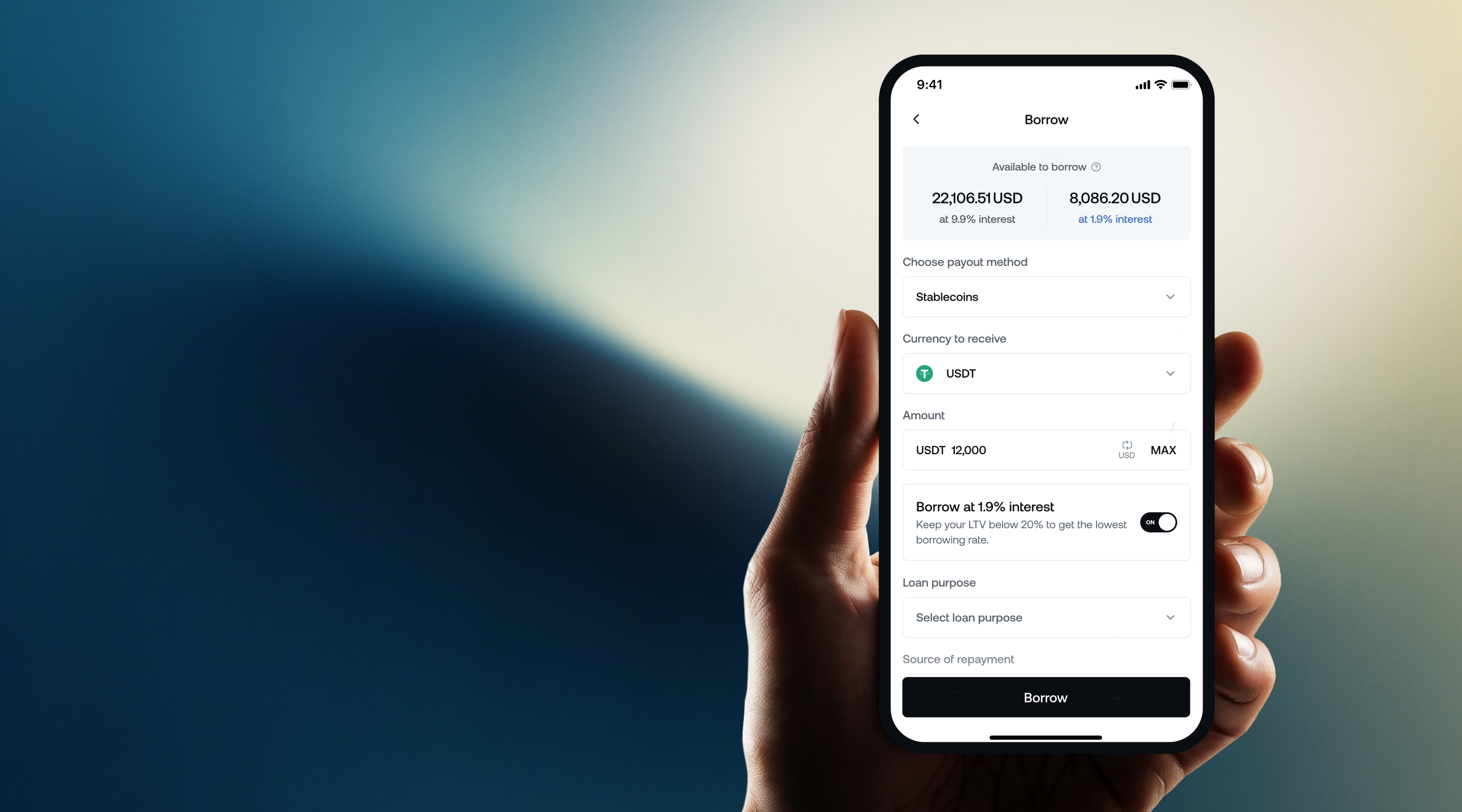

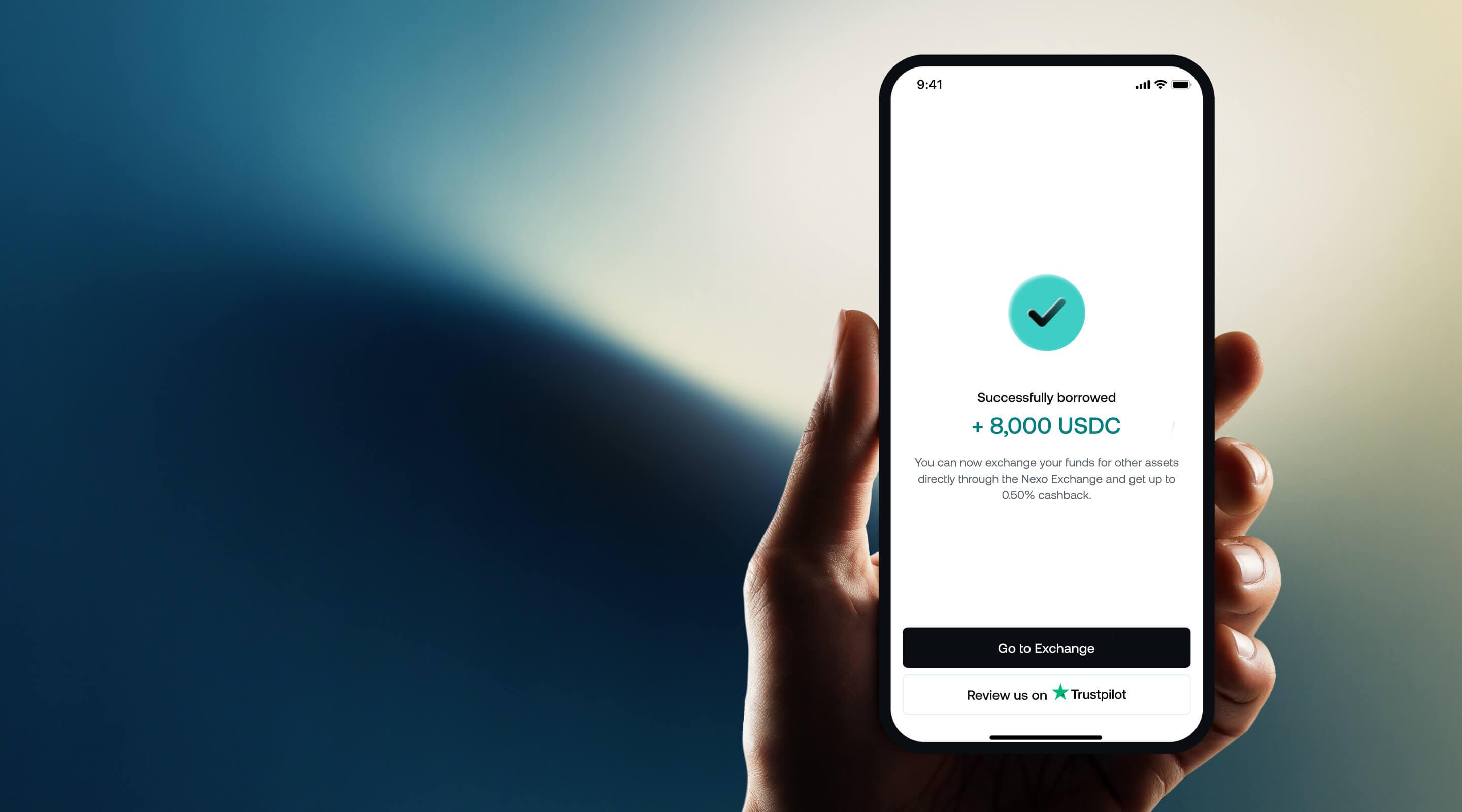

Open once, repay anytime, and use it again whenever you need.

Find out how much collateral you would need to borrow your desired amount.

The amount of NEXO Tokens you hold against the rest of your portfolio puts you into one of four Loyalty Tiers. Reach Platinum to get the best benefits across our entire offering.

