Dispatch #263: Bitcoin’s balancing forces in play

Sep 24, 2025•6 min read

In this patch of your weekly Dispatch:

- A major date for Bitcoin

- An Ethereum upgrade

- The next key macro report

Market cast

Is BTC cooling on the springboard?

Bitcoin’s weekly chart suggests the rally may be pausing for breath, with the Average Directional Index (ADX), a trend-strength indicator, easing below 25. Momentum gauges are also softening: the Relative Strength Index (RSI) and the Stochastic oscillator are turning lower, though both remain comfortably in neutral territory. The Moving Average Convergence Divergence (MACD), another momentum tool, has seen its histogram slip slightly negative, yet the recent pullback found support right at the middle Bollinger Band, defined by the 20-week simple moving average (SMA), a level that has often acted as a springboard in past consolidations.

On the daily chart, momentum signals lean more cautious as oscillators drift lower and the MACD lines cross down, though the Stochastic has already reached oversold conditions, hinting that sellers could soon run out of steam. With $112,000 and $110,000 providing strong support and resistance capped at $115,000–117,000, the setup points less to a breakdown and more to a cooling phase within a broader uptrend.

The big idea

The complexity of Bitcoin’s moves

Bitcoin has been seesawing through September, rallying on short squeezes one moment and retracing on profit-taking the next. Amid bursts of momentum, the asset has not managed the clean break above all-time highs that many expected this fall. Instead, it remains in the low $100,000s, suspended between optimism and consolidation.

This standoff reflects three powerful forces at work: trading activity, macroeconomics, and investor behavior. Together, they form the tightrope Bitcoin must walk to sustain its advance.

The sparks of trading activity: Nowhere is this balancing act clearer than in trading activity, where leverage and derivatives have amplified every move, turning routine swings into fireworks. Perpetual open interest peaked at nearly 395,000 BTC before FOMC-driven swings trimmed leverage, settling closer to 380,000 BTC. Shorts were squeezed into the decision, pushing Bitcoin toward $118,000, followed by some long positions being pared back as profit-taking set in.

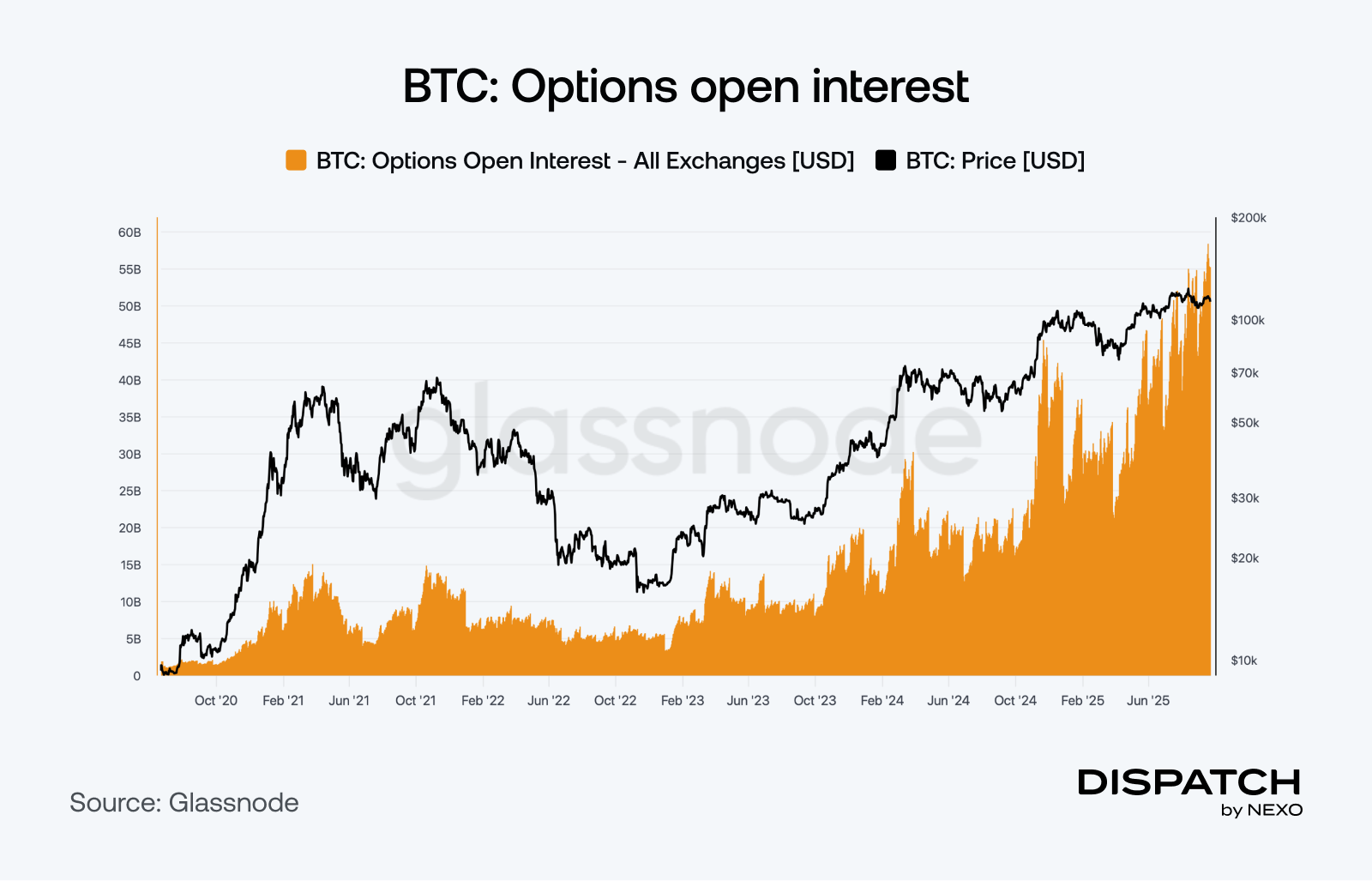

Options markets are also flashing historic signals, with open interest at record highs and expiry flows set to play an outsized role – more on this in this week’s data story below.

