Dispatch #275: Will 2025 give Bitcoin a runway into 2026?

Dec 16, 2025•6 min read

In this patch of your weekly Dispatch:

- XRP’s ETF milestone

- SOL’s latest upgrade

- BTC’s strong support

Market cast

BTC navigates support amid mixed signals

Bitcoin continues to retrace on the weekly chart, with price action pulling back toward the 100 SMA, now tested for the third time in recent weeks and still holding as a notable trend-support indicator. The weekly structure leans cautious: BTC is tracking along the lower Bollinger Band, while momentum signals such as RSI and Stochastic sit near subdued levels. The MACD histogram, a measure of trend strength, remains below the zero line, suggesting momentum has yet to stabilize.

The daily chart reflects a similar setup. Price is pressed against the lower Bollinger Band, the Stochastic oscillator has moved into oversold territory, and the RSI continues to show softer momentum. The MACD has also registered a bearish crossover, keeping the near-term bias tilted to the downside.

Attention now turns to the $86,000–$85,000 support area, with $80,000 emerging as the next meaningful level if downside pressure persists. On the upside, initial resistance is seen around $88,000–$89,000, followed by $92,000–$93,000 should buyers regain control.

The big idea

Bitcoin reaches a crossroad: Rising tailwinds and quiet headwinds

With 2025 drawing to a close, Bitcoin’s surface looks subdued, yet the foundations are firming. Regulation is advancing, institutions are allocating again, and global liquidity is turning higher just as speculative froth clears. Short-term headwinds remain – from choppy data to stubborn consolidation, but the broader setup continues to tilt in Bitcoin’s favor. So, here’s Bitcoin’s stance as the year ends.

Tailwinds: Policy clarity, institutional demand, and a global liquidity push

U.S. regulation is progressing in a way the market hasn’t seen before. Senate Banking Chair Tim Scott says “real progress” is underway toward a bipartisan digital-asset market-structure bill after meeting with the heads of Bank of America, Citi, and Wells Fargo. With the House already having passed its version, the Senate’s negotiations now carry real weight. For institutions, clearer rules mean fewer barriers — and more confidence in allocating to the sector.

Institutions outside the U.S. are already moving. Itaú Unibanco, Latin America’s largest private bank, is advising a near-3% Bitcoin allocation as a long-term diversification and currency-protection tool – guidance that mirrors Bank of America’s own allocation framework for its wealth clients. Bitcoin is increasingly treated as part of a modern portfolio, not a speculative add-on.

The most important tailwind, however, is global liquidity. After three Fed cuts in late 2025 and the end of quantitative tightening, liquidity is expanding again. Global M2 has reached an all-time high near $130 trillion, driven largely by China but reinforced by U.S. Treasury measures designed to keep funding conditions smooth. Historically, when liquidity rises, risk assets follow – though crypto has not yet reflected this shift, with the total market cap still down more than 20% in Q4. That disconnect leaves room for a rebound as liquidity trends continue into early 2026.

Altogether, policy, institutional positioning, and liquidity point in the same direction: the pressures that defined 2025 are easing.

Headwinds: Near-term Chop, range-bound trading, and macro wildcards

In the short run, Bitcoin’s chart still reflects hesitation. The market is moving within a tight range, with liquidity clustering around $95,000 – a level likely to attract price before any decisive move. The widely watched daily “bear flag” has traders split, but on-chain data shows speculative losses and strong long-term holder conviction, a combination often seen before recoveries rather than trend breaks.

Macro conditions could add brief volatility. CPI and unemployment data arrive this week, and the Bank of Japan’s potential rate hike remains one of Bitcoin’s few clear short-term risks given its history of tightening global liquidity. But these are tactical headwinds – not structural ones, and none meaningfully alter the improving setup for 2026.

