Dispatch #272: Renewal after a reset: Crypto’s move in 2025

Nov 25, 2025•5 min read

In this patch of your weekly Dispatch:

- From pullback to rally?

- Will a Fed cut follow?

- Bitcoin’s macro balance

Market cast

BTC: Bottom in and the tides are turning?

Bitcoin’s latest pullback appears to be stabilizing, with price action now testing long-term support levels that could define the next directional move. On the weekly chart, Bitcoin’s price decline has paused near the 100-period Simple Moving Average (SMA), a trend-following indicator that now acts as dynamic support. Momentum indicators still show that bearish sentiment prevails, with the Stochastic Oscillator lingering in the oversold zone, the MACD histogram deepening in negative territory, and the Relative Strength Index (RSI) approaching the 30 level, often viewed as a threshold for oversold conditions.

The daily chart, however, offers a more constructive picture. The price has rebounded from the lower Bollinger Band, a volatility-based indicator that can mark the end of a selloff and the start of stabilization. Momentum gauges such as the RSI and Stochastic are both rising from oversold levels, typically signaling that a bottom may have formed and a short-term rebound could be underway. Meanwhile, the MACD lines are edging closer to a bullish crossover, hinting at a potential shift in momentum toward buyers.

Key levels remain defined by support at $84,000 and $82,000, reinforced by the weekly 100-period SMA, while resistance sits around $89,000, followed by the $91,000–$92,000 area, and then $98,000.

The big idea

Could a rally follow the correction?

Every reset reshapes expectations — and this one may ultimately form the base for the next rally. Last week’s pullback wasn’t triggered by a headline or a single market — it followed months of leverage and optimism.

Bitcoin’s climb from $40,000 to $126,000 was powered by expectations of Fed easing and robust institutional flows. December rate-cut odds narrowed from 90% to 40%, real yields held above 5%, and institutions rebalanced positions, leading to short-term ETF outflows of just over $1 billion.

Long-term investors — many sitting on substantial unrealized gains — used the opportunity to lock in profits, a typical late-cycle behavior.

The current scenario reflects an adjustment to shifting rate expectations – textbook deleveraging – largely reflecting a compression of earlier paper gains, not structural damage or systemic stress. With leverage now cleared, liquidity expectations improving, and innovation accelerating across the ecosystem, the groundwork for the next phase is already being laid.

Now the question shifts to what comes next.

Early signs point to stabilization. Bitcoin found support near $82,000 and has since shown constructive price action. With rate-cut expectations recovering toward 70%, even a modest shift toward easier liquidity or reserve expansion could serve as a trigger. Historically, Bitcoin has responded strongly to improving liquidity conditions — a dynamic that could reassert itself.

For Ethereum, the focus is squarely on fundamentals. The upcoming Fusaka upgrade on December 3 is expected to enhance efficiency and validator performance. After a brief period of ETF outflows, a smooth upgrade could help restore confidence and reinforce Ethereum’s role as core infrastructure for the next phase of network growth.

Solana remains one of the cycle’s relative strengths. Its ETF products have recorded nearly three consecutive weeks of inflows, reflecting resilient institutional interest and its expanding presence in tokenized finance.

Meanwhile, XRP and Dogecoin are entering a new institutional chapter. The NYSE-approved ETFs launching Monday extend regulated access to two of the market’s most recognized assets — a meaningful signal that institutionalization is broadening beyond Bitcoin and Ethereum.

Markets rarely rebound in a straight line, but they do rebuild. With leverage reduced, liquidity expectations improving, and innovation accelerating across the major networks, the foundations for the next phase are already forming. Every reset refines expectations — and this one may ultimately set the stage for the next sustained rally.

Macroeconomic roundup

Countdown to the cut?

The December Fed meeting dominates macro focus after New York Fed President John Williams signaled room to move policy “closer to neutral”, sending rate-cut odds above 70%. Markets now price a 25-bps cut to 3.50–3.75%, a potential shift toward renewed easing. Bitcoin briefly bounced from $81,000 to $84,000 as traders positioned for softer real yields and rising liquidity. For crypto, conviction is key — on-chain data still shows recent buyers underwater and ETFs bleeding. A cut with forward guidance could flip liquidity into a tailwind; a one-and-done move may keep Bitcoin capped below resistance.

CB Consumer Confidence (Tue): A steady or stronger reading could temper easing expectations; softer sentiment would favor risk assets.

Jobless Claims (Wed): Expected 225,000; higher claims would hint at labor cooling.

Q3 GDP (Wed): The final growth check before the Dec. 9–10 meeting.

TradFi trends

USD and Liquidity: Bitcoin’s key equilibrium

Bitcoin’s macro setup still turns on two levers — liquidity and the dollar — and they’re finally starting to drift toward alignment. Global M2 growth has picked up to roughly +0.6% MoM, its strongest pace since mid-2024. Historically, that liquidity impulse filters into risk assets with a six-to-eight-week lag — putting early Q1 in play for a potential rebound.

The catch is the dollar. The DXY remains elevated around 104–105, just below its 2025 high of 107, keeping real yields tight and risk appetite restrained. For the liquidity effect to stick, that index likely needs to settle below 103 and stay there.

In practical terms, traders should watch for continued M2 expansion alongside a cooling dollar trend. If the Fed’s December cut anchors real yields and pushes the DXY lower, Bitcoin could transition from defensive to accumulation mode as global liquidity finally finds an open gate.

