How to make crypto work for your wealth goals

Aug 28, 2025•5 min read

From buying crypto to building wealth.

Maybe you’ve just bought Bitcoin for the first time. Or perhaps you’ve been watching the market and wondering, “How do people actually use this to build wealth?”

It’s a common question. Most guides about crypto investing stop at “buy and hold.” But wealth isn’t built by waiting — it’s built by making your assets work for you.

That’s why we’re going to look at how to invest in crypto with a strategy in mind so it supports your long-term goals.

Getting started the right way.

The first step is choosing a trusted platform where you can buy digital assets like Bitcoin, Ethereum, or stablecoins.

From there, investing with clarity means three things: secure your assets, diversify across different digital assets, and think long-term instead of chasing quick wins.

Crypto investing can go beyond buying and holding. Once you own digital assets, you can also put them to work through savings, lending, or other tools that can support your financial goals.

Make your crypto work for you.

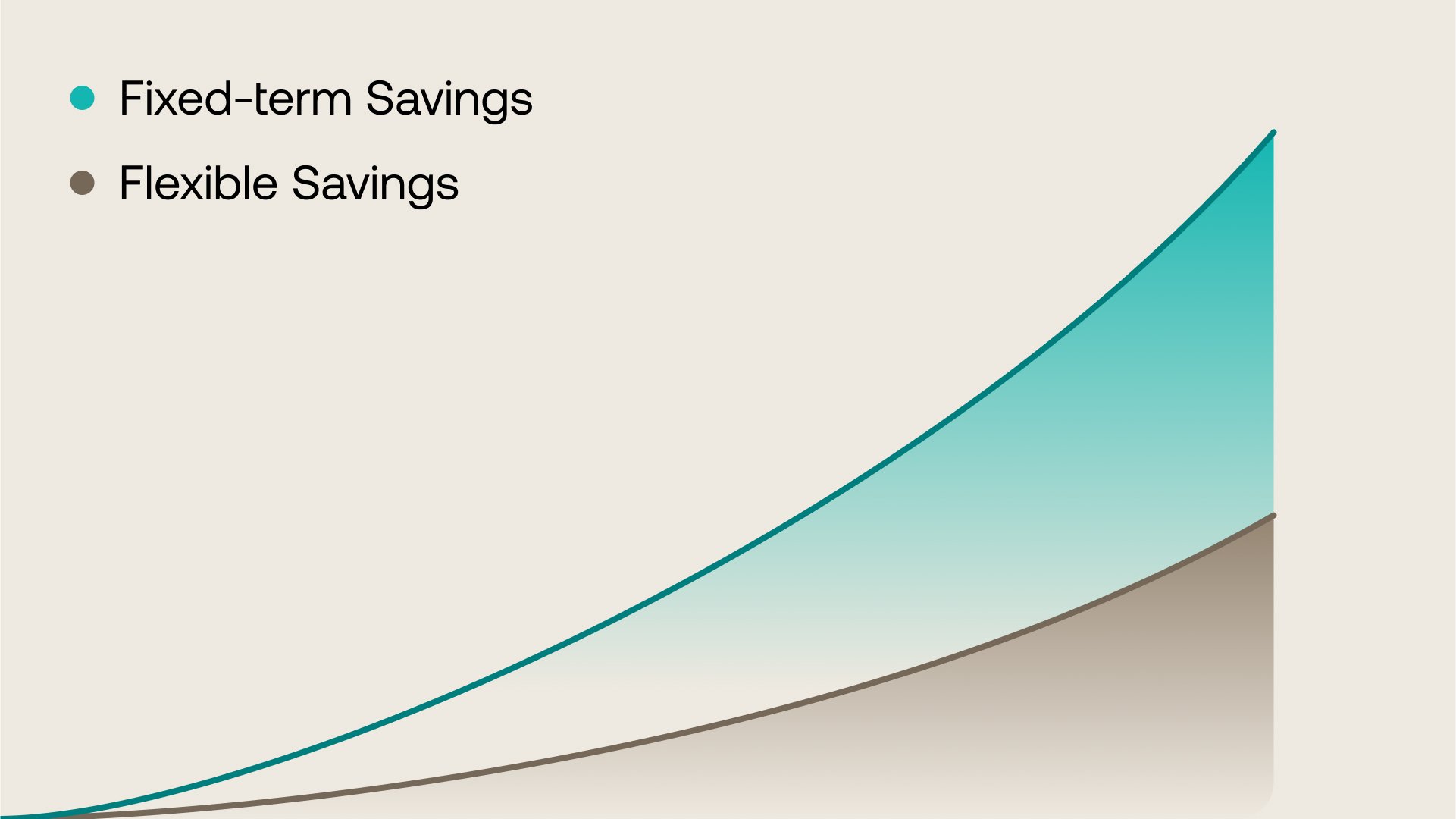

Just like traditional savings accounts pay interest on cash, some platforms offer ways to earn on your digital asset holdings. Two of the most practical options are Flexible Savings and Fixed-term Savings:

- Flexible Savings: Your crypto earns interest daily, while your assets are available to trade at all times. It’s ideal for beginners or anyone who values quick access to their funds.

