Ethereum at 10: From programmable money to the backbone of tokenized finance

Jul 30, 2025•6 min read

In July 2015, a new blockchain quietly launched with an audacious goal: to become a "World Computer." While Bitcoin established itself as digital gold—a secure, decentralized store of value—Ethereum introduced a complementary vision: a decentralized platform enabling applications to run without intermediaries, servers, or downtime. It was not just about money. It was about rebuilding the internet from the ground up.

Ten years on, Ethereum has not just survived the turbulent tides of tech cycles, regulatory uncertainty, and internal schisms – it has flourished. Today, Ethereum anchors a vast modular financial stack, inspires cultural movements, and serves as public infrastructure for decentralized value and identity. To understand how Ethereum became the beating heart of Web3, we look at its defining pillars – accomplishments that reflect what it is and what it aspires to be.

Scaling the vision: Ethereum’s modular evolution

Ethereum's early success created its biggest growing pain: congestion. The 2017 CryptoKitties craze and the 2020 DeFi boom highlighted Ethereum’s myriad of use cases, but also limitations, with fees soaring and transaction speed lagging. Yet rather than abandoning its base layer, the Ethereum community embraced a layered future.

Layer 2 rollups now process tens of millions of transactions weekly. These off-chain scaling solutions batch and compress user activity, settling it securely back on Ethereum. This architecture preserves Ethereum’s decentralization while unlocking speed, scale, and experimentation, fueling continued advancement.

Ethereum’s modular future is already here. It no longer tries to do everything on Layer 1 – instead, it anchors an entire ecosystem where execution, data availability, and applications operate across multiple layers. This is a foundational shift, and it reaffirms Ethereum’s identity not as a single chain but as a settlement layer for the decentralized internet.

Importantly, these Layer 2 networks are not just technical infrastructure – they are shaping user experience, developer incentives, and even governance models. Each network often comes with its own native token, designed to incentivize usage, secure the protocol, and fund future development. While Ethereum remains the common denominator, the diversity of Layer 2 approaches – from optimistic to zero-knowledge rollups – means that experimentation is happening in parallel at scale. This diversity strengthens the ecosystem, even if it introduces new complexity.

