Dispatch #255: Here’s how Ethereum marks its 10th anniversary

Jul 29, 2025•5 min read

In this patch of your weekly Dispatch:

- Bitcoin’s structural shifts

- The Fed’s interest rate pivot

- XRP’s support dynamics

Market cast

Will macro events bring $120,000 for Bitcoin?

Bitcoin’s weekly chart continues to show a well-defined uptrend. Key momentum indicators—including the MACD, RSI, and Stochastic oscillator—remain supportive, while the ADX, which measures trend strength rather than momentum, confirms the underlying directional bias. The MACD is firmly above its signal line, and the RSI is elevated but still below overbought levels. The only early sign of fatigue comes from the Stochastic oscillator, which is beginning to turn down from overbought territory, hinting at potential short-term consolidation. A potential bull flag is forming on the weekly timeframe. A break and close above $120,000 would confirm the pattern and likely trigger further upside.

On the daily chart, price action is more neutral, with sideways movement and mostly flat indicators. The MACD hovers just below zero, while the ADX remains above 25, indicating the broader trend is still intact. Bollinger Bands are narrowing, often a precursor to volatility expansion and a potential breakout.

Key technical levels to watch include resistance at $120,000, $123,000, and $130,000, with support at $116,000 and $111,000. This week’s price action may be influenced by macroeconomic developments. For what could drive volatility and shape Bitcoin’s next move, see the Macroeconomic Roundup below.

The big idea

A decade of Ethereum: 90% in profit and counting

Ethereum turns 10 this week, and ETH is marking the occasion with a powerful run — hovering near $4,000, up 50% this month, and bringing over 90% of all ETH addresses into profit. That’s a milestone in itself. But it may not be the destination.

Rather than just a celebratory bounce, Ethereum’s move is supported by three emerging catalysts now taking shape — each with the potential to fuel the next phase of its climb.

ETH goes institutional The arrival of spot Ethereum ETFs has turned ETH into an institutional-grade asset almost overnight. In just six trading days, spot ETH funds attracted a staggering $1.8 billion in net inflows — nearly three times Bitcoin’s total over the same stretch. ETH ETFs now hold 5.6 million ETH, or roughly 5% of the total supply. With the GENIUS Act expected to supercharge stablecoin activity on Ethereum, this isn’t just momentum, but rather structural demand.

ETH finds a home on balance sheets Institutions aren’t just buying ETH — they’re putting it to work. SharpLink and Bitmine have accumulated over $3.5 billion in ETH, with plans for more. SharpLink alone recently acquired 77,210 ETH, more than the network’s 30-day net issuance, and staked most of it.

Meanwhile, validator queues show signs of churn and strength: over 625,000 ETH queued for exit, while 343,000 ETH is waiting to enter. As staking yields improve and regulatory clarity arrives, ETH is emerging as a yield-bearing treasury asset.

ETH leads the rotation ETH is not just rising — it’s leading. Up 72% versus BTC since April, ETH has overtaken BTC in weekly spot volume for the first time in over a year ($25.7 billion vs $24.4 billion). Key metrics show a rotation underway: the ETH/BTC MVRV ratio has broken multi-year resistance, ETF holding ratios are climbing, and altcoin volumes just hit a four-month high of $67 billion. ETH is front-running what could become a full-blown altseason.

Upgrades on deck Ethereum’s upcoming Fusaka upgrade (November) will improve scalability, gas efficiency, and validator access. Longer-term features, like zkEVM, cross-chain liquidity, and lower staking thresholds, are aimed at making ETH more deflationary and enterprise-ready.

Ethereum’s 10th birthday comes with more than just candles. With ETF inflows booming, treasury demand rising, and altseason unfolding, ETH isn’t running out of steam — it could just be warming up.

Bitcoin

Trade bump, but bigger forces at play

Bitcoin edged above $119,000 at the start of the week after the U.S.–EU trade pact lifted risk appetite, giving the market a modest boost. But the real story lies in two much deeper structural shifts that are reshaping the asset’s trajectory. Institutions now hold over 2.5 million BTC — more than 10% of total supply and up from just 4% eighteen months ago. That’s over $250 billion in Bitcoin held by public companies and ETFs, with funds absorbing coins at nearly ten times the daily mining supply.

At the same time, the once-dominant four-year halving cycle is losing relevance, giving way to steady, ETF-driven adoption and strategic accumulation. All eyes now turn to the July 30 U.S. crypto policy report, which could add further fuel to Bitcoin’s institutional evolution.

XRP

XRP’s strong month and Nexo’s match

XRP took a breather last week after its recent all-time high, but the broader trend remains intact, up nearly 50% over the past month. Price action held steady above $3.16, forming a clear ascending channel, with late-session volume spikes hinting at institutional interest. A break above $3.23 could set the stage for a move toward $3.30+, according to media.

With momentum still in play, Nexo users increasing their net position by 1,000 XRP or more this week will receive a 5% bonus as part of our ongoing XRP campaign. Phase one wraps up soon.

Macroeconomic roundup

Cooling in July, cutting in September?

The Fed is almost certain to hold rates steady this Wednesday at 4.25%–4.50%. Markets place the odds of a cut at just 3%. But this isn’t a quiet pause — it’s the calm before a potentially pivotal shift.

