Dispatch #266: Is Bitcoin’s new rise coming?

Oct 14, 2025•5 min read

In this patch of your weekly Dispatch:

- Crypto’s reset

- Ethereum’s next step

- Bitcoin’s rebound

Market cast

In search of momentum: Bitcoin tests key support

Bitcoin is hovering around $112,000, testing the middle Bollinger Band on the weekly chart, a volatility-based trend indicator that often acts as dynamic support. A close below this level could invite a deeper pullback, while holding it would keep the broader uptrend intact. Momentum signals are softening: the Relative Strength Index (RSI) and Stochastic Oscillator, both momentum indicators, remain near neutral but are trending lower, suggesting fading buying pressure. The Moving Average Convergence Divergence (MACD) histogram, a trend-following momentum tool, stays below the zero line, reinforcing a cautious short-term outlook. Key levels to watch are support at $112,000 and $110,000, and resistance around $115,000 and $117,000.

The big idea

A rebound that defines resilience

What started as a bout of volatility ended as a proof of crypto’s growing maturity. Bitcoin’s implied volatility had signaled movement ahead — and while geopolitics triggered a sudden drop from $121,000 to $109,000 on Friday, the market swiftly recalibrated. By Monday, Bitcoin was back above $115,000, Ethereum had surged over 10%, and major altcoins recovered in tandem.

The market dynamics followed renewed trade tensions between the U.S. and China, after President Trump announced additional tariffs and Beijing responded with export curbs on rare earth minerals. The escalation underscored how fragile the balance between the world’s two largest economies remains — and how swiftly uncertainty can ripple across asset classes. The headlines briefly weighed on risk sentiment across global markets, with the Nasdaq down 3.6% and the S&P 500 off 2.7%.

Crypto markets regained composure and digital assets once again demonstrated their ability to absorb shocks and rebound quickly.

The broader takeaway is structural. While traditional markets remain vulnerable to policy shifts and trade disruptions, digital assets continue to prove their resilience. Bitcoin stands out as a scarce, non-sovereign store of value, immune to trade barriers and resource politics. More importantly, the collective recovery across altcoins highlights how far the ecosystem has come — from fragile to fundamentally adaptive.

The weekend began with uncertainty and ended with renewed conviction. For all its volatility, crypto remains defined not by its declines, but by how swiftly and decisively it rebounds.

TradFi trends

Crypto is in most institutions’ plans

Institutional investors are quietly but decisively reshaping their relationship with crypto and blockchain. A new State Street study shows that the majority now expect their exposure to digital assets to double within three years, signaling that tokenization and on-chain infrastructure are moving from pilot projects to core strategy.

Nearly 60% of institutions plan to boost allocations in the next 12 months, viewing blockchain not as a speculative frontier but as the next stage in financial modernization. Private equity and fixed income are seen as the first to be transformed, unlocking liquidity in traditionally illiquid asset classes.

Transparency, faster settlement, and lower operational costs are driving this shift, with 40% of firms already running dedicated digital asset units. State Street’s Joerg Ambrosius calls it “a strategic lever for growth, efficiency, and innovation.”

The message is unmistakable: as tokenization, AI, and quantum computing converge, institutions aren’t just exploring the future of finance — they’re starting to build it.

Macroeconomic roundup

Will Powell assist the bulls?

Bitcoin’s macro sensitivity is back in play as traders brace for a “super week” of data. With Fed speakers, inflation signals, and labor updates ahead, every word could sway liquidity expectations — and crypto sentiment. Adding to the uncertainty, the U.S. government shutdown drags on with no clear resolution, complicating the macro picture.

Fed Lineup (Mon–Fri): Eight Fed officials are set to speak, including Bowman, Waller, and Miran. Markets found relief last week after his dovish comments suggested that slower growth might lower the neutral rate. Similar signals could reinforce easing bets and buoy Bitcoin.

Jerome Powell (Tue): All eyes are on Powell’s speech at the NABE meeting. He’s expected to balance softening labor data with lingering inflation. Any hint of front-loaded cuts could weaken the dollar and lift crypto; a firmer tone may cap risk appetite.

Jobless Claims (Thu): Consensus sits near 229K. A higher print would validate slowdown signals and strengthen liquidity expectations — a tailwind for Bitcoin.

Macro may be all over the place, but it’s still calling the shots. And for now, Bitcoin remains its barometer.

Blockchain

Ethereum steps up on privacy

The Ethereum Foundation has launched a new privacy cluster led by Igor Barinov of Gnosis Chain, bringing together nearly 50 engineers and researchers to advance privacy across its ecosystem. It’s starting to look a bit like a crypto conference — minus the merch tables and afterparties.

The initiative follows the rollout of Kohaku, a wallet SDK designed to enable private Ethereum transactions without trusted intermediaries.

With privacy debates intensifying globally and renewed market interest in tools like Zcash, Ethereum’s move signals a clear intent — to make privacy not an add-on, but a built-in feature of the network’s future.