A forward look: Signals of the next move

The clearest sign that a larger shift is approaching comes from Bitcoin’s options market. Nearly $56 billion in open interest is stacked around one expiry – December 26, and one level at $100,000. Gamma and max-pain align around the mid-$90,000s to six figures, effectively pinning spot prices until the expiry clears. Once it does, hedging unwinds, liquidity resets, and the market begins trading with fewer constraints, right as macro data and global liquidity turn a new page.

So while price feels subdued, the underlying layout suggests transition rather than stagnation. Policy clarity is advancing, liquidity is expanding, institutions are leaning in, and speculative excess is being flushed out.

Bitcoin enters 2026 not with explosive momentum, but with a stronger foundation – and historically, that’s when the most durable upside begins.

XRP

Quiet strength behind an ETF milestone

Spot XRP ETFs have topped $1.1 billion in assets and posted 30 straight days of inflows since launch – a consistency Bitcoin and Ethereum ETFs didn’t match. The pattern suggests structural, long-term allocation rather than short-term trading.

If momentum holds near $200 million a week, inflows could exceed $10 billion by 2026, setting up a potential supply squeeze. Meanwhile, XRP trades near $2.00, with whales accumulating into weakness, a classic bottoming signal. XRP’s price may be quiet, but flow data shows deepening institutional conviction heading into 2026.

TradFi trends

Regulators step back: Crypto no longer a “risk”

The Financial stability oversight councils 2025 report drops digital assets from its roster of financial-system vulnerabilities, ending three years of systemic-risk warnings. Crypto is now treated as a “market development to monitor,” reflecting growing institutional participation rather than contagion concerns.

The shift aligns with this year’s policy reset: the White House formally backed the responsible growth of digital assets, Congress passed the GENIUS Act to regulate stablecoins, and bank regulators reopened channels by rescinding SAB 121 and permitting broader crypto intermediation.

Global bodies remain cautious on AML and cross-border risks, but the U.S. macroprudential stance has clearly softened. For Bitcoin heading into 2026, the removal of “vulnerability” language clears a major institutional barrier.

Macroeconomic roundup

Catalyst-heavy: The macro week ahead

Markets have been trading cautiously, with equities stabilizing after recent swings and Bitcoin consolidating near $90,000. A dense run of U.S. data and a closely watched BOJ meeting now sets the tone for the week ahead. With bullish equity technicals but fragile tech sentiment and elevated yields, upcoming releases will determine whether risk assets extend their momentum or slip into higher volatility.

Nonfarm Payrolls (Tuesday): The key data catalyst. A soft print supports dovish Fed expectations; a strong one risks hawkish repricing.

Retail Sales (Wednesday): A pulse check on consumer strength as growth expectations remain high.

Initial Jobless Claims (Thursday): Rising claims bolster easing bets; lower readings could cool risk appetite.

November U.S. CPI (Thursday): The pivotal inflation read. Softer CPI would fuel a risk-on tilt; a hotter print threatens downside for equities and crypto.

Bank of Japan Meeting (Fri): A potential global inflection point. A hawkish stance could lift yields worldwide and pressure risk assets.