Behind the scenes, momentum is building for a September rate cut, with Fed funds futures pricing in a 62% chance. And there’s more: for the first time since 1993, we could see two sitting Fed governors dissent at the same meeting. Christopher Waller and Michelle Bowman, both Trump appointees, have publicly argued that waiting to cut carries greater risks. If they break ranks and vote to ease, it would send a loud signal that the Fed’s center of gravity is shifting — from patience to urgency. It’s not just the Fed in focus — see what else could move markets below.

The week’s most interesting data story

250+ million and counting

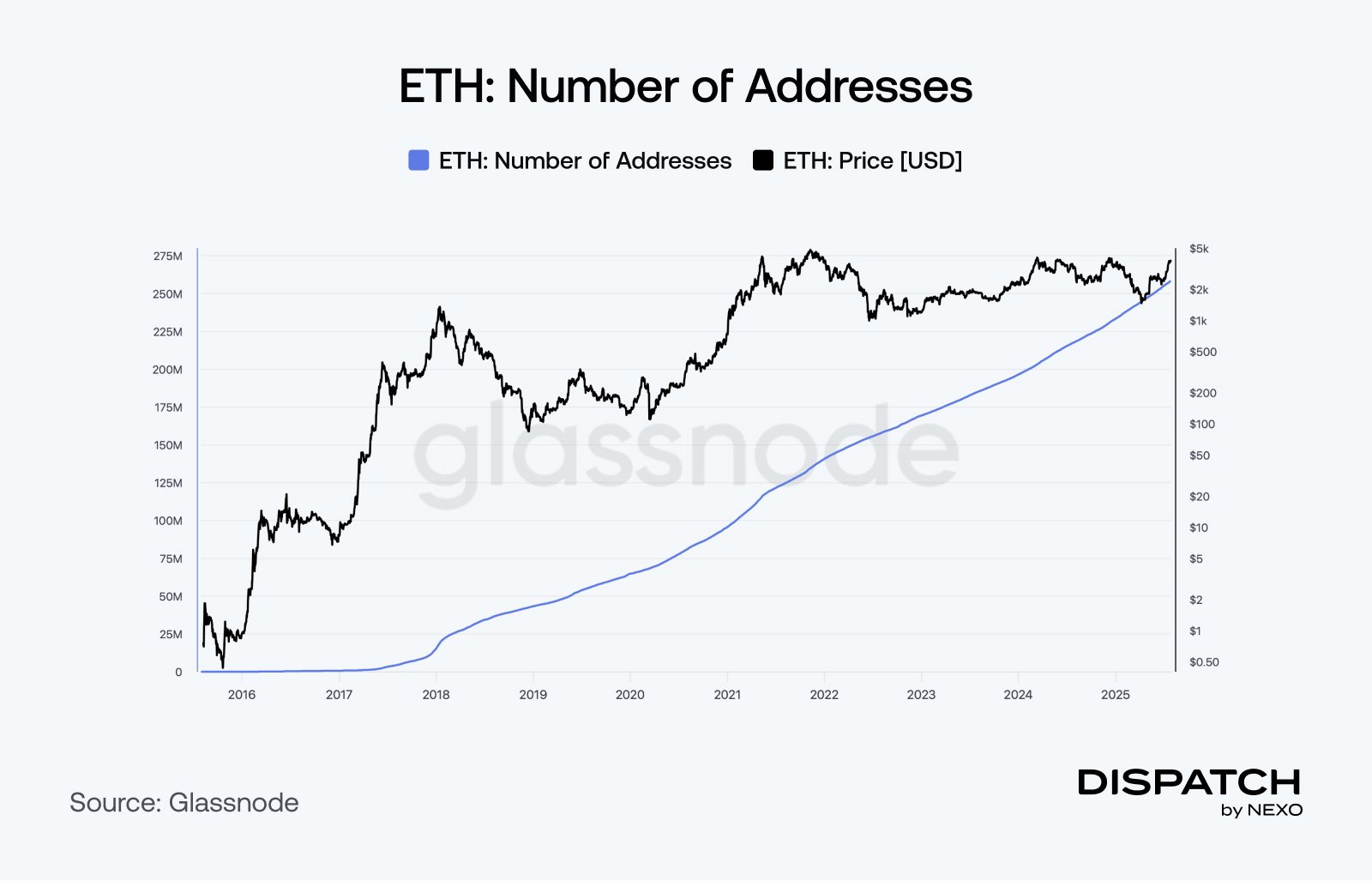

Nigh on its 10th birthday, Ethereum is still adding candles — and addresses. The network just crossed 250 million unique addresses, with nearly 1 million new ones created each week. That’s a 33% jump year-over-year, pointing to quiet but persistent adoption driven by Layer 2s, staking, and DApp activity. It’s a clear signal that Ethereum’s ecosystem is expanding faster and deeper than ever.

The numbers

The week’s most interesting numbers

- $60,000 – BitMine’s projected fair value for ETH, citing institutional demand.

- 50% – Rise in the number of public companies holding 1,000+ BTC since Q1.

- 17,132 BTC – Metaplanet’s total holdings, now the 7th-largest public BTC holder.

- $372,773 – Block reward earned by a solo miner who beat the odds.

- 30% – Current odds of ETH hitting $6K by year-end, up from 7% in early July.

Hot topic

What the community is discussing

Is this the most bullish performance ever?

Is that the most significant structural shift for BTC?

Is this one of ETH’s most overlooked milestones?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].