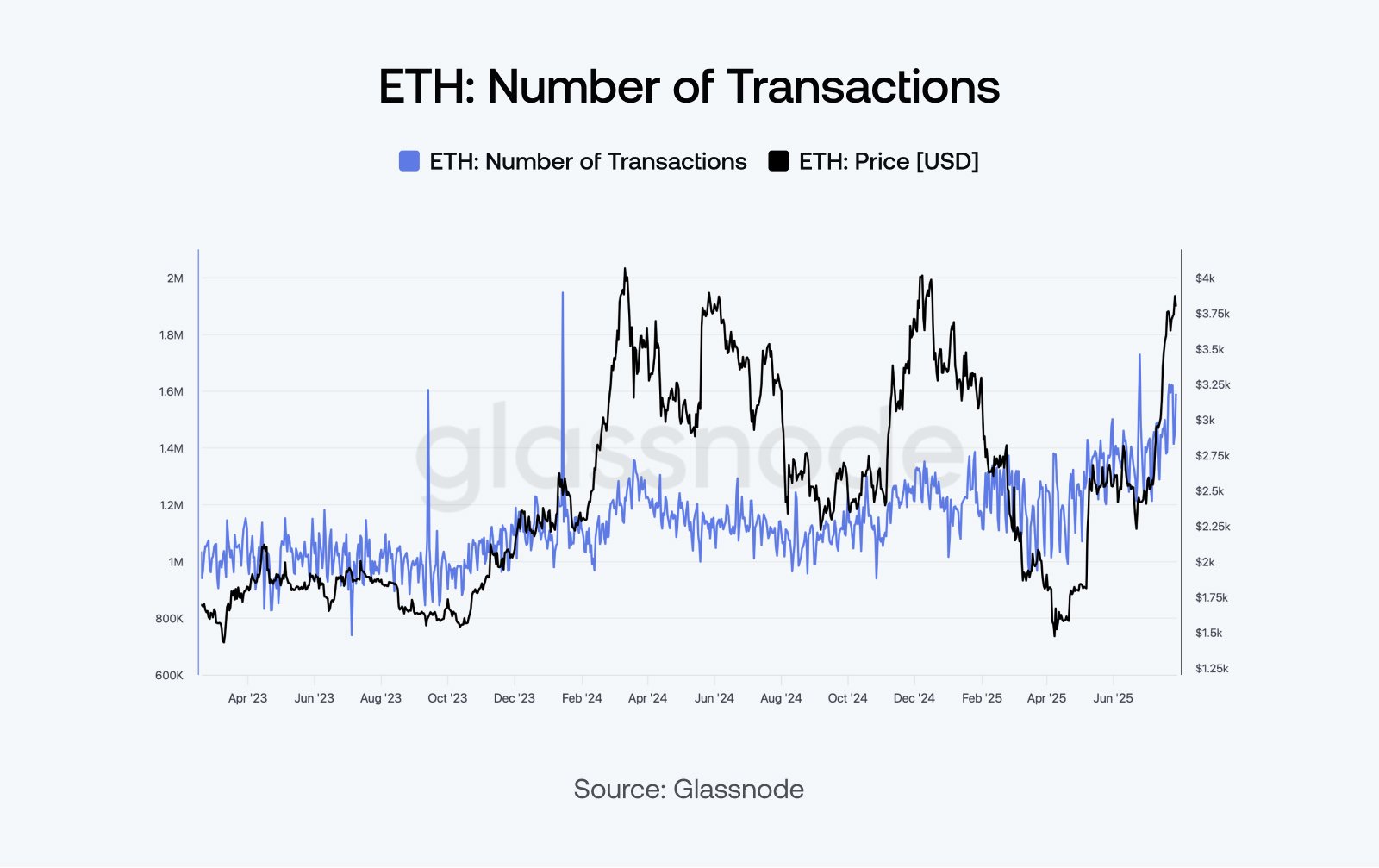

Total Ethereum transactions, including Layer 2 activity, highlight the protocol’s evolution into a high-throughput settlement platform.

Reinvention by design: a blockchain that evolves

Ethereum’s capacity for change is one of its most underappreciated traits, Ethereum being among the few chains to embrace adaptation as a strength, not a flaw.

From the Ethereum Virtual Machine (EVM) to Solidity, Ethereum gave developers programmable money. But it didn’t stop there. The transition from proof-of-work to proof-of-stake in 2022 – known as The Merge – reduced Ethereum’s energy use by over 99.9%, making it the most significant sustainability shift in blockchain history.

Other upgrades followed: EIP-1559 introduced fee burns and added deflationary pressure. Proto-danksharding (EIP-4844) lowered rollup costs. And Ethereum’s long-range roadmap – the Surge, Scourge, Verge, Purge, and Splurge – signals its intent to keep refining scalability, censorship resistance, and UX.

Ethereum doesn’t harden – it iterates. Its willingness to rewrite itself while staying live is a defining achievement.

Ethereum’s post-Merge monetary policy has stabilized supply growth, aligning incentives for long-term network health.

Real-world assets and on-chain finance

Tokenization was once a buzzword. Now it’s reality – and Ethereum is where it’s happening. From U.S. Treasury bills and money market funds to private credit and real estate, Ethereum has quietly become the default platform for real-world asset tokenization.

Major financial institutions have moved from pilots to live deployments. Regulatory clarity in jurisdictions like the EU and UAE has accelerated the trend. As of mid-2025, Ethereum and its scaling layers host around 60% of the tokenized asset market.

This shift reflects more than technical capability. Ethereum offers transparency, programmability, and global accessibility. It is becoming the trust layer where traditional finance meets open infrastructure.

