Dispatch #257: Crypto, meet retirement

Aug 12, 2025•6 min read

In this patch of your weekly Dispatch:

401(k) order changes the game

The Nexo Championship course record

All eyes on inflation

Market cast

Bullish structure with room to run

Bitcoin is maintaining a bullish setup across both daily and weekly timeframes. With key resistance at $120,000 and $123,000, and strong support at $117,000 and $114,000, the next moves hinge on follow-through momentum — and, as always, macro.

On the weekly chart, the trend remains clearly bullish. The Average Directional Index (ADX) is elevated, confirming trend strength; the Moving Average Convergence Divergence (MACD) is firmly positive; and the Relative Strength Index (RSI) continues to rise, supporting positive sentiment. Only the Stochastic Oscillator is flashing early signs of potential trend exhaustion — something to watch as price nears upper Bollinger Bands.

The daily chart echoes this optimism. The MACD has just flipped positive, the Stochastic is climbing but not yet overbought, and RSI sits in neutral territory, giving bulls room to push higher. While the ADX on this timeframe remains relatively low, it is starting to climb, suggesting that upward momentum may be building.

With inflation data and macro headlines driving volatility this week, all eyes remain on how Bitcoin behaves around these well-defined technical levels.

The big idea

Crypto, meet retirement

It’s official: Americans may soon be able to include Bitcoin, private equity, real estate, and other alternatives in their 401(k)s. On August 7, President Trump signed an executive order directing federal agencies to clear the way for these assets in retirement plans, including the $8.7 trillion currently sitting in 401(k)s.

It’s a shift with enormous potential, especially for crypto. The order instructs the Department of Labor and the SEC to create new guidelines and remove outdated barriers. The goal? Make it easier for employers to offer diversified retirement options that go beyond stocks and bonds, and bring digital assets into the retirement mainstream.

So what would this mean in practice? Even modest allocations from retirement plans could generate billions in structural demand for crypto. Based on data from the Investment Company Institute (ICI), a 0.50% allocation adopted by just 25% of plans would translate to $15.3 billion flowing into digital assets.

What about the rest of the world?

While the U.S. is now moving decisively, it’s not alone in exploring crypto for retirement. Australian self-managed pension funds were among the first to invest in cryptocurrency as early as 2019.. In Germany, regulated funds can allocate up to 20% to crypto since 2021. Norway’s state retirement fund invests in cryptocurrencies and buys shares in the likes of MicroStrategy and MARA, which hold Bitcoin on their balance sheets. In the U.K., at least one pension fund has allocated 3% to Bitcoin, while Canada has seen growing adoption via ETFs, with provincial pension funds cautiously entering the space. Brazil, by contrast, has prohibited crypto in closed pension funds, citing volatility and investor protection.

These steps vary in scale and maturity, but they all reflect a growing recognition: crypto is being evaluated not just as an asset, but as a reserve, a yield source, and a long-term hedge.

The pushback

Still, there’s plenty of caution. Critics warn that private assets and crypto carry higher fees, less transparency, and more volatility than traditional 401(k) investments. Some financial planners argue that without proper education and strict guardrails, investors could be lured in by hype, while private equity funds can charge up to 20% in performance fees.

But here’s the thing: you don’t have to wait for permission – or depend on a retirement plan provider – to build long-term wealth with crypto.

At Nexo, you can already access a full suite of digital asset investment tools. Whether you’re earning yield on stablecoins, growing your Bitcoin position over time, or using Dual Investment strategies to maximize accumulation, you can create your own retirement plan.

What comes next

For now, the ball is in the regulators’ court. The Labor Department, SEC, and Treasury have 180 days to produce guidance. Plan sponsors and recordkeepers will also need to build infrastructure, including options for target date funds, managed sleeves, and ETF integrations.

But the direction is clear: crypto is at the table of retirement conversations. And while it may start as a small allocation inside a long-term path, that’s how all big shifts begin.

