Dispatch #258: How big is Wall Street’s appetite for BTC?

Aug 19, 2025•6 min read

In this patch of your weekly Dispatch:

- ETH’s fresh tailwinds

- Nexo leads in lending

- Economics at Jackson Hole

Market cast

BTC: Cooling off before the next move?

Bitcoin has pulled back slightly from its all-time high, with charts suggesting a pause in momentum rather than a decisive reversal. On the weekly view, the Stochastic Oscillator is easing from overbought territory, the Moving Average Convergence Divergence (MACD) shows early divergence, and the Relative Strength Index (RSI) has softened — all pointing to a cooling phase.

On the daily chart, bullish strength has moderated, with oscillators trending lower and the MACD histogram dipping just below the zero line. This indicates a shift toward consolidation, though downside remains contained for now.

Key levels to watch: resistance at $116,000–$117,000, with stronger resistance at $120,000. On the downside, support lies at $114,000, followed by $112,000–$110,000.

The big idea

A shrinking supply meets relentless demand

Last week, Bitcoin surged to a fresh all-time high just above $124,400, breaking through key resistance before pulling back slightly. While the move sparked short-term volatility, the deeper story suggests this could only be the beginning.

Behind the scenes, Wall Street is loading up. Far from taking profits, institutions are accelerating their Bitcoin accumulation — not only through spot ETFs but also via crypto-linked stocks and indirect exposure plays.

In Q2 alone, Brevan Howard grew its IBIT stake by 71% to more than $2.3 billion. Jane Street now holds more in IBIT than in Tesla. Goldman Sachs, Cantor Fitzgerald, and Wells Fargo all boosted their exposure, while Harvard and Norway’s $1.7 trillion sovereign wealth fund quietly scaled into Bitcoin-adjacent equities like MicroStrategy and Metaplanet.

The ETF wave is reshaping Bitcoin’s market structure. BlackRock’s IBIT alone now holds over 744,000 BTC. In total, U.S. spot ETFs control more than 1.3 million BTC — nearly 6.5% of the total supply — and are on pace to hit 1.5 million by year-end if current inflows persist.

With just 450 BTC mined per day after the April halving, ETF demand is now consistently outpacing new supply. Much of this BTC is functionally off the market, creating a slow but steady liquidity squeeze. This imbalance means Bitcoin’s supply is getting tighter, so even small increases in demand can push the price up sharply. Over time, the market adjusts by moving higher.

The macro backdrop is also turning favorable. Futures markets are pricing in an 80%+ chance of Fed rate cuts by September, pushing the dollar lower and risk appetite higher. In Washington, crypto is benefiting from regulatory clarity — including the GENIUS Act and new 401(k) guidelines that open the door for Bitcoin in retirement plans.

Persistent accumulators in play

This time, it's not just about retail excitement or momentum chasing. As crypto analyst Udi Wertheimer recently argued, we’ve entered a new era of persistent accumulators — institutions like MicroStrategy that keep accumulating BTC as their core strategy. Unlike past cycles, today’s market features this steady institutional bid alongside a gradually shrinking float — conditions that hint at a potential supply squeeze down the line, with Wertheimer even suggesting long-term targets near $400,000.

The price action may look volatile, but the underlying trend is harder to ignore: supply is thinning while institutional demand continues to build. Rather than marking a peak, the latest all-time high could be setting the stage for a new phase in Bitcoin’s evolution — one where scarcity is not just a narrative, but a market reality. And with the halving continually reducing new issuance, that scarcity is set to deepen further, leaving the market little choice but to reprice higher over time.

Hot in crypto

Nexo: Still leading in lending

Galaxy Research’s latest lending report places Nexo as the second largest crypto lender globally, alongside Tether and Galaxy. With a $1.96 billion loan book and an 11% market share, Nexo is a key player in powering crypto’s credit markets.

At a time when several former giants in the sector have exited or downsized, Nexo’s position highlights both our resilience and ability to scale sustainably. The report notes that the top three lenders now control more than 70% of the tracked CeFi market — with Nexo firmly embedded since 2018.

By continuing to serve both retail and institutional clients globally, we’ve not only weathered past market cycles but strengthened our role as one of the industry’s most trusted wealth platforms.

Еthereum

Is this ETH’s era?

Ether is steadily gaining ground in 2025. ETFs drew nearly $3 billion in inflows last week, helping spot crypto ETFs hit record $40 billion trading volumes. Despite a 33% outperformance vs Bitcoin in the past month, social sentiment remains cooler, which Santiment says could be a healthier setup.

Supportive tailwinds are building. Stablecoin regulation is boosting activity on Ethereum’s rails, while BitMine has added 1.2 million ETH to its treasury. Standard Chartered lifted its year-end target to $7,500, and Fundstrat calls ETH “arguably the biggest macro trade for the next 10 to 15 years.”

Muted hype, strong inflows, and structural demand suggest Ethereum’s momentum may only be starting to take shape.

Macroeconomic roundup

All eyes on Jackson Hole symposium

Crypto markets entered the week cautiously, with traders balancing recent gains against a dense lineup of U.S. macro events. With rate cut expectations now firmly priced in, the focus has shifted to whether these upcoming macro signals would confirm the narrative or challenge it:

FOMC Minutes (Wed): Markets will parse July’s Fed meeting notes for clues on rate cuts. FedWatch now shows an 85% chance of a September cut to 4.00–4.25%. A dovish tilt could support risk assets, while hawkish signals risk more downside.