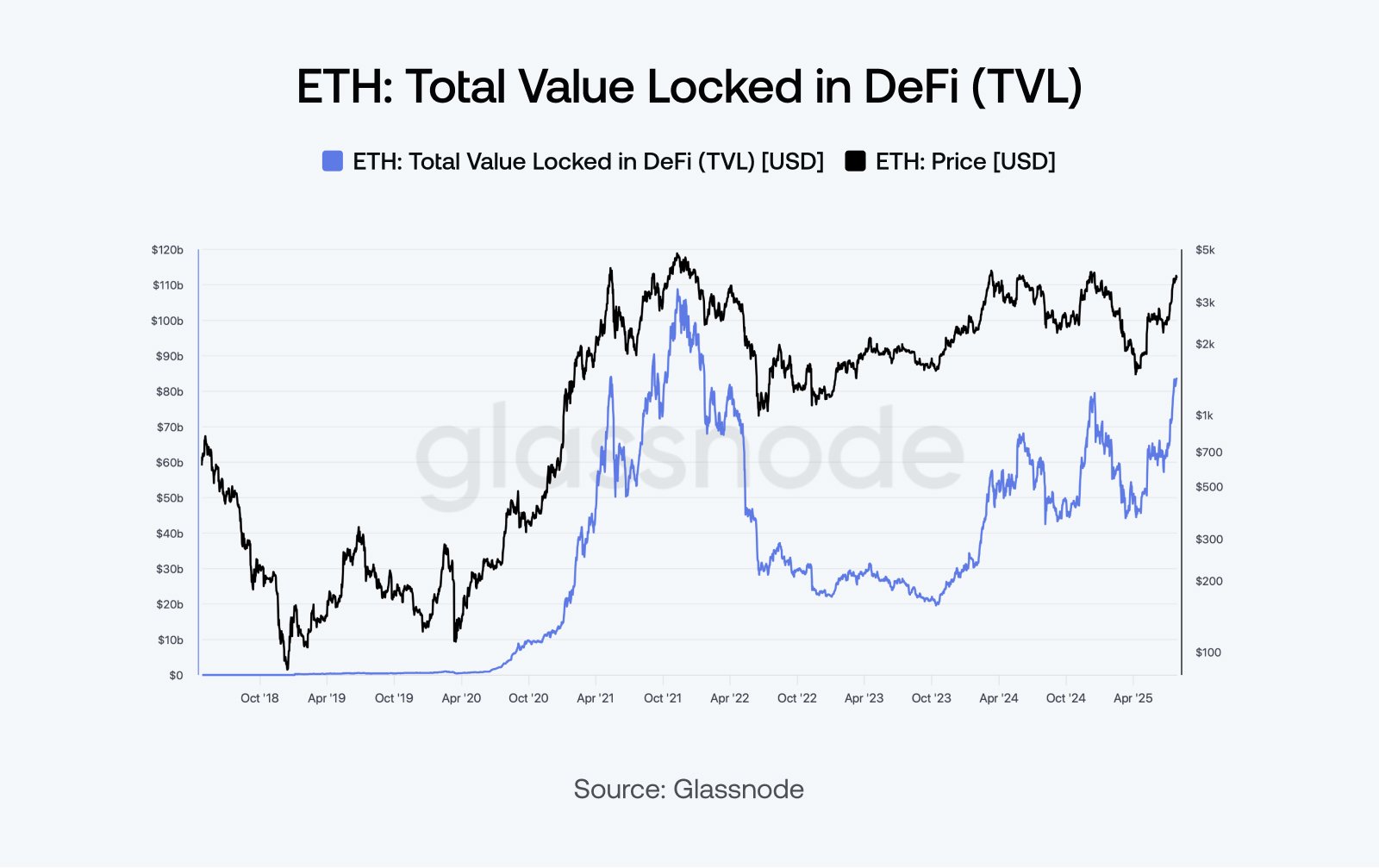

Ethereum continues to anchor DeFi’s capital base, with billions in real-world and native assets locked across its ecosystem.

The liquidity layer: stablecoins on Ethereum

If Ethereum is a decentralized economy, stablecoins are its cash. Ethereum continues to host the majority of global stablecoin volume, enabling everything from cross-border payments to on-chain savings.

Stablecoins are integrated across DeFi protocols, used as base pairs for decentralized exchanges, and underpin on-chain credit markets. They’re not only essential to crypto-native use cases – they also serve people in inflationary economies, enabling access to dollar-denominated assets without bank accounts.

Ethereum’s role as the backbone of digital dollar liquidity is no accident. Its infrastructure is secure, composable, and battle-tested.

