Đừng bán crypto, hãy vay dựa trên nó.

từ năm 2018

cá nhân hóa 24/7

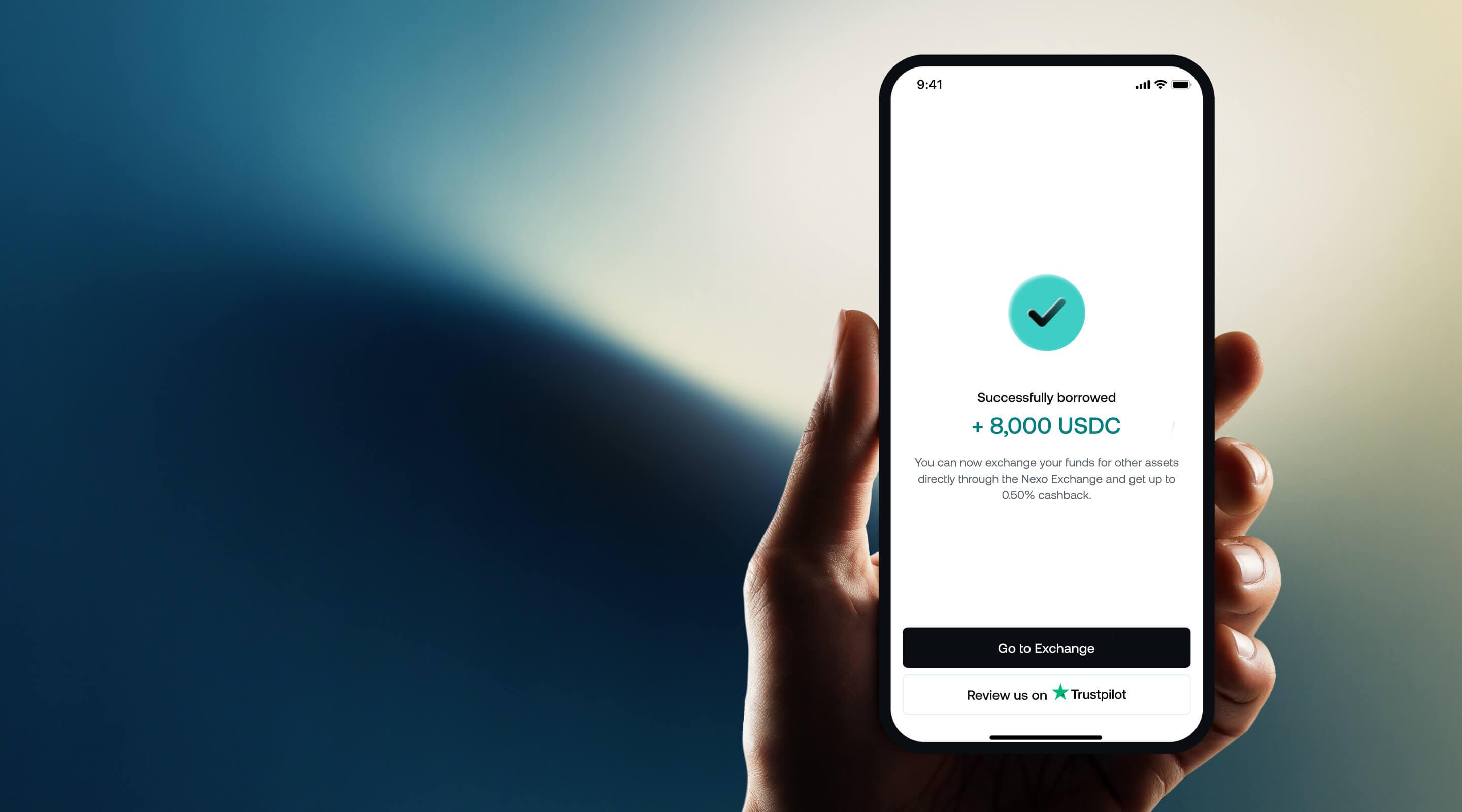

Mở một lần, trả nợ bất cứ lúc nào và sử dụng tiếp khi cần.

