Digital gold: What it is, how it works, and why investors are choosing it

Feb 12•10 min read

The simple answer

In 2025, something shifted. Gold hit 53 all-time highs, averaging $3,431 per ounce. And a new wave of investors discovered they could own gold without the storage headaches or high minimums.

Digital gold is a way to own real, physical gold through blockchain tokens. Each token represents a specific amount of gold stored in a vault, and you can buy, sell, or trade it just like cryptocurrency.

Most people think owning gold means buying bars, coins, or ETFs. But there's another option that combines the stability of gold with the flexibility of digital assets.

That option is digital gold — and it's changing how people think about wealth preservation.

This guide covers what digital gold is, how it works, and why tokenized gold like PAXG is becoming a practical choice for modern investors.

What is digital gold?

Digital gold refers to blockchain-based tokens backed by physical gold. Each token represents ownership of a specific amount of gold held in vaults by regulated custodians.

Think of it like this: instead of buying a gold bar and storing it yourself, you buy a token that proves you own a fraction of a bar stored elsewhere. The gold is real, allocated, and audited. The token is just the digital proof of ownership.

The most common form of digital gold is PAXG (Pax Gold), where one token equals one fine troy ounce of gold. The gold-backed PAXG is stored in London Good Delivery bars in professional vaults, and each token holder has a claim to that specific gold.

In 2025, the market cap of tokenized gold surged 177% to $4.4 billion. Trading volume hit $178 billion — a 1,550% increase year-on-year. First-time precious metals buyers grew by 309% in December alone.

People aren't just speculating. They're using digital gold as a wealth tool — one that's easier to access and more flexible than traditional methods.

How tokenized gold works

The concept is straightforward, but the mechanics matter.

When you buy a token like PAXG, you're not buying a representation or promise. You're buying ownership of physical gold. Here's the process:

The backing: Each PAXG token is backed by one troy ounce of London Good Delivery gold bars. These bars meet strict purity and weight standards set by the London Bullion Market Association.

The custodian: Paxos Trust Company, which issues PAXG, stores the gold in regulated vaults. Paxos is overseen by the New York State Department of Financial Services and holds full reserves.

The token: PAXG is an ERC-20 token on the Ethereum blockchain. This means it can be transferred, traded, or held in any compatible wallet. Ownership is transparent and verifiable on-chain.

Monthly audits: Third-party firms verify that the gold reserves match the number of tokens in circulation. These audit reports are published publicly.

Redemption: If you hold enough tokens, you can redeem them for physical gold bars. Smaller holders can sell their tokens back for cash or other crypto.

Everyday analogy: Imagine a parking garage where each car has a numbered ticket. The ticket isn't the car, but it proves you own a specific vehicle parked in a specific spot. Digital gold works the same way — the token is your ticket, and the gold is your car.