Bitcoin & Ethereum

Will macro trigger new all-time highs or halt the rally?

Over the weekend, Bitcoin surged past $122,000, nearing its previous all-time high and triggering a second wave of bullish positioning. Ethereum broke through $4,300, its highest level since 2021, on the back of sustained ETF inflows and large corporate treasury activity.

Data pointed to $253 million in weekly Bitcoin ETF inflows, alongside $461 million for Ethereum, as evidence that institutional demand remains the key driver in this cycle. ETH's outperformance is drawing comparisons to the 2020 rotation that preceded its last breakout. As always, macro holds the final word — and this week, that means inflation.

Today’s U.S. inflation print did little to shake Bitcoin’s trajectory. The data for July was mixed, with headline CPI slightly below expectations but core inflation rising more than forecast. The report likely wasn’t far enough off the mark to change market expectations for a potential Fed rate cut in September, with odds still near 84% going into the print. In the minutes after the release, Bitcoin hovered just below $119,000, while Ethereum climbed 3%, continuing to lead on short-term momentum.

With Bitcoin flirting with resistance and Ethereum just 11% off its all-time high, volatility around CPI and Fed commentary will shape the next leg up. If not — well, you’ve seen how quickly this market resets and reclaims.

Crypto & Sports

Utility on the fairway

The first-ever Nexo Championship wrapped up this Sunday in Scotland, delivering more than a trophy — winner Grant Forrest took home a $50,000 prize in NEXO Tokens, alongside a $10,000 course record bonus and a $467,500 purse.

It marked the first time digital assets have been used as part of a performance-based award in elite golf, showing how crypto is moving from sponsorship into real utility. As Nexo's Dimi Stalimirov wrote in his recent piece, this is the evolution of crypto in sport: less about logos, more about value, alignment, and trust.

Macroeconomic roundup

Inflation, rates, and retail

A pivotal week for inflation data and rate-cut expectations, as crypto tests its sensitivity to macro signals.

U.K. GDP MoM (Aug 14): After a strong Q1 driven by pre-tariff exports, Q2 is expected to show contraction. A weaker print would add pressure on the BoE and support the appeal of crypto as a non-sovereign hedge.

U.S. Initial Jobless Claims (Aug 14): Forecasts point to a slight rise to 229,000. An uptick would reinforce labor market softness and help justify a dovish Fed pivot — a likely tailwind for Bitcoin.

U.S. Producer Price Index (Aug 14): If PPI surprises to the upside, inflation concerns may return and drag on crypto; a soft reading would support a continued disinflation narrative.

U.S. Retail Sales MoM (Aug 15): Expected to dip slightly from 0.6% to 0.5%. A beat would strengthen the “resilient consumer” narrative and weigh on crypto via higher yields, while a miss could revive easing hopes.