Jobless Claims (Thu): Labor market cooling has become central to Fed policy bets. Claims have steadied near 224K; any uptick could reinforce rate-cut expectations and give Bitcoin a tailwind.

Jackson Hole (Fri): Powell’s keynote has a history of moving markets. Traders will watch for confirmation of easing ahead — or a reminder that the Fed remains cautious.

With inflation still sticky at 2.7% and traders heavily positioned for cuts, this week’s data and Powell’s words could set the tone for Bitcoin’s next breakout attempt.

The week’s most interesting data story

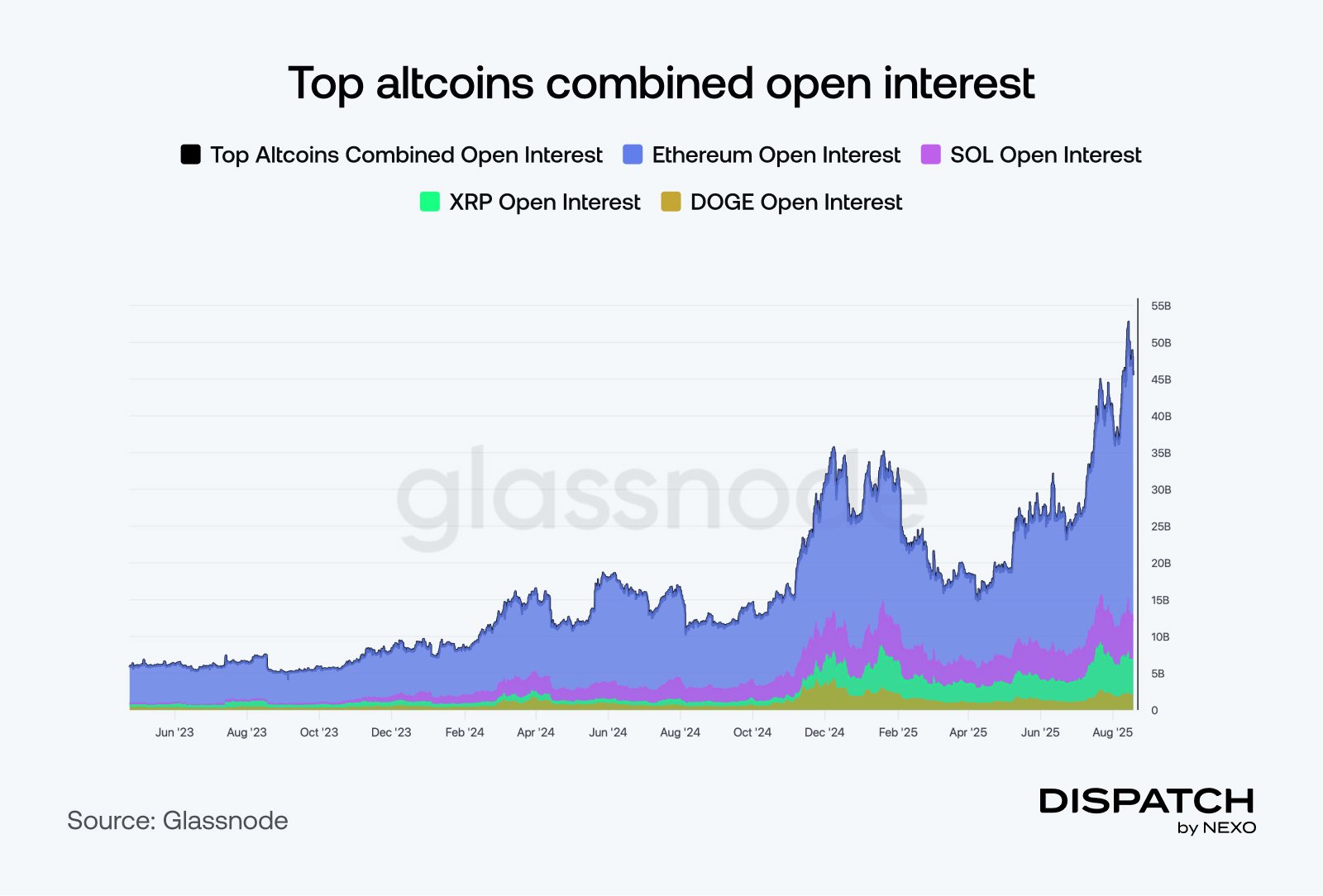

Altcoins open interest loads up

Altcoins are seeing a surge in conviction — and leverage. Open interest across the top tokens has climbed to a record $47 billion, fueled by pronounced price action in Ethereum, which is near its 2021 highs. The build-up highlights a more reflexive market environment: elevated leverage can magnify both rallies and reversals, leaving altcoins more exposed to sharp swings. While Bitcoin’s options markets remain priced for low volatility, the contrast with surging altcoin activity suggests traders are bracing for bigger moves — and the next tests at key resistance levels could decide the direction of this cycle.

The numbers

The week’s most interesting numbers

- 3.1% – Share of Bitcoin’s supply now held by Strategy and Metaplanet combined.

- $150,000–$200,000 – Bernstein’s 12-month price target range for Bitcoin.

- 107,540 TPS – Solana’s new stress-test throughput record.

- 775 BTC – Metaplanet’s latest buy, taking its stash to nearly 19K BTC.

- $3.7 billion – Crypto miner TeraWulf’s Google-backed AI hosting pivot.

Hot topics

What the community is discussing

Pioneers then. Leaders now. Always Nexo.

Will 2025 be ETH’s best summer?

Could there be a better catalyst for BTC?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].