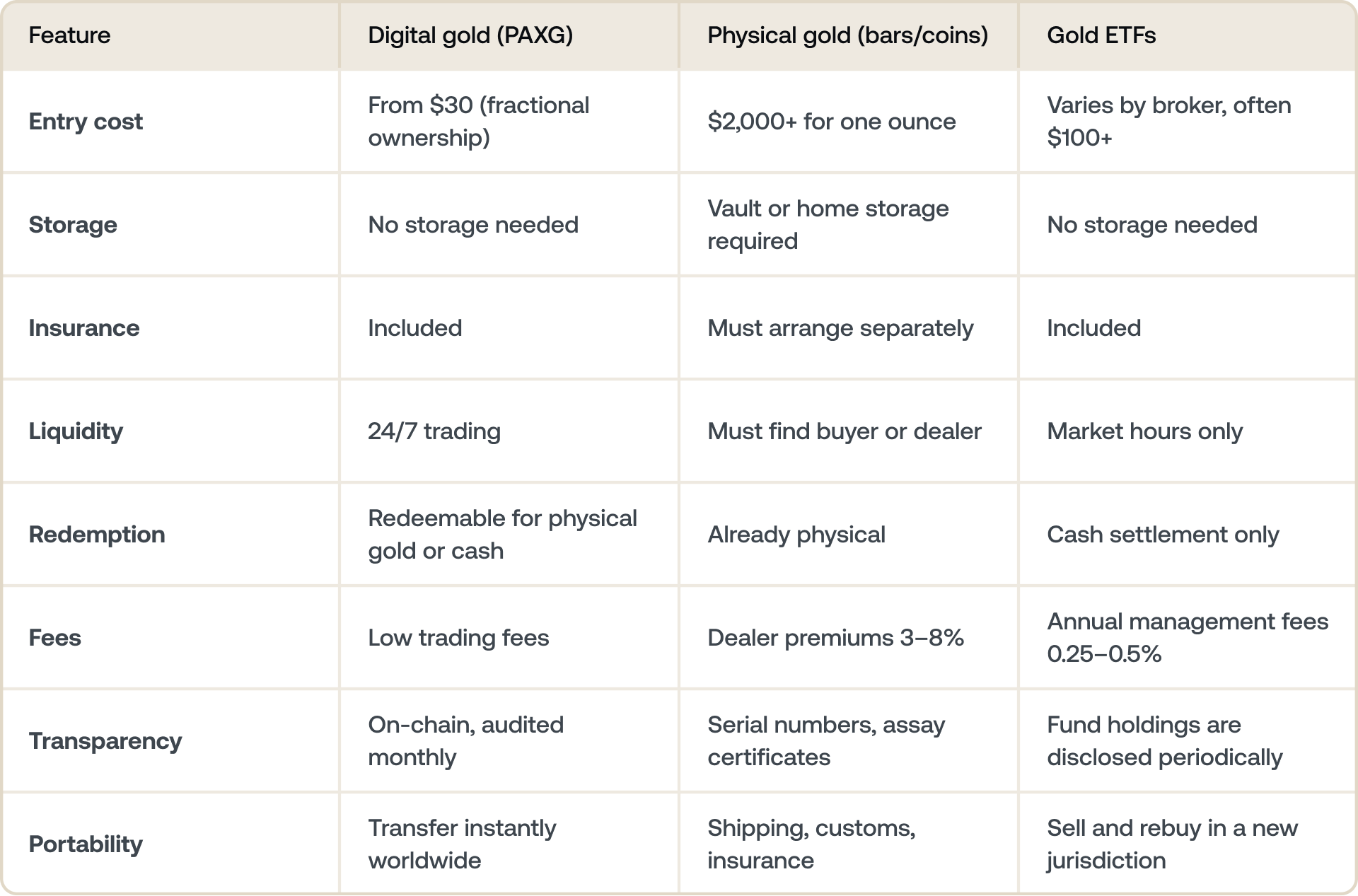

Digital gold vs physical gold vs gold ETFs

Each method of owning gold has trade-offs. Here's how they compare:

When digital gold makes sense:

You want exposure to gold's price movements without the logistics of physical ownership. You value 24/7 access and the ability to trade or transfer instantly. You're comfortable with blockchain technology and prefer flexibility over holding a physical bar.

When physical gold makes sense:

You prioritize direct possession and don't trust custodians. You want the tangibility of holding metal in your hand. You're willing to handle storage, insurance, and security yourself.

When gold ETFs make sense:

You invest through a traditional brokerage and want exposure through familiar channels. You prefer regulated securities markets over crypto platforms. You don't need redemption rights or 24/7 access.

