Dispatch #157: Crypto Rises in the East

Sep 16, 2023•3 min read

In this patch of your weekly Dispatch:

- More ETF action 🪙

- Inflation creeps up 📈

- The future of BTC 🔮

The Big Idea

The Grass Is Greener in India

Cryptocurrencies have become a truly global phenomenon with adoption continuing to spread. And it’s all the more reassuring when it’s the world’s most populous country that now comes to spearhead adoption – India.

This is one of the key findings in Chainalysis’ fourth annual Global Crypto Adoption Index report. Apparently, it is the Central & Southern Asia and Oceania (CSAO) countries that lead the crypto adoption index, with six of the top ten countries in the report situated in this region – India, Vietnam, Philippines, Indonesia, Pakistan, and Thailand. And there’s more inspiring details too.

Lower middle income (LMI) countries have performed best when it comes to grassroots crypto adoption – a rate measured by factoring transaction volumes, web traffic patterns and usage, purchasing power, and population. What makes this reassuring for crypto's future, is that LMI countries include developing countries with significant economic growth potential from expanding industries and populations. Mind you, these are home to 40% of the world's population and represent the largest share among income categories.

With institutional interest and venture capital stealing the headlines frequently (you’ll see more below), it’s important to acknowledge this grassroots resurgence in the less wealthy parts of the world of all places.

It’s this potential bottom-up, top-down adoption convergence that serves best as evidence of the diverse needs that crypto addresses across different segments of the population. There isn’t much more we can hope for.

The Latest In…

The ETF Attraction Continues

In what many will describe as bullish news flashes for the crypto market, two major players filed ETF applications. It's a race to the top for the world’s leading asset managers – here are the latest significant entries.

- Franklin Templeton, a renowned asset management firm, has sought approval for a spot Bitcoin ETF with the SEC.

- The Nasdaq stock exchange filed an application to list an Ethereum ETF from Brazilian asset manager Hashdex. This unique ETF plans to hold both spot Ether and futures contracts, providing a balanced approach to asset diversification.

These filings signify growing interest from established financial institutions in the crypto space, hinting at a promising future for digital assets in mainstream finance.

The Latest In…

Did BTC Get a CPI Vaccine?

The all-important August U.S. Consumer Price Index (CPI) report marked Wednesday to gauge YoY inflation rates. Amidst it all, Bitcoin has held impressively well – here’s the numbers:

- Cryptocurrency prices remained stable on Wednesday as the U.S. CPI showed a 3.7% increase (YoY), slightly surpassing expectations.

- Bitcoin traded around $26,100, while Ethereum fell 0.5% to $1,600, with the wider altcoin market seeing slight declines.

- The Fed will consider these figures, along with labor market strength before its September 20 interest rate announcement, where market expectations suggest a 91% chance of unchanged rates.

The Latest In…

The Lightning-fast Future of Money feat. Bitcoin

Stepping away from charts and prices, what does the future possibly hold for Bitcoin? PayPal Co-Founder, David Marcus shared his vision for the network to become a “universal protocol for money on the internet.” Marcus compared this to how texting has become a universal protocol for communication – even if the phone apps differ, the core principle behind it is the same.

According to him, users will be able to send any currency through the network, such as USD, JPY, and EUR and receive money of any choice on the other end, bringing Bitcoin’s Lightning Network infinitely closer to a “real-time,” “low cost,” and “cash final” settlement layer.

