Use the same collateral for all your positions and leverage your unrealized profits as margin to grow your trading power.

Your risk is limited to the assets only within the Futures Wallet, protecting your main portfolio.

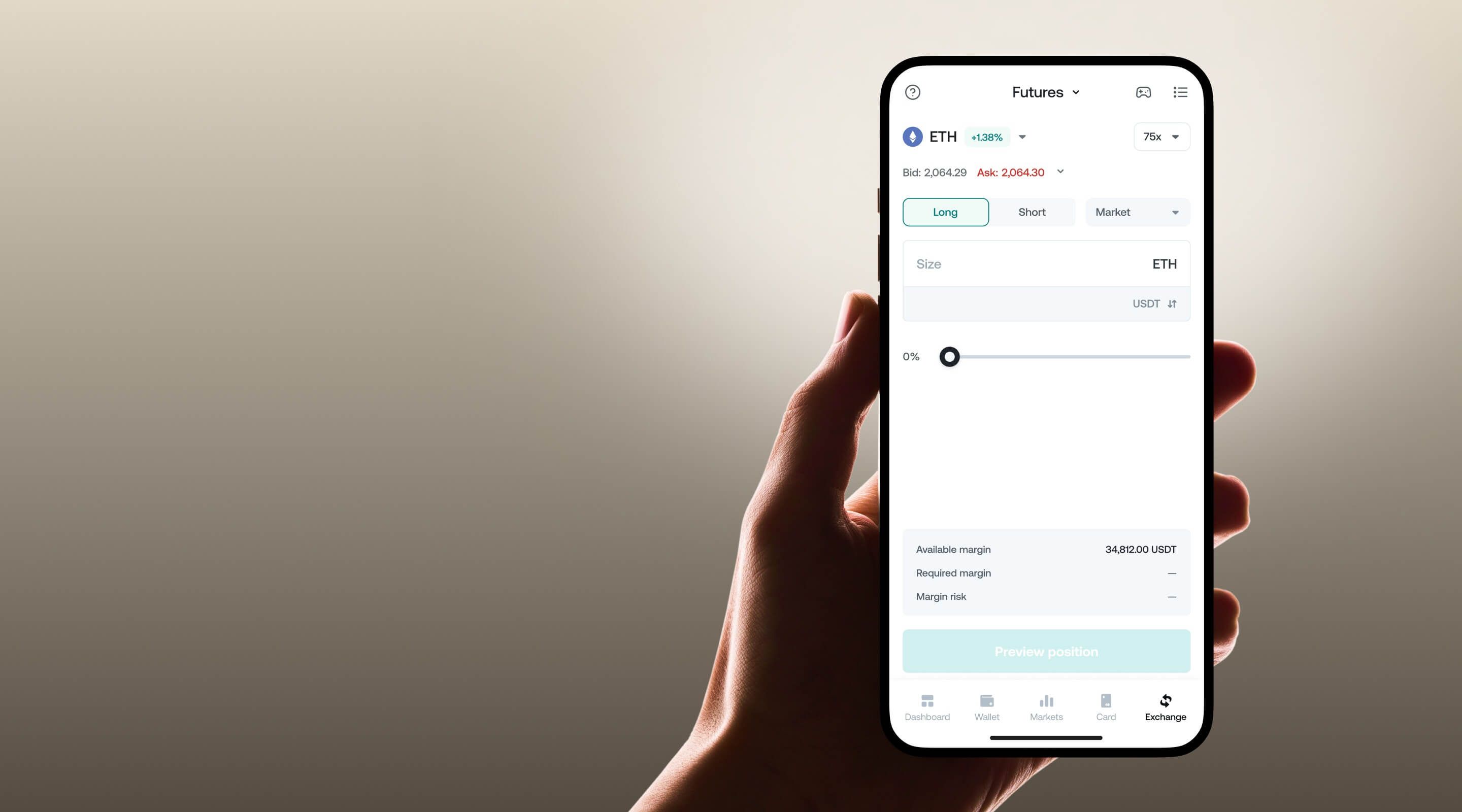

Crypto Futures trading allows you to speculate on the future price of cryptocurrencies without owning the asset by opening a long or short positions based on your market predictions.

For example, if you believe the price of Bitcoin will rise in the near future, instead of buying Bitcoin today, you decide to enter into a Perpetual Futures contract that allows you to gain exposure only to its price movement.

On the flip side, if you think the price of Bitcoin will go down, you open a 'short position'. As there is no expiration date, you can maintain this position as long as you wish, provided you manage your Margin Risk.

Currently, on the Nexo app or web platform, you can trade over 100 Perpetual Futures contracts.

To begin trading, you need to complete a short quiz and transfer collateral instantly and free of charge to your Futures Wallet.

To read more about funding your Futures Wallet, visit our Help Center article.

Leverage allows you to trade crypto Futures by controlling positions that are greater than your balance. For example, with $100 of your own asset and 10x leverage, you can control a $1,000 position.

The minimum leverage for a single trade is always 2x and the maximum varies between 10x and 100x depending on the Futures contract.

Cross-margin allows you to use all collateral in your Futures Wallet to manage trades across various assets. Instead of isolating your collateral to individual positions, cross-margin pools your resources.

This provides flexibility and the ability to cover potential losses with profits from other trades without prematurely closing positions.

Futures contracts, while offering potential rewards, come with the risk of potentially losing your entire collateral. This is why you should be attentive to Margin Calls – a push notification and email that may come when your Margin Risk surpasses a certain threshold.

In normal circumstances, you may receive a push notification as an alert if your Margin Risk goes above 65% and an email if your Margin Risk goes above 85%. In this case, you should either close part of your positions or add more collateral to your Futures Wallet to avoid losses. In general, it is important to always monitor your Margin Risk in your Nexo app or web platform when trading Futures.