別賣出您的加密資產,用它來借入所需資金。

2018 年起穩健營運至今

Galaxy Research 2025 年第二、三季評比 CeFi 借貸機構總貸款量排名第二

個人化

24 小時全年無休客戶服務

24 小時全年無休客戶服務

開立一次、隨時還款、隨時再用。

試算貸到需求金額需提供多少抵押品。

您所屬的會員等級將取決於 NEXO Token 在您整體投資組合中的佔比。 升級至 Platinum,可在所有產品中享有最惠權益。

| Borrow with your crypto as collateral | Sell your crypto | |

|---|---|---|

持續投資,於價格上漲時同步受惠 | ||

無須賣幣即可取得資金 | ||

即時借貸,無需信用審查 | ||

避免出售加密資產所產生的稅務 |

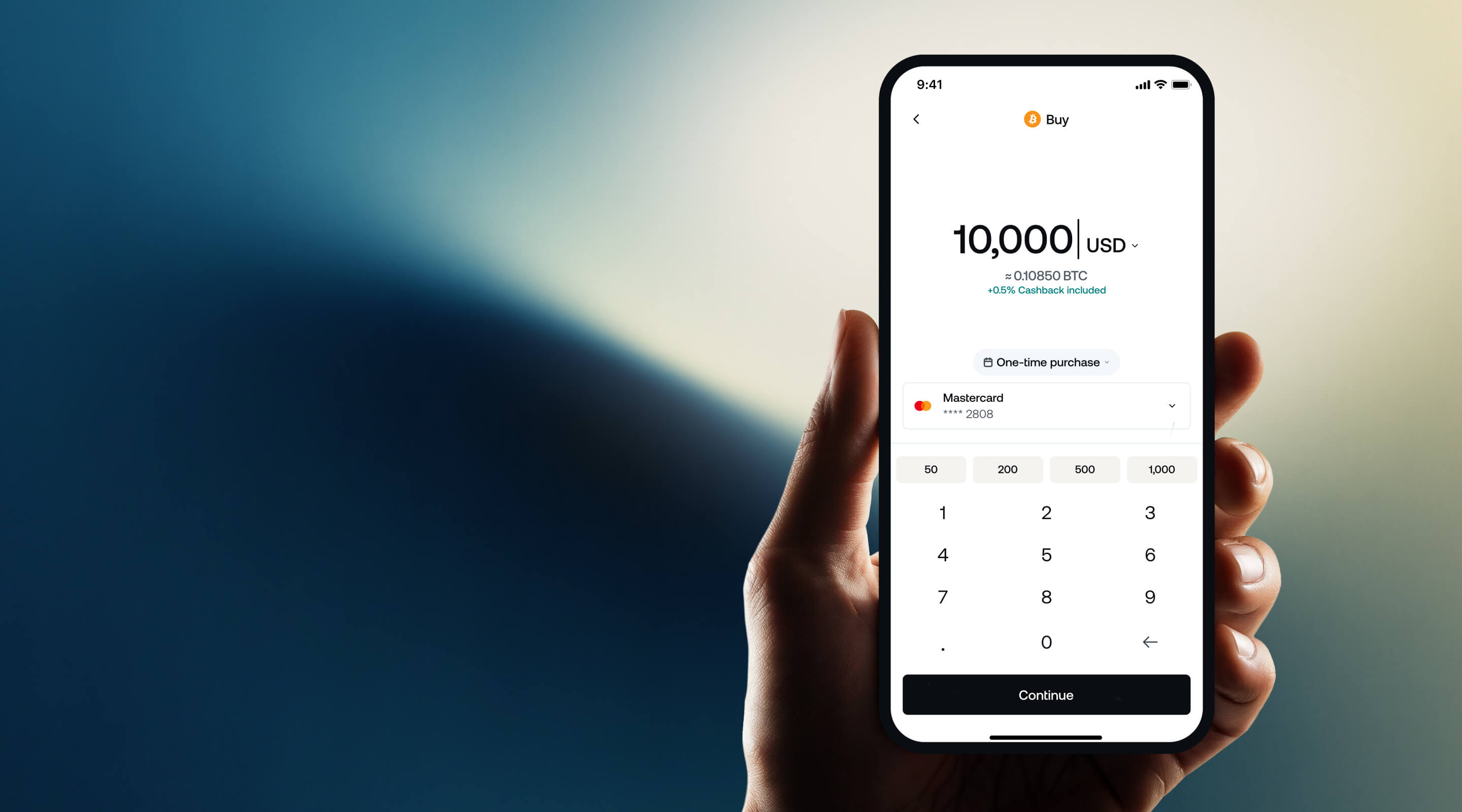

從超過 100 種支援的數位資產中選擇抵押標的,並查看各類資產的貸款成數比 (LTV)。

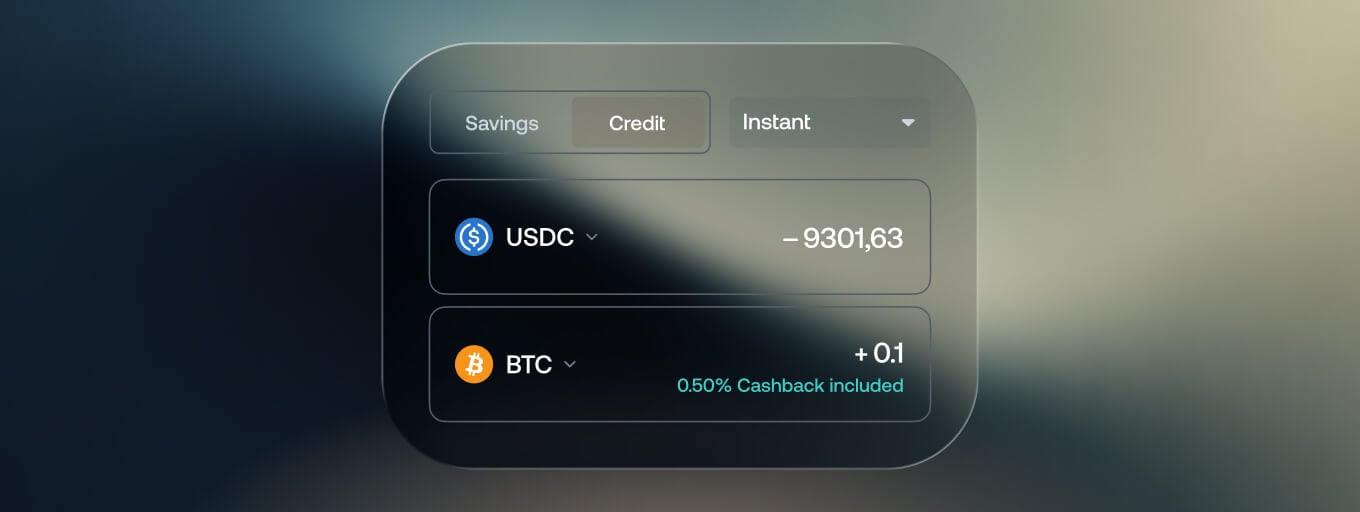