The week’s most interesting data story

Long-term holders show a longer horizon

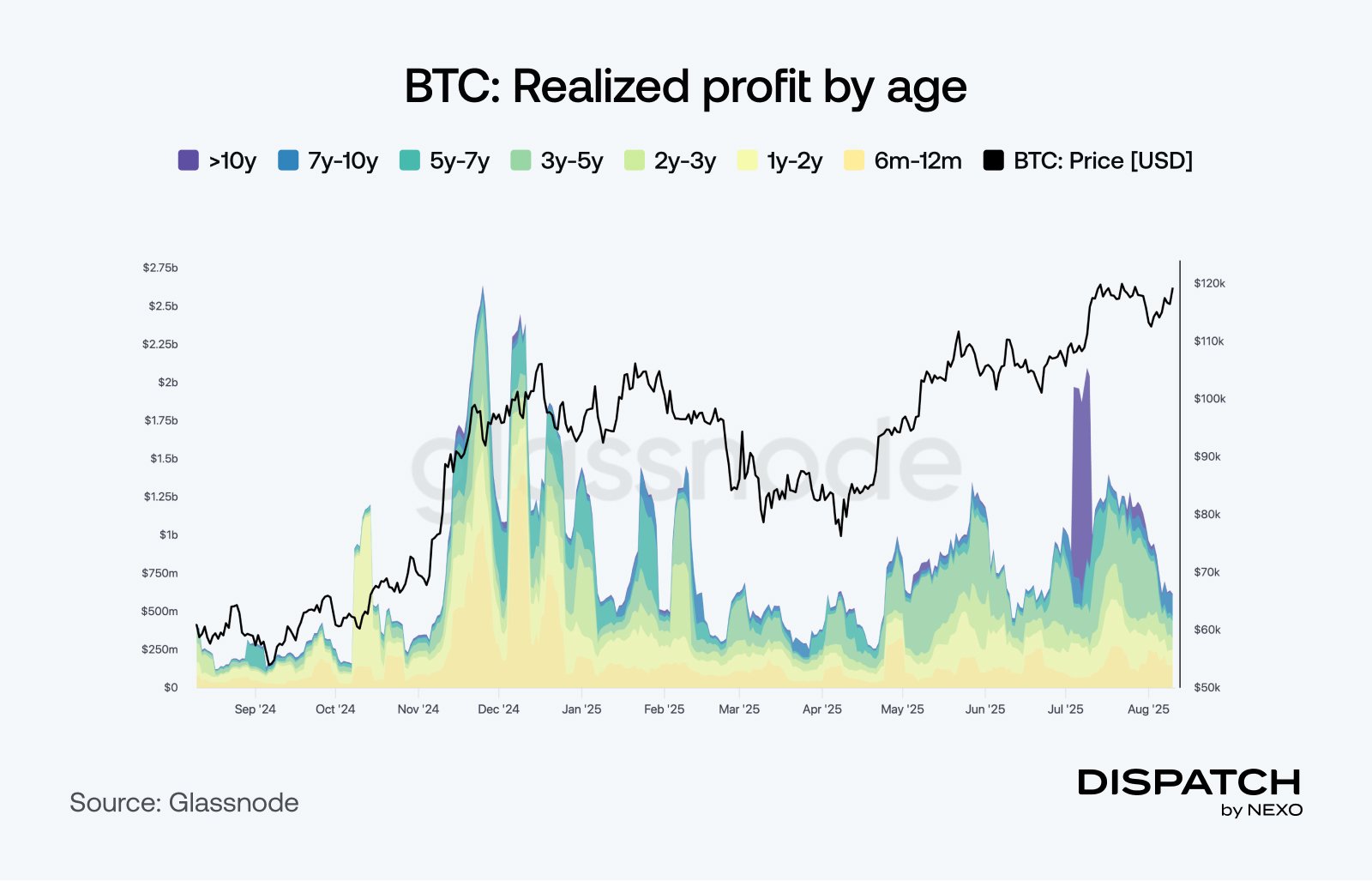

After one of the biggest profit-taking periods on record in July, with realized profits topping $1 billion per day, Bitcoin’s long-term holders are stepping back. Profit realization has slowed notably in August, with 3–5 year holders now leading the selling, in contrast to the 6–12 month ETF-era cohort that drove peaks last winter. This marks a shift: instead of chasing tops, seasoned holders appear content to wait as institutional interest and DeFi growth restore confidence. With macro headwinds and no major catalysts on deck, strong hands seem to be playing the long game – holding back, not out.

The numbers

The week’s most interesting numbers

70 million – The rough number of Americans who participate in 401(k)s.

$2.6 billion - The amount raised by crypto startups in July.

1.75 million – Record number of daily ETH transactions reached on August 8

$117 million - Harvard University’s position in Bitcoin ETFs, topping Nvidia and Google stakes.

$4.96 billion – The value of BitMine’s 1,150,263 ETH holdings, making it the largest ETH treasury.

Hot topics

What the community is discussing

The Nexo Championship sets records and firsts.

An interesting take on Big Tech concentration in the S&P 500.

Generative AI patent applications.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].