The counterweight of macroeconomics: The Fed’s 25bps cut on September 17 lifted Bitcoin briefly, but Fed chair Jerome Powell described it as “risk management” and stressed no urgency for rapid easing. Markets now look to October 29 and December 10 for further cuts, with the pace hinging on labour data. A strong jobs picture would let the Fed proceed cautiously, while weakness – rising unemployment or softer payrolls, could force deeper cuts, freeing liquidity that supports risk assets.

The impact is already visible: digital asset funds drew $1.9 billion in the week after the decision, $977 million into Bitcoin. Year-to-date inflows of $25 billion highlight firepower waiting for confirmation.

The balancing in investor behavior: On-chain, Bitcoin trades above the $115,200 cost basis of 95% of supply. Holding this line signals confidence; losing it risks a contraction back toward $105,500–$115,200. Sentiment-wise, long-term holders remain steady, while short-term traders await a breakout above $124,000 to confirm the next leg.

Corporate treasuries continue to accumulate, if at a slower pace. Strategy added 850 BTC, while Japan’s Metaplanet was more aggressive. Institutions are reinforcing the thesis, with Deutsche Bank comparing Bitcoin’s adoption arc to gold’s transition from skepticism to a reserve asset. Volatility is already near historic lows, underscoring its growing role in portfolios.

This week’s big idea is balance — and so far in 2025, Bitcoin has tilted it in its favor. By holding above key levels, attracting inflows, and keeping long-term conviction intact, it has kept the scales leaning its way. Trading flows fuel volatility, macro sets the weight, and investor conviction steadies the rope. The next gust of wind will decide the next move.

Ethereum

Is strength building beneath ETH’s surface?

Ether has cooled near $4,200 after a failed push above $4,700, but network and investor signals remain constructive. Fees rose 35% last week and active addresses climbed 10%, lifting validator yields and accelerating ETH’s burn. Corporate treasuries added nearly 878,000 ETH in the past month, while spot ETFs swelled to $24.7 billion in AUM. Exchange balances are at five-year lows, reducing near-term sell pressure.

What could spark momentum back? One catalyst is the Fusaka upgrade, set for December 3, with further expansions later in the month and into January that will more than double blob capacity. The upgrade is designed to make Layer-2s cheaper and more efficient, reinforcing Ethereum’s scaling roadmap. With solid on-chain activity, institutional demand, and Fusaka on the horizon, the foundations for a breakout toward $5,000 possibly remain in place.

TradFi trends

Will crypto make it to retirement savings (officially)?

A new policy shift in Washington is opening the door for digital assets to enter mainstream retirement plans. President Trump’s Executive Order 14330, signed in August, directs regulators to update rules so savers can diversify beyond traditional stocks and bonds, explicitly backing “alternative assets” that include cryptocurrencies.

Fast forward to today, lawmakers are now pressing the SEC and Department of Labor to move quickly, arguing that millions of retirement savers should have the same access to digital assets as institutions. If carried through, the change would bring crypto directly into 401(k)-style plans, expanding demand well beyond today’s ETF structures and embedding Bitcoin and Ethereum alongside the core building blocks of long-term wealth.

Macroeconomic roundup

The countdown to the next Fed rate cut

Fed Chair Jerome Powell set the tone this week, warning of the twin risks of sticky inflation and a softening job market while insisting policy is “not on a preset course.” His balanced stance highlights a split among Fed officials—some pushing for faster cuts to shield employment, others urging caution with inflation still above target, leaving markets confident of another quarter-point trim at the October 29 meeting. Here’s what’s on the radar this week as potential signals for the path ahead:

Jobless Claims (Thu): Initial claims have trended higher since July, with last week at 231,000 and forecasts for a modest rise to 235,000. Continued increases would strengthen bets on deeper cuts and support short-term BTC demand, while steady numbers keep the focus on inflation risks.

PCE Inflation (Fri): The Fed’s preferred inflation gauge is expected to be hotter at 0.3% MoM and 2.7% YoY, with core PCE steady at 0.3% monthly but rising to 3% annually. A sticky print would limit the Fed’s flexibility, weighing on crypto, while softer data would open the door to more aggressive easing.

The week’s most interesting data story

The BTC options compass

Bitcoin options open interest has climbed to an all-time high of almost $60 billion, underscoring the growing role of derivatives in shaping market dynamics. The focus now turns to the September 26 expiry, the largest in Bitcoin’s history. Expiries of this size can influence spot prices in the run-up, as dealer hedging flows respond to concentrated positions. With much of the market clustered around $110,000, expiry day could act as a gravitational pull before freeing the market for sharper moves.

The numbers

The week’s most interesting numbers

32 — The number of countries now pursuing Bitcoin exposure through legislation or state-backed programs

241,700 — That’s the estimated number of crypto millionaires worldwide, up 40% year-over-year.

$37.7 million — First-day trading volume for the new XRP ETF, the strongest debut of any U.S. ETF in 2025.

$632 million — Metaplanet’s latest Bitcoin buy, making it the fifth-largest corporate holder with 25,555 BTC worth $2.7B.

Week 38 — This week marks the 38th of the year, historically Bitcoin’s third-worst, with average returns of -2.25%, per Coinglass.

Hot topics

What the community is discussing

Surely, Bitcoin can beat that.

Do you remember 2017?

Crypto regulation goes transatlantic.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].