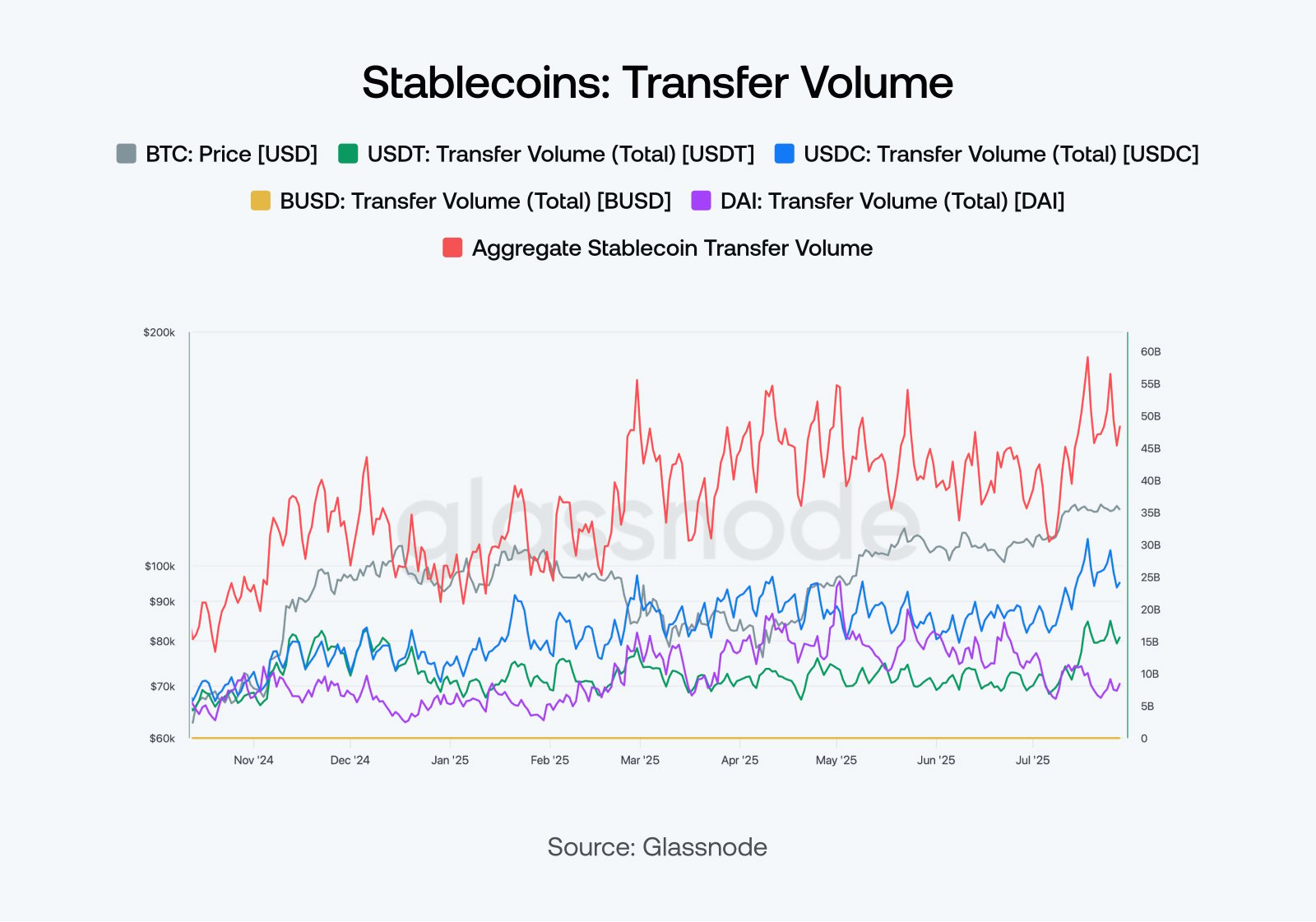

Ethereum consistently handles the majority of global stablecoin transfer volume, anchoring its role as crypto’s liquidity layer.

The culture layer: identity, creativity, and web3 expression

Ethereum is more than finance – it’s where code meets culture. The rise of NFTs in 2021 turned Ethereum into the canvas of the internet. Artists, musicians, and creators used the blockchain to sell, license, and remix digital work in ways never before possible.

ENS names became portable identities. DAOs evolved from governance tools to digital cooperatives. Wallets stopped being mere key vaults – they became your social passport, your on-chain resume.

This isn’t a fringe movement. Ethereum is helping define what digital identity, community, and ownership mean in the age of Web3.

Ethereum vs. Bitcoin: two philosophies, one ecosystem

Bitcoin is sound money. Ethereum is programmable infrastructure. Both have merit, and both are better understood in contrast.

Ethereum’s flexibility allows it to integrate with financial systems, power complex apps, and adapt to user needs. Bitcoin’s simplicity ensures its security and clarity of purpose. While Bitcoin remains steadfast, Ethereum embraces change.

Together, they’ve shaped how we think about value, control, and code. But Ethereum’s ambition – to become the settlement layer for everything – makes it a fundamentally different kind of project.

Public good infrastructure: Ethereum’s governance and ethos

Unlike a traditional tech company, Ethereum is stewarded by its community. The Ethereum Foundation, Gitcoin, and Protocol Guild support development through grants, retroactive funding, and collective coordination.

The network’s continued success hinges on four unresolved challenges: user experience, scalability, decentralization, and privacy. Each is being addressed – from account abstraction and rollups to zero-knowledge tech and funding experiments. But Ethereum’s strength is that it doesn’t pretend the job is done.

Instead, it makes that unfinished work public – and invites others to help.

Ethereum’s second decade begins

Ethereum has gone from an idea in a whitepaper to a settlement layer for billions in value, culture, and community. It introduced smart contracts to the world, powered a decentralized financial system, and created the tools for online identity and expression.

It did all this without a CEO, without a centralized roadmap, and without giving up on its founding principles.

If the last decade was about experimentation, the next is about integration across finance, society, and even AI. Ethereum may not dominate every niche. But like TCP/IP or Linux, it could become essential infrastructure for the age of value.