The week’s most interesting data story

In the depths of a rebound

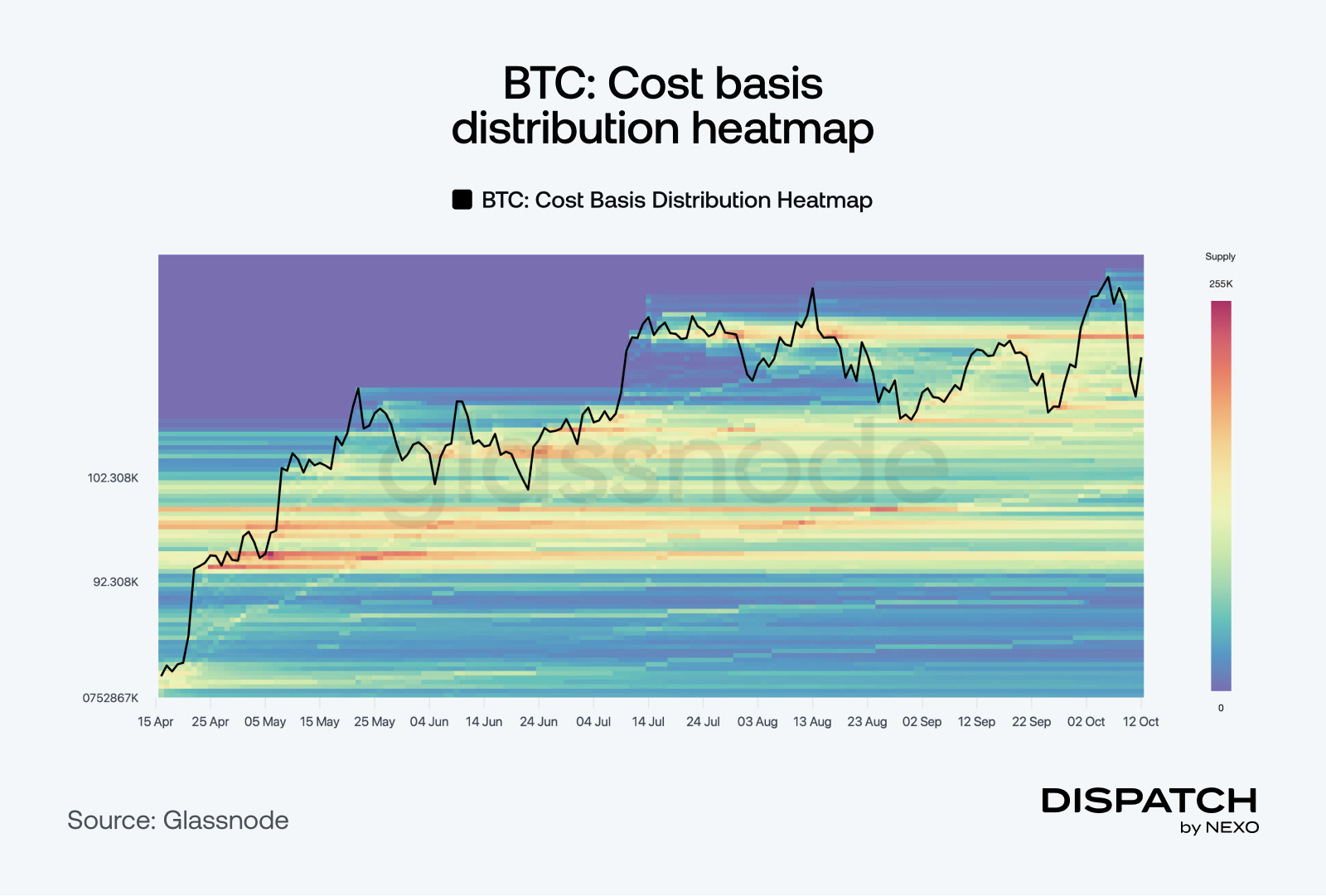

Bitcoin has bounced back toward $115,000 after Friday’s sharp drop to $109,000, reaffirming its resilience despite macro headwinds. On-chain data points to several support clusters forming between $112,000 and $117,000, areas that could offer attractive reentry points if volatility persists. With risk sentiment improving and buyers defending key zones, Bitcoin’s quick rebound signals the market’s confidence in sustaining higher levels.

The numbers

- $3.17 billion — Net inflows into crypto investment products last week, led by U.S. spot Bitcoin ETFs.

- $127 billion — Tether’s total U.S. Treasury exposure as of June 2025, placing it 18th among foreign holders.

- 640,250 — The total bitcoins now held by Strategy after purchasing 220 BTC for $27.2 million.

- $5,000 — Bank of America’s new 2026 price target for gold, up from the current $4,000 level.

- 1 million — The number of unique weekly stablecoin senders on Ethereum in recent weeks, marking a new record high.

Hot topics

What the community is discussing

A fresh start for the next run up?

Surely an uptrend is due now.

Time to de-escalate.

N.B.: Next week’s Dispatch will be sent on Wednesday, October 22, instead of Tuesday.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].