The week’s most interesting data story

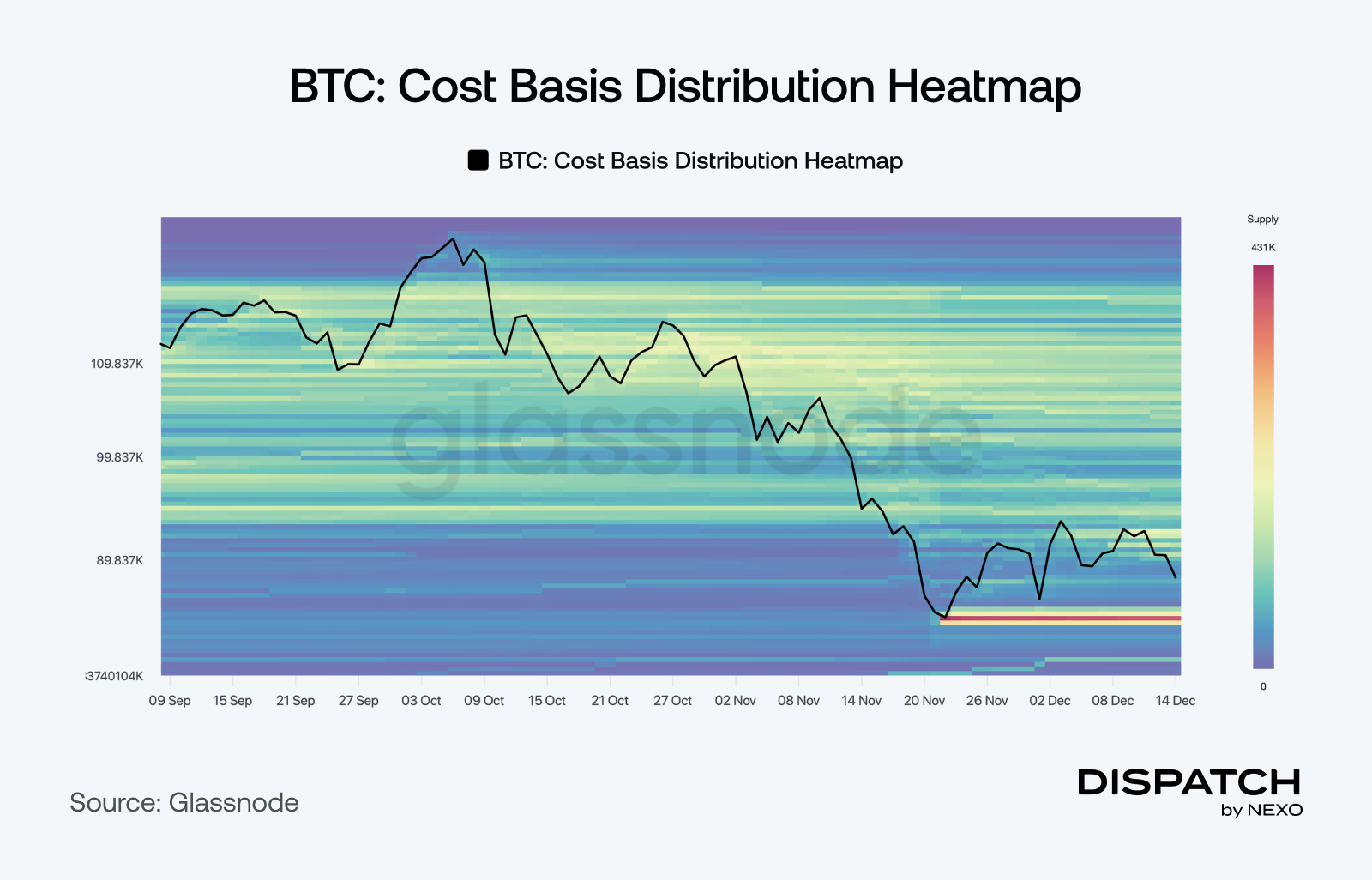

$85,000: The solid BTC support

On-chain data shows Bitcoin building a major support base around $85,000, with roughly 400,000 BTC acquired in this zone. This range aligns with the True Market Mean, the volume-weighted cost basis of U.S. spot ETFs, and the average 2024 acquisition price – three signals pointing to heavy institutional accumulation. With spot trading near $92,000, Bitcoin remains historically close to one of its strongest structural support levels of the year.

The numbers

The week’s most interesting numbers

$1,000,000 TPS — Firedancer’s breakthrough throughput test, bringing Solana closer to its vision.

1 in 30,000 — The odds a solo miner beat this week to win a full Bitcoin block reward worth roughly $282,000.

€1.1 billion — Tether’s all-cash bid to buy Juventus, a bold expansion play from the world’s largest stablecoin issuer.

$864 million — Net inflows into global crypto investment products last week, marking the third straight week of capital returning.

Hot topic

What the community is discussing

Looking for the purchase confirmation now?

A hidden bullish signal?

Is that an up-only signal then?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].