Tìm hiểu lượng tài sản thế chấp bạn cần để vay số tiền mong muốn.

Thứ hạng khách hàng thân thiết của bạn sẽ được quyết định dựa trên số lượng NEXO Token bạn nắm giữ so với phần còn lại của danh mục đầu tư. Đạt hạng Platinum để nhận được những lợi ích tốt nhất trong toàn bộ dịch vụ của chúng tôi.

| Borrow with your crypto as collateral | Sell your crypto | |

|---|---|---|

Tiếp tục đầu tư & hưởng lợi nếu giá tăng | ||

Có vốn mà không cần bán crypto của bạn | ||

Vay tức thì, không bị xét tín dụng | ||

Tránh nghĩa vụ thuế khi bán crypto |

Chọn từ hơn 100 tài sản số được hỗ trợ để vay dựa vào và xem tỷ lệ khoản-vay-trên-giá-trị (LTV) tương ứng.

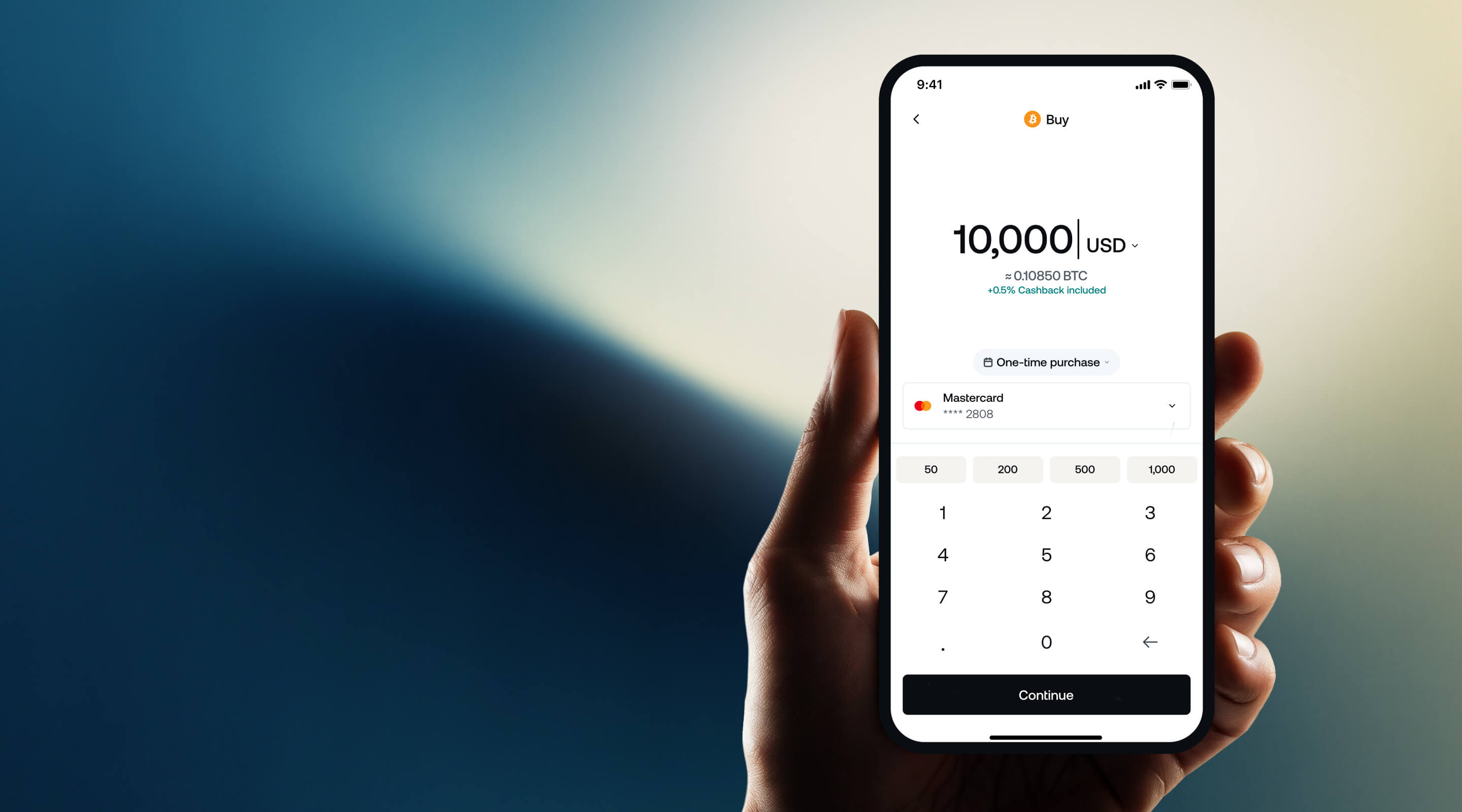

Discover how crypto-backed loans work and when they make sense. Understand collateral, loan-to-value ratios, and flexible repayment — without having to sell your digital assets.