The World Computer is no longer theoretical. It’s operational – and it's just getting started.

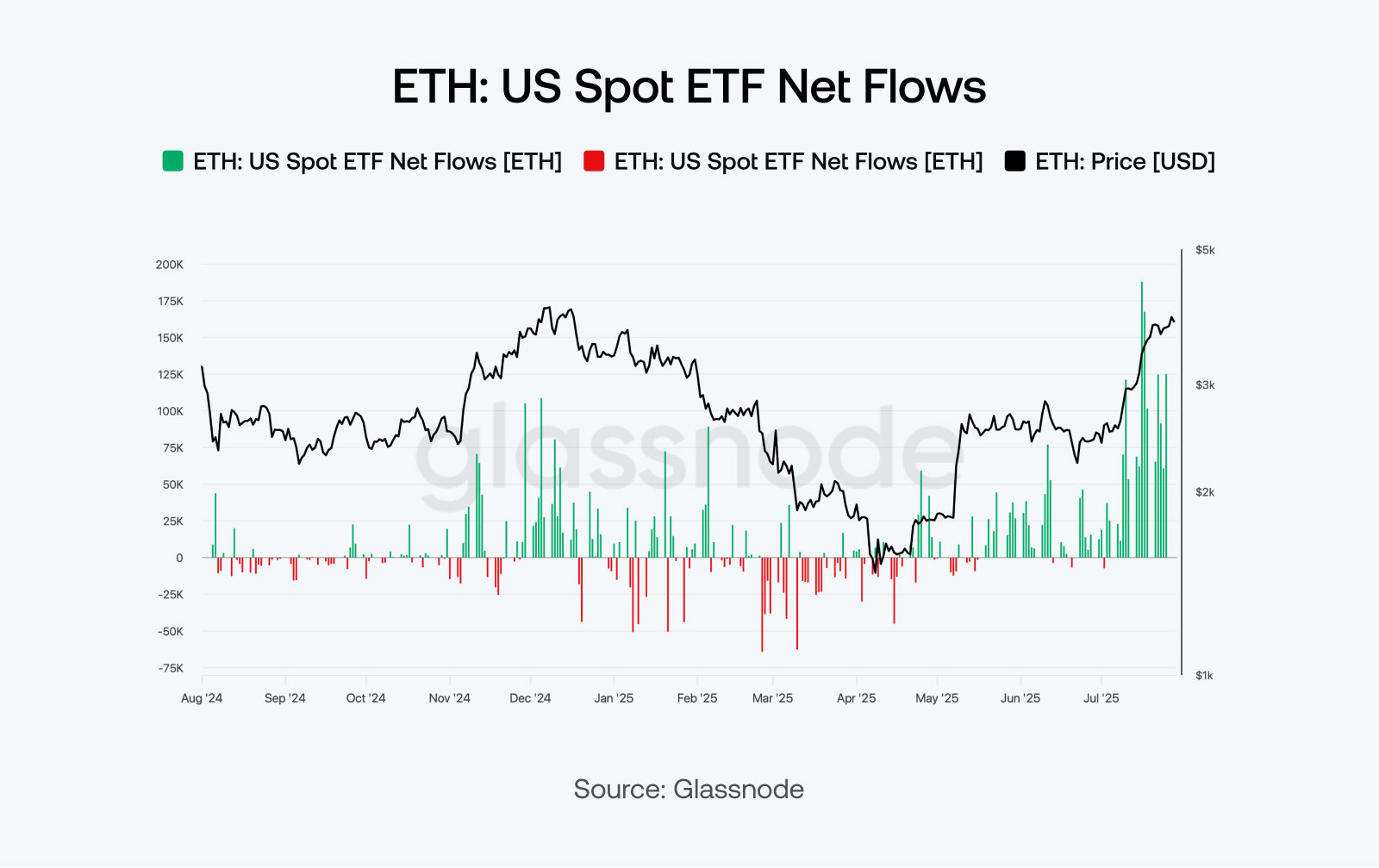

Surging spot ETH ETF inflows reflect Ethereum’s growing role in institutional portfolios and long-term strategic positioning.

Key Ethereum numbers on ETH's 10th anniversary:

- Daily Transactions (7-day avg): ~1.5 million

- Active Addresses (7-day avg): ~550,000

- New Addresses (7-day avg): ~130,000

- Blocks Produced Per Day: ~7,000

- ETH Supply Staked: ~30%

Hot topic

What the community is discussing

A great symbol, apart from being a cool NFT.

Is this the biggest achievement, though?

Happy 10th anniversary, Ethereum!