The week’s most interesting data story

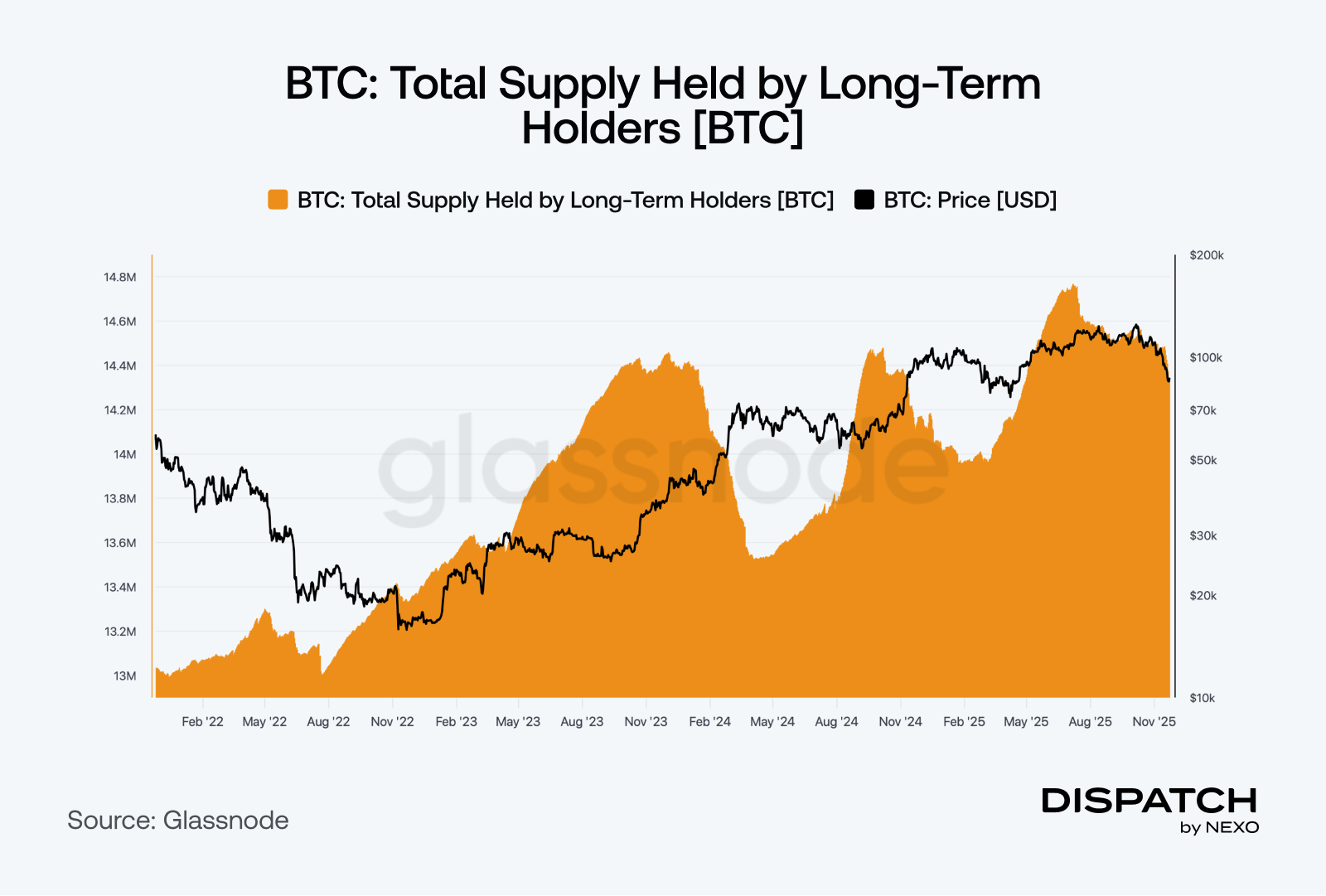

The long-term holders’ anchor

Despite recent volatility, long-term Bitcoin holders continue to anchor the market. Over 14.4 million BTC — around 70% of total supply, remains in long-term storage, only slightly below the record 14.8 million. Short-term holders have been more active as price tests the $85,000 range, while option positioning shows a tilt toward caution rather than conviction. Historically, these periods of heightened risk management and stable long-term ownership have coincided with market rebalancing rather than deep drawdowns. The current pattern suggests consolidation is underway, with patient investors maintaining confidence as the market searches for equilibrium.

The numbers

The week’s most interesting numbers

- 1 in 180 million — The odds a tiny six-terahash miner beat to win a full Bitcoin block worth $265,000 — pure luck in proof-of-work form.

- $238.5 million — Bitcoin ETF inflows on Nov. 21 ended a $1.2B outflow streak, hinting that fresh demand is back.

- $5,000 — Bank of America’s 2026 gold target, seeing continued tailwinds from loose fiscal policy and global liquidity.

- $135.5 billion — Japan’s record stimulus aims to lift growth and inject liquidity — a macro tailwind for Bitcoin.

- 14% — China’s stealth mining comeback puts it back among the top three countries for hashpower, defying the 2021 ban.

Hot topic

What the community is discussing

Here’s how quickly the market adapts.

Will ETH find the next rally in December?

Sui is on Nexo too, you know.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].