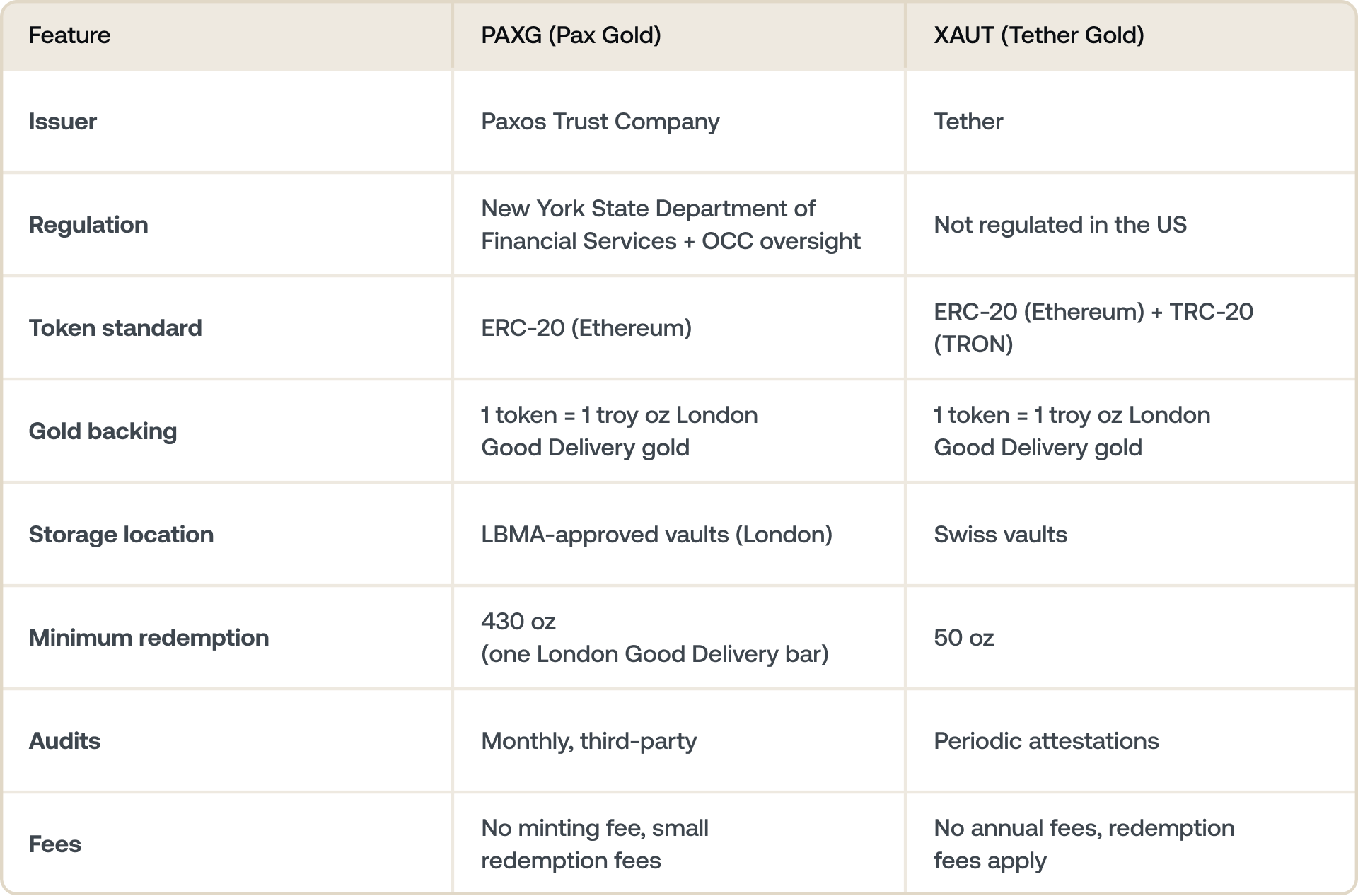

PAXG vs XAUT: which gold token is right for you?

Two tokens dominate the digital gold market: PAXG (Pax Gold) and XAUT (Tether Gold). Together, they represent over 95% of tokenized gold.

Here's the breakdown:

The main difference lies in regulatory oversight and transparency. PAXG operates under strict US financial regulation. XAUT offers multi-chain flexibility and lower redemption minimums but with less regulatory clarity.

For investors who prioritize compliance and transparency, PAXG is the common choice. For those who want cross-chain portability or lower redemption thresholds, XAUT offers an alternative.

Both tokens track gold's spot price closely, so the decision often depends on your preferences around regulation, blockchain choice, and redemption plans.

How to buy digital gold

Getting started with digital gold is more straightforward than most people expect.

Step 1: Choose a platform

You can start buying gold-backed crypto on Nexo with as little as $30. Once you own PAXG or XAUT, you can also earn daily interest on your holdings, depending on your jurisdiction.