| Borrow with your crypto as collateral | Sell your crypto | |

|---|---|---|

Stay invested and benefit if prices rise | ||

Access funds without selling your crypto | ||

Borrow instantly without credit checks | ||

Avoid taxes that come with selling crypto |

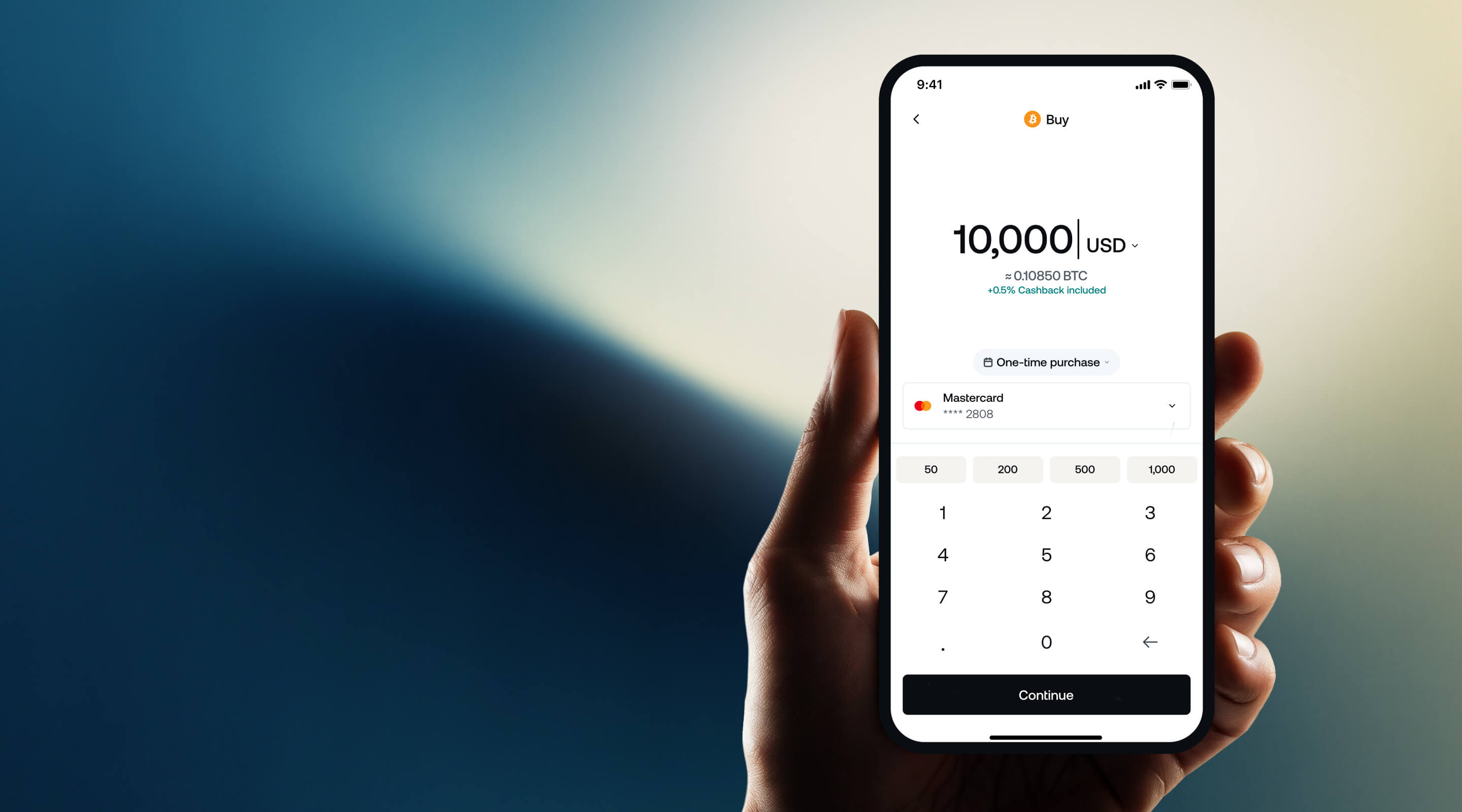

Pick from over 100 supported digital assets to borrow against and view their respective Loan-to-value (LTV) ratio.

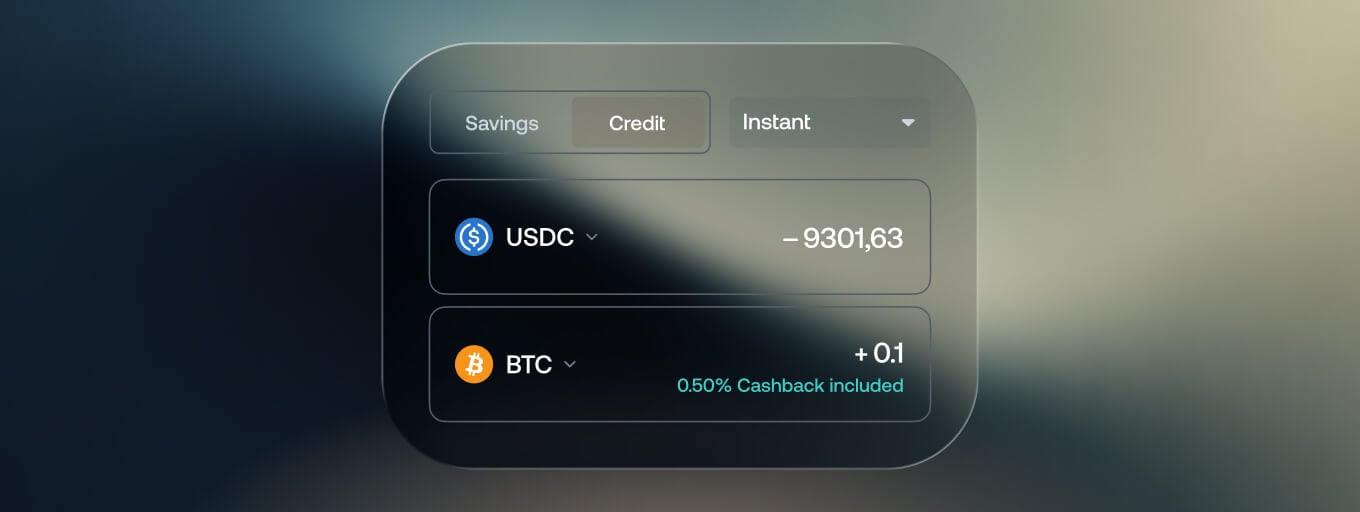

Unlike traditional loans that consider your credit score, Nexo offers a crypto-backed Credit Line that uses your digital assets as collateral. Once you top up, you can immediately utilize your Credit Line. You have two options for your loan.

To start utilizing your Credit Line, follow the steps detailed in our dedicated Help Center article.