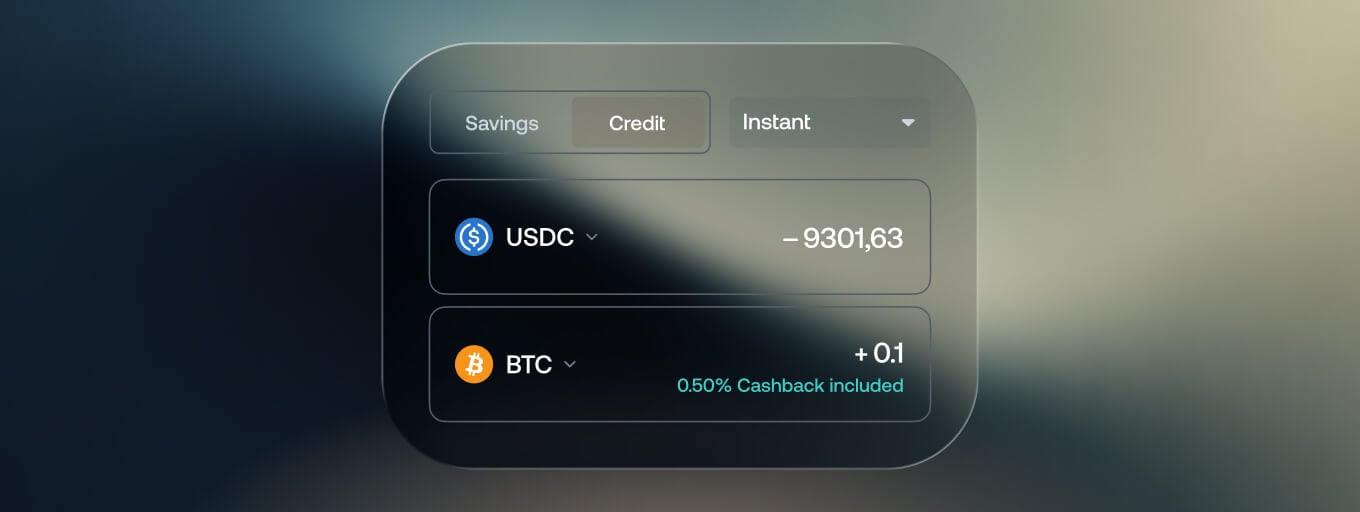

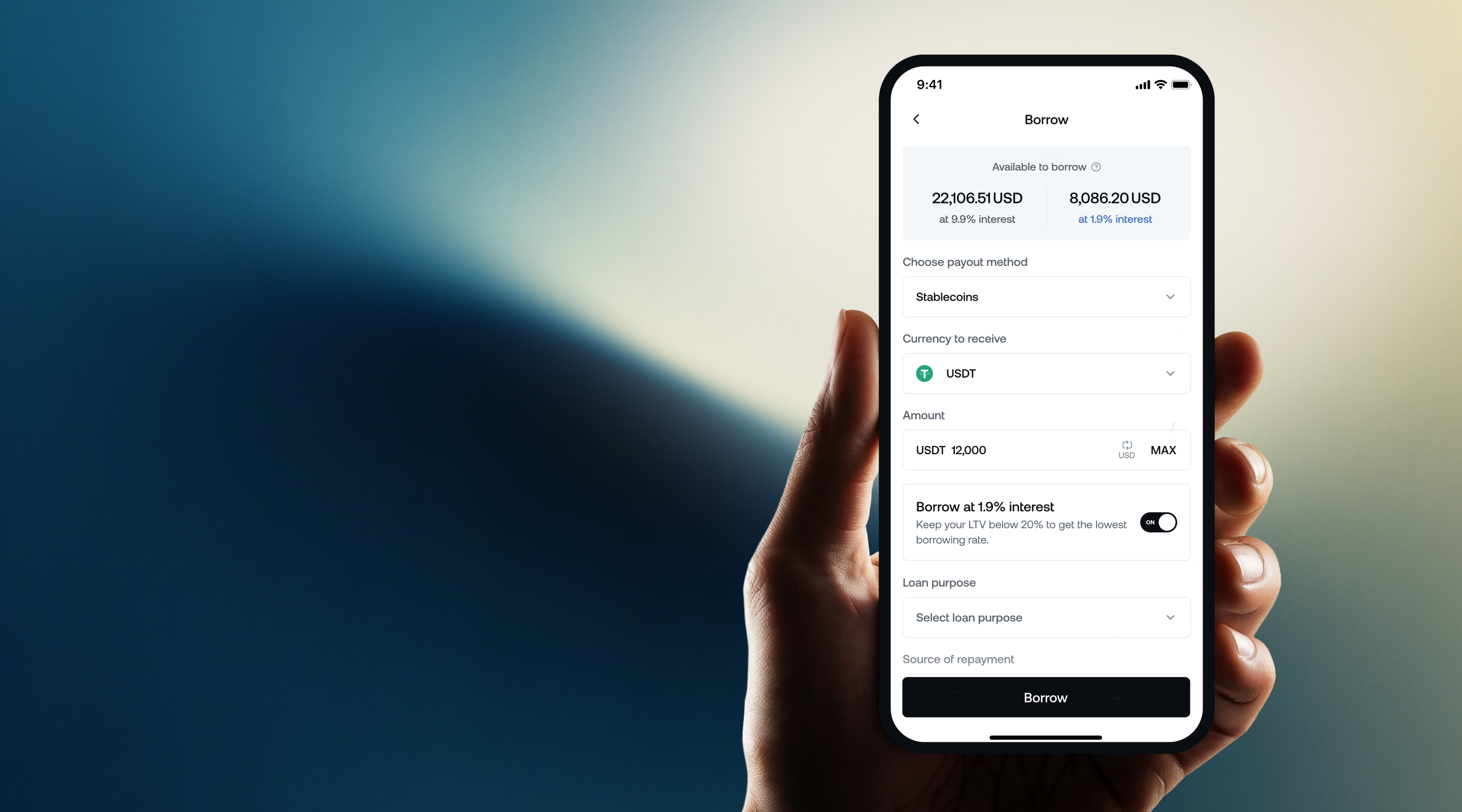

Không giống như các khoản vay truyền thống xem xét điểm tín dụng của bạn, Nexo cung cấp Credit Line được hỗ trợ bằng tiền điện tử, sử dụng tài sản số của bạn làm tài sản thế chấp. Ngay sau khi nạp tiền, bạn có thể lập tức dùng Credit Line của mình. Bạn có hai lựa chọn cho khoản vay.

Để bắt đầu sử dụng Credit Line, hãy làm theo các bước được nêu chi tiết tại bài viết cụ thể trong Trung tâm trợ giúp của chúng tôi.