Step 2: Complete identity verification

Regulated platforms require Know Your Customer (KYC) verification. This typically involves uploading an ID and proof of address. Verification can take minutes to a few hours, depending on the platform.

Step 3: Add funds

You can purchase digital gold with:

Debit or credit card (instant, small convenience fees)

Bank transfer (lower fees, 1–3 business days)

Existing cryptocurrency (if you already hold stablecoins or other assets)

Apple Pay or Google Pay on supported platforms

Step 4: Buy your tokens

Decide how much gold you want to own. You don't need to buy a full ounce — most platforms let you purchase fractional amounts starting from $30 or less.

Step 5: Store or use your tokens

Once purchased, your tokens are added to your account. You can leave them on the platform, transfer them to a personal wallet, or use them for other purposes, such as earning interest or borrowing.

Digital gold as an investment

Gold has a 5,000-year track record as a store of value. Digital gold brings that history into the blockchain era.

Why investors are choosing tokenized gold:

In 2025, 47.5% of millennials aged 35–44 bought gold or silver. That's higher than any other age group. Among first-time precious metals buyers, 41% chose tokenized gold over physical bars or ETFs.

The reasons are practical:

Fractional access: You don't need thousands of dollars to start. Buy $30 worth, and you own a fraction of an ounce. Add more over time as your budget allows.

No storage logistics: No need to rent a safe deposit box, install a home safe, or worry about theft. The gold is stored professionally, and you hold the digital proof.

Liquidity: Physical gold requires finding a dealer, negotiating a price, and waiting for payment. Digital gold trades 24/7 on global markets. You can sell in seconds if needed.

Portability: Moving physical gold across borders involves customs, insurance, and shipping costs. Digital gold transfers instantly to any wallet address.

Transparency: On-chain ownership means you can verify your holdings anytime. Monthly audits confirm that reserves match circulating tokens.

Diversification: Gold tends to move independently from stocks and crypto. When markets are volatile, gold often holds value or rises. Tokenized gold gives you that diversification without leaving the digital ecosystem.

What to keep in mind:

Gold doesn't generate cash flow. It doesn't pay dividends or interest by itself. Its value comes from scarcity, demand, and its role as a hedge. If you're looking for growth, gold alone won't deliver the returns of riskier assets. But if you're looking for stability and wealth preservation, it has a proven track record.

Gold that earns interest: Nexo's edge

Most platforms let you buy gold-backed crypto. Nexo lets you buy it and put it to work.

When you hold PAXG on Nexo, you earn up to 7% annual interest, paid daily.* When you hold XAUT, you earn up to 6.25%.* That means your digital gold grows while staying liquid and accessible.

This is rare. Traditional gold sits in a vault and does nothing. Gold ETFs charge storage fees instead of paying you. With Nexo, your gold-backed crypto compounds daily without lock-in periods or withdrawal restrictions.

How it works:

Interest accrues automatically on your PAXG or XAUT balance.

Payouts happen daily, so you see growth in real time.

No minimum holding period — withdraw anytime you want.

Rates depend on your Loyalty Tier, starting from 3% and reaching up to 7% for PAXG.*

This turns gold from a static store of value into an active part of your wealth strategy.

*Interest rates vary by Loyalty Tier and are subject to change. PAXG and XAUT are not available in all jurisdictions, including the EEA. Check nexo.com/earn-crypto for current rates and availability in your region.

What else can you do with PAXG and XAUT on Nexo

Buying gold-backed crypto is one thing. Using it as an active financial tool is another.

When you hold PAXG* or XAUT on Nexo, you unlock capabilities that traditional gold simply can't match:

Borrow against your gold — Use PAXG or XAUT as collateral and access liquidity in the form of stablecoins without selling. Rates start from 2.9% depending on your loan-to-value ratio and Loyalty Tier. This means you can cover expenses or seize opportunities while keeping your gold exposure intact.

Trade instantly across 100+ pairs — Swap PAXG or XAUT for Bitcoin, Ethereum, stablecoins, or other assets in seconds. No need to move between platforms, pay withdrawal fees, or deal with multiple accounts. Your digital gold stays liquid and ready to deploy.