The Week’s Most Interesting Data Story

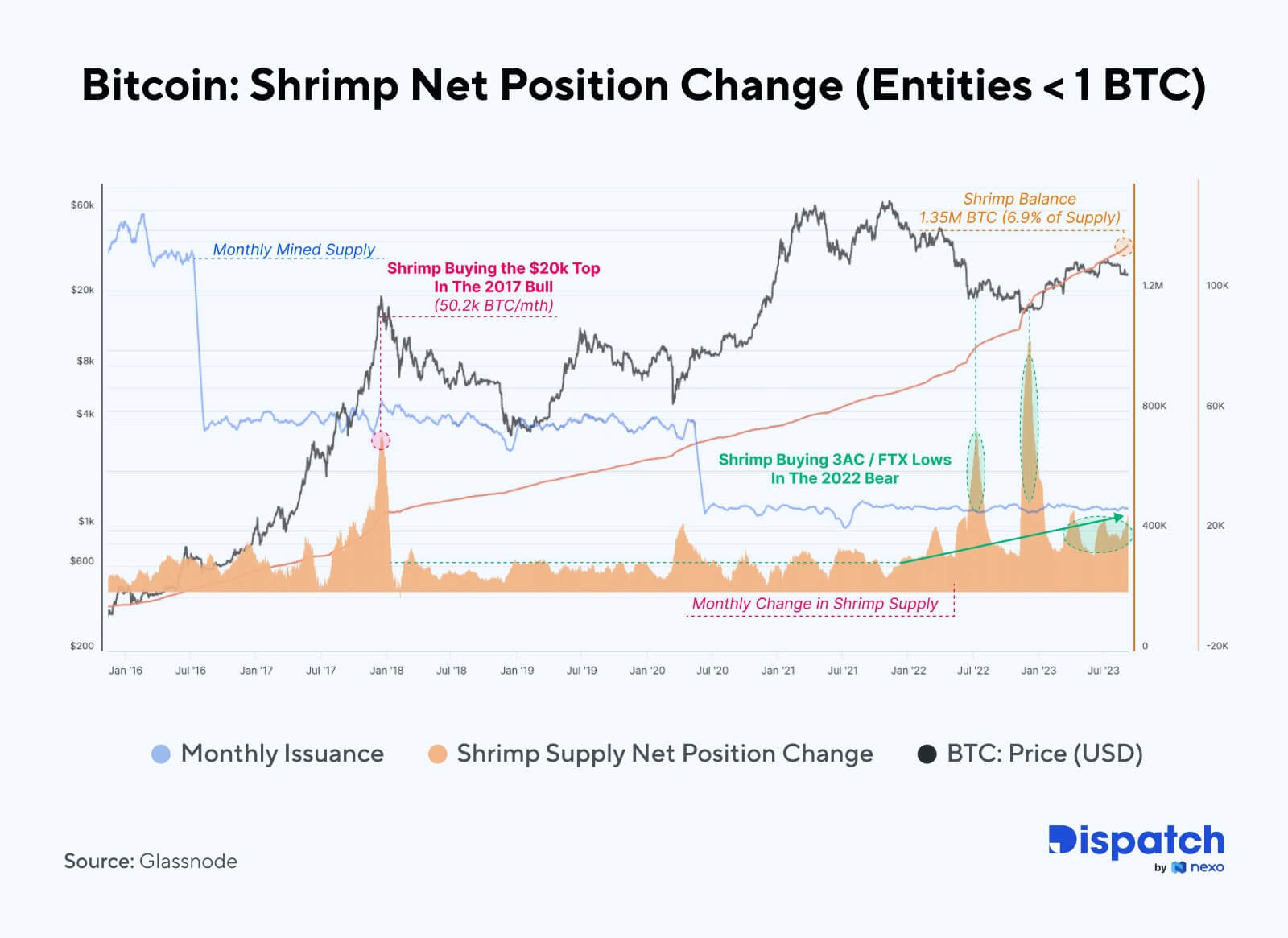

The Shrimp Just Got Better

We always give credit where it’s due and this week it goes to the small investors, accumulating BTC, one satoshi at a time. Called “shrimp” for the size of their holdings (less than 1 BTC) , this market segment now holds a whopping 1.35 million BTC or 6.9% of the total supply after learning to buy the dip!

Hot Topics

What the Community Is Discussing

Just bigger picture things.

Token 2049? Of course we are there!

Where do we sign up for this?

What to Watch for Next Week:

- Has volatility returned to crypto?

- Are stablecoins evolving?

- Is crypto trading back up?