- Fixed-term Savings: You commit your crypto for a set period and receive a higher return in exchange. It’s designed for people with a longer-term outlook who want stronger yields.

Think of it this way:

- Flexible Savings = convenience and control.

- Fixed-term Savings = higher rewards for patience.

By choosing the approach that fits your lifestyle, you’re letting your investment work for you in a way that’s aligned with your wealth goals.

With Nexo’s Flexible and Fixed-term Savings, you can earn daily interest or higher returns.

Borrowing: The wealth tactic of the rich.

There’s a quiet secret in traditional finance: the wealthy rarely sell their most valuable assets. Instead, they borrow against them. That way, their assets stay invested, continue to grow in the background, and often avoid triggering taxable events.

Crypto brings this same strategy to anyone, not just the ultra-wealthy. With a crypto-backed credit line, you can use your Bitcoin or Ethereum as collateral and access funds without selling assets you think might appreciate in the future.

Why this matters:

- You keep your crypto in place, so it can benefit if the market rises.

- You get the funds you need for expenses, investments, or opportunities.

- You avoid the “buy high, sell low” trap that comes from panic-selling during volatility.

When you borrow agains your crypto, two things define your experience:

- Interest rates → This is the cost of borrowing. With Nexo, rates can be as low as 2.9% if you keep your Loan-to-Value (LTV) below 20%, making it one of the most efficient ways to unlock liquidity without selling.

- Loan-to-Value (LTV) → This shows how much you can borrow compared to the value of your crypto. A lower LTV means lower risk (and lower interest rates), while a higher LTV gives you more funds but at a higher cost and risk.

Staying safe as you invest.

Start by choosing platforms with a strong reputation.

- Security first: Look for providers with industry-leading custodians, insurance, and regulatory oversight.

- Diversification: Spread your holdings across different digital assets like Bitcoin, Ethereum, and stablecoins. This approach can help balance your portfolio during market shifts.

- Mindset: Volatility is normal. Stay focused on your long-term goals instead of reacting to short-term price swings.

Investing is about building confidence. With the right habits, crypto can go beyond a speculative bet and become a practical tool for building long-term wealth.

Why this approach is forward-thinking?

For years, crypto was seen as a gamble — buy some of it, hold, and hope for the best. But 2025 looks very different. Crypto has matured into a global asset class, with tools that go far beyond speculation.

By putting your assets to work through savings products, or borrowing against them instead of selling, you’re following strategies that the wealthy have used for generations — but with a new level of flexibility and accessibility.

This is why crypto is a way to build and preserve wealth that looks to the future. You’re not only part of the digital economy — you’re shaping how wealth itself evolves.

Frequently asked questions.

1. Is investing in crypto a good idea in 2025?

Crypto is still volatile, but it has matured into a global asset class. If approached with diversification and wealth strategies in mind, it can be part of a forward-looking portfolio.

2. How to invest in crypto?

Start by choosing a regulated platform. Then explore ways to buy digital assets like Bitcoin or Ethereum. After that you can explore strategies like earning interest, accessing liquidity, or growing your portfolio over time.

3. How to invest in crypto safely?

Use regulated platforms, diversify your assets, enable security tools like 2FA, and focus on long-term growth instead of chasing quick gains.

4. What is LTV in crypto borrowing?

LTV, or Loan-to-Value, measures how much you borrow compared to the value of your crypto. For example, if you borrow $2,000 using $10,000 worth of Bitcoin, your LTV is 20%. A lower LTV usually means lower interest rates and less risk if the market moves.

These materials are accessible globally, and the availability of this information does not constitute access to the services described, which services may not be available in certain jurisdictions. These materials are for general information purposes only and not intended as financial, legal, tax, or investment advice, offer, solicitation, recommendation, or endorsement to use any of the Nexo Services and are not personalized, or in any way tailored to reflect particular investment objectives, financial situation or needs. Digital assets are subject to a high degree of risk, including but not limited to volatile market price dynamics, regulatory changes, and technological advancements. The past performance of digital assets is not a reliable indicator of future results. Digital assets are not money or legal tender, are not backed by the government or by a central bank, and most do not have any underlying assets, revenue stream, or other source of value. Independent judgment based on personal circumstances should be exercised, and consultation with a qualified professional is recommended before making any decision.