Start from $30 — Traditional gold dealers require large minimums. With tokenized gold on Nexo, you can start with fractional ownership and build your position over time. No dealer premiums, no storage fees.

This transforms gold from a passive store of value into an active wealth tool. You can borrow, trade, and spend — all from a single platform.

*PAXG and XAUT are not available in all jurisdictions, including the EEA. Check nexo.com for current availability in your region.

Is PAXG safe?

Paxos is a regulated trust company overseen by New York's Department of Financial Services. It holds full reserves and undergoes monthly third-party audits. The gold is bankruptcy-remote, meaning it's held separately from Paxos's corporate assets.

Regulatory risk:

Regulations around tokenized assets are evolving. Changes in law could affect how tokens are issued, traded, or redeemed.

How it's mitigated: Paxos operates under existing US financial regulations. PAXG has been live since 2019 and has weathered multiple regulatory updates. Staying informed about regulatory changes in your jurisdiction is part of owning any digital asset.

Smart contract risk:

PAXG is an ERC-20 token. If there's a vulnerability in the Ethereum network or the PAXG contract, tokens could be affected.

How it's mitigated: Ethereum is the most battle-tested smart contract platform. PAXG's contract has been audited and has operated without incident for years. Still, all blockchain assets carry some technical risk.

Redemption limitations:

To redeem PAXG for physical gold, you need at least 430 troy ounces (one London Good Delivery bar). That's around $150,000 at current prices. Smaller holders can only sell tokens for cash or crypto, not exchange them for bars.

Market risk:

Gold's price fluctuates. If gold drops in value, your PAXG tokens drop too. This isn't unique to tokenized gold — it applies to any form of gold ownership.

PAXG eliminates many risks associated with self-custody of physical gold (theft, loss, storage). It introduces different risks (counterparty, regulatory, technical). Whether those trade-offs work for you depends on your situation and risk tolerance.

Frequently asked questions.

1. What is digital gold?

Digital gold refers to blockchain tokens backed by physical gold. Each token represents ownership of real gold stored in regulated vaults. PAXG is a common example, where one token equals one troy ounce of gold.

2. How does tokenized gold work?

Tokenized gold works by linking blockchain tokens to physical gold reserves. When you buy a token like PAXG, you own a claim to gold stored in a vault. The gold is audited regularly, and the tokens can be traded, transferred, or redeemed.

3. What is PAXG?

PAXG (Pax Gold) is a digital token issued by Paxos Trust Company. Each PAXG token represents ownership of one troy ounce of gold stored in London Good Delivery bars. It's an ERC-20 token on the Ethereum blockchain.

4. How do I buy digital gold?

You can buy digital gold through crypto platforms that support PAXG or XAUT. After verifying your identity, you can purchase tokens with a card, bank transfer, or existing crypto. Fractional amounts start from as little as $30 on Nexo.

5. Can I earn interest on digital gold?

Yes. Platforms like Nexo allow you to earn interest on PAXG holdings. Rates depend on market conditions, Loyalty Tier, and your jurisdiction. This lets your gold generate yield while you hold it.

6. What's the difference between PAXG and XAUT?

PAXG is issued by Paxos under US regulation and uses Ethereum. XAUT is issued by Tether, uses Ethereum and TRON, and stores gold in Swiss vaults. Both represent one ounce of gold per token, but they differ in regulatory oversight and redemption terms.

7. Can I redeem PAXG for physical gold?

Yes, but you need at least 430 troy ounces (one London Good Delivery bar) to redeem PAXG for physical gold. Smaller holders can sell tokens for cash or other crypto instead.

These materials are for general information purposes only and not intended as financial, legal, tax, or investment advice. Digital assets are subject to a high degree of risk, including volatile market price dynamics, regulatory changes, and technological advancements. Independent judgment based on personal circumstances should be exercised, and consultation with a qualified professional is recommended before making any decision.

*Gold-backed tokens (PAXG and XAUT) have geographic restrictions and are not available in all jurisdictions, including the EEA, US, and Canada. Check nexo.com/earn-crypto for current availability and rates in your region.