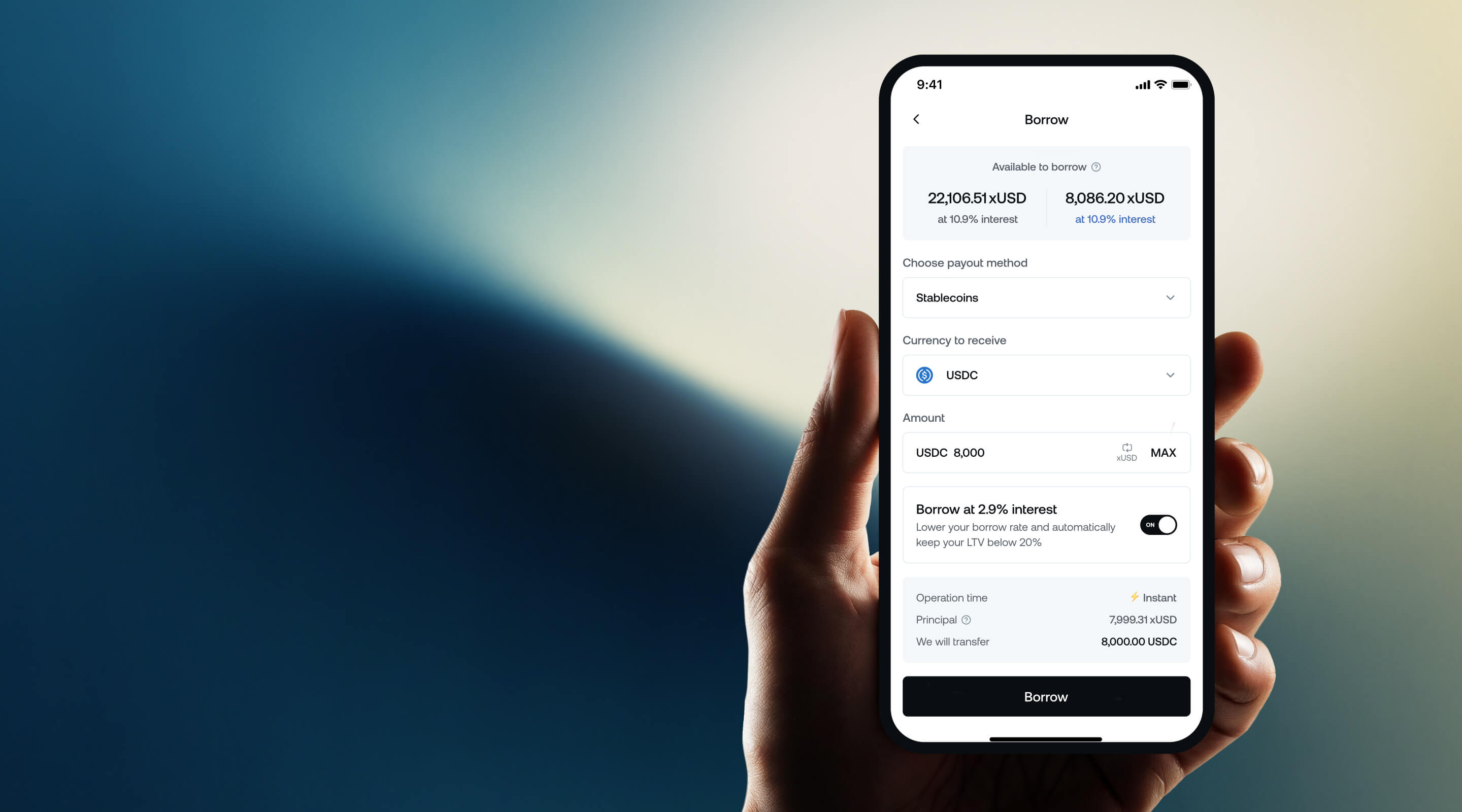

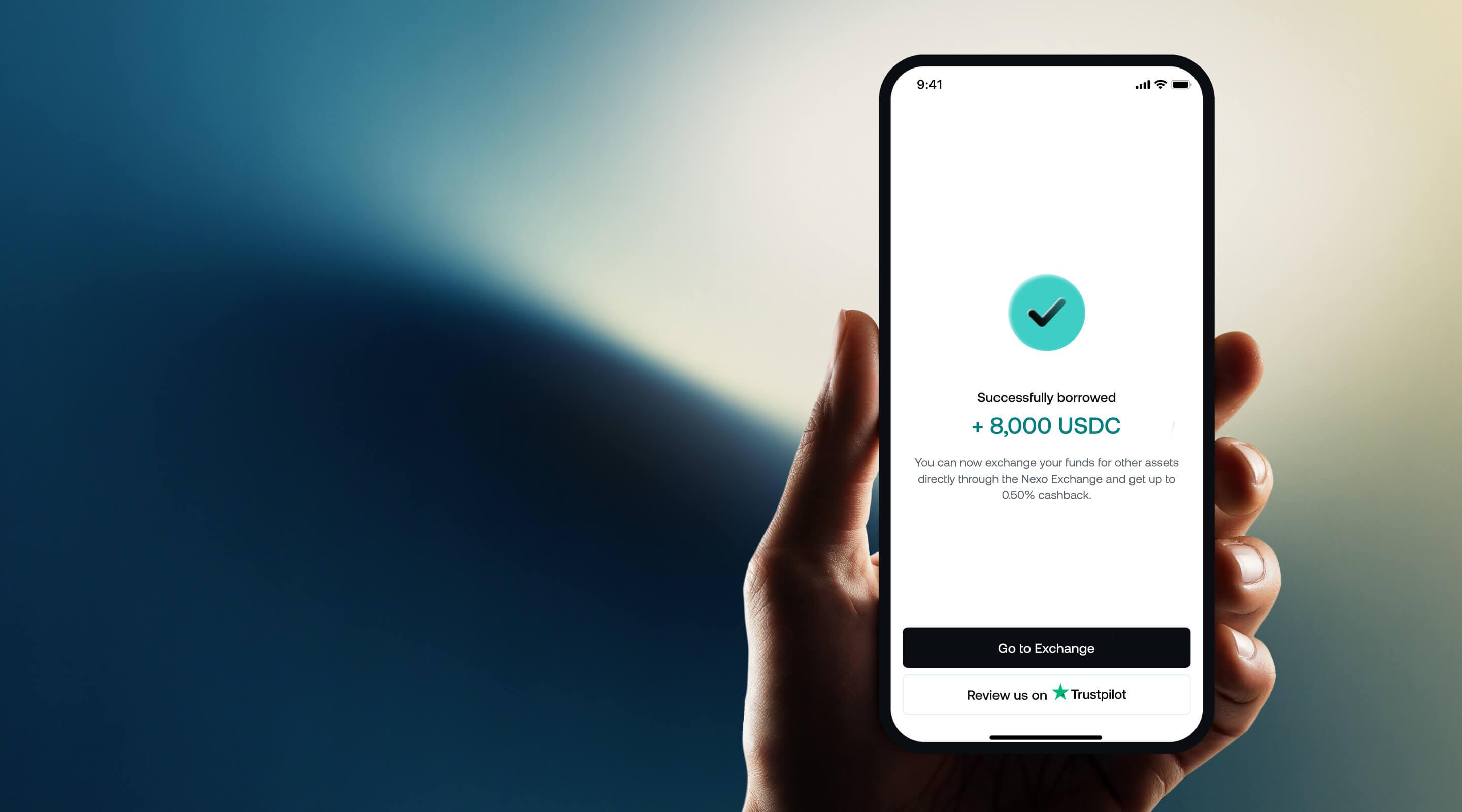

不同於考量信用評分的傳統貸款,Nexo 提供的是以加密貨幣做擔保的 Credit Line,也就是以您的數位資產作為抵押品。 帳戶充值完成後,您就能立即啟用 Credit Line。 您有兩種收取貸款資金的選項。

若要開始使用 Credit Line,請參考我們為此建立的幫助中心文章中的步驟操作。

更多詳細資訊,請前往我們為此建立的幫助中心文章。