Dispatch #273: Quantitative easing: The next step up

Dec 02, 2025•6 min read

In this patch of your weekly Dispatch:

- Bitcoin’s Christmas

- ETH’s Fusaka upgrade

- The final 2025 macro test

Market cast

Stabilising or settled: What is BTC's next move?

Bitcoin’s technical setup leans cautious, with the weekly chart showing the price hovering around the 100-period SMA — a long-term trend gauge — while trading below the lower Bollinger Band, a sign that the recent downside move may be pressing the limits of its usual volatility range. The momentum indicators on this timeframe point to a similar picture: the Stochastic oscillator is in oversold territory, the MACD histogram sits well below zero to reflect weakened momentum, and the RSI is approaching the 30 level, where assets often begin to stabilize. On the daily chart, the middle Bollinger Band continues to act as dynamic resistance after several unsuccessful attempts to break above it, while the oscillators here give a more mixed read: the Stochastic is neutral, the RSI is starting to lift from low levels, and the MACD histogram remains positive but is gradually easing. Key levels remain unchanged, with support at $85,000–$84,000 and $82,000 below, and resistance at $89,000 and $91,000.

The big idea

The (complex) shift in BTC price mechanics?

Bitcoin’s brief move into the $90,000s faded over the weekend, reflecting a cooldown in some of the demand engines that powered the early part of the cycle. ETF inflows have normalized, stablecoin growth has paused, and futures leverage has eased. None of this breaks the broader trend; it marks a shift from a mechanically bid market to one driven more by positioning.

Short-term flows aside, the more critical story sits at the macro level. As of December 1, the Federal Reserve ended quantitative tightening — a two-year drain of nearly $2.4 trillion that quietly weighed on every corner of risk assets, including crypto. The Fed is not calling this process easing, and it isn’t QE, but directionally it means one thing: liquidity is no longer shrinking at the pace it once was.

This matters because the financial system has reached the practical limits of how much tightening it can absorb. Bank reserves are lean, the excess-liquidity buffer is narrow, and heavy Treasury issuance makes it increasingly difficult for the Fed to keep conditions tight without creating stress elsewhere. When the system is this stretched, even modest adjustments to ensure smooth market functioning tend to leave more liquidity in place — and risk assets feel that shift quickly.

Crypto sits at the front of that sensitivity curve. Bitcoin historically responds more to changes in liquidity direction than to the level of interest rates themselves. When liquidity stops contracting and begins to stabilize, even gradually, early flows often reappear first in Bitcoin, then rotate into Ethereum, Solana, and the broader altcoin complex. We saw a version of this in 2019, when the pause in QT coincided with an altcoin bottom and the early stages of Bitcoin’s next leg — not a perfect analogue, but a useful rhyme.

This cycle is different, but the setup is familiar. Liquidity cushions are thin, borrowing needs are high, and pressure for gentler financial conditions is building. Markets are already leaning toward more rate cuts in 2025 and the possibility of a more dovish Fed. Taken together, the environment ahead looks meaningfully more supportive than what crypto has endured over the last two years.

Ending QT won’t instantly restart Bitcoin’s demand engines, but it does change the playing field. The biggest macro headwind has faded, replaced by a backdrop where liquidity is stabilizing and may begin to tilt positive. That’s a far better foundation for risk assets to find their footing. The coming weeks will show whether this becomes a stabilizer or the start of something larger — but the direction of monetary conditions is shifting. In a market defined by liquidity cycles, that matters more than any temporary softness in ETF flows or stablecoin supply.

The engines may be cooling, but the tide beneath them is starting to rise.

Ethereum

ETH’s tried-and-tested: An upgrade and a rally?

Ether appears to be finding its footing after a 22% monthly pullback that saw the asset drop below $3000. With stablecoin lending yields still near 4%, Santiment points to a market far from overheating — leaving room for a renewed push higher. ETF flows have turned constructive as well, with spot ETH products taking in $312.6 million this week, reversing a stretch of outflows. The ETH/BTC weekly chart is closing in on its first bullish ribbon flip in four years, sentiment has recovered from extreme lows, and December has historically averaged a 6.85% gain for ETH. The backdrop is improving across the board.

This reset comes just ahead of Fusaka, scheduled for December 3, Ethereum’s second major upgrade of 2025. Its headline feature, PeerDAS, lets validators verify only slices of L2 data instead of full blobs — reducing bandwidth, lowering settlement costs, and making L2 transactions faster and cheaper. With 12 EIPs improving both L2 throughput and mainnet efficiency, and institutions like Fidelity highlighting its strategic importance, Fusaka arrives as a potential near-term tailwind for ETH.

Macroeconomic roundup

The final test for the Fed’s rate cut

A pivotal first week of December brings four major U.S. data releases that will shape expectations ahead of the Fed’s December 10 meeting. With markets already pricing a rate cut, the setup leans supportive for risk assets — and Bitcoin historically thrives when easing expectations build. Fresh forecasts from Bank of America add to the tailwind, projecting 2.4% U.S. growth in 2026 driven by consumer strength, AI investment, and friendlier trade policy. If that growth comes with the softer real yields BofA anticipates, the macro backdrop becomes increasingly constructive for BTC.

Powell Speech & End of QT (Mon): Powell’s remarks land as the Fed officially halts quantitative tightening. Any hint on December policy or leadership uncertainty could swing rate-cut odds and risk sentiment.

ADP Employment (Wed): Last month saw just 42,000 jobs added. A softer print reinforces easing expectations; a stronger number could dent them.

Initial Jobless Claims (Thu): A clean read on labor momentum. Rising claims support policy easing; lower claims argue for patience.

PCE Inflation (Fri): The Fed’s preferred gauge. Cooling core PCE would validate disinflation and strengthen the case for a cut; a hotter print risks unsettling a market positioned for accommodation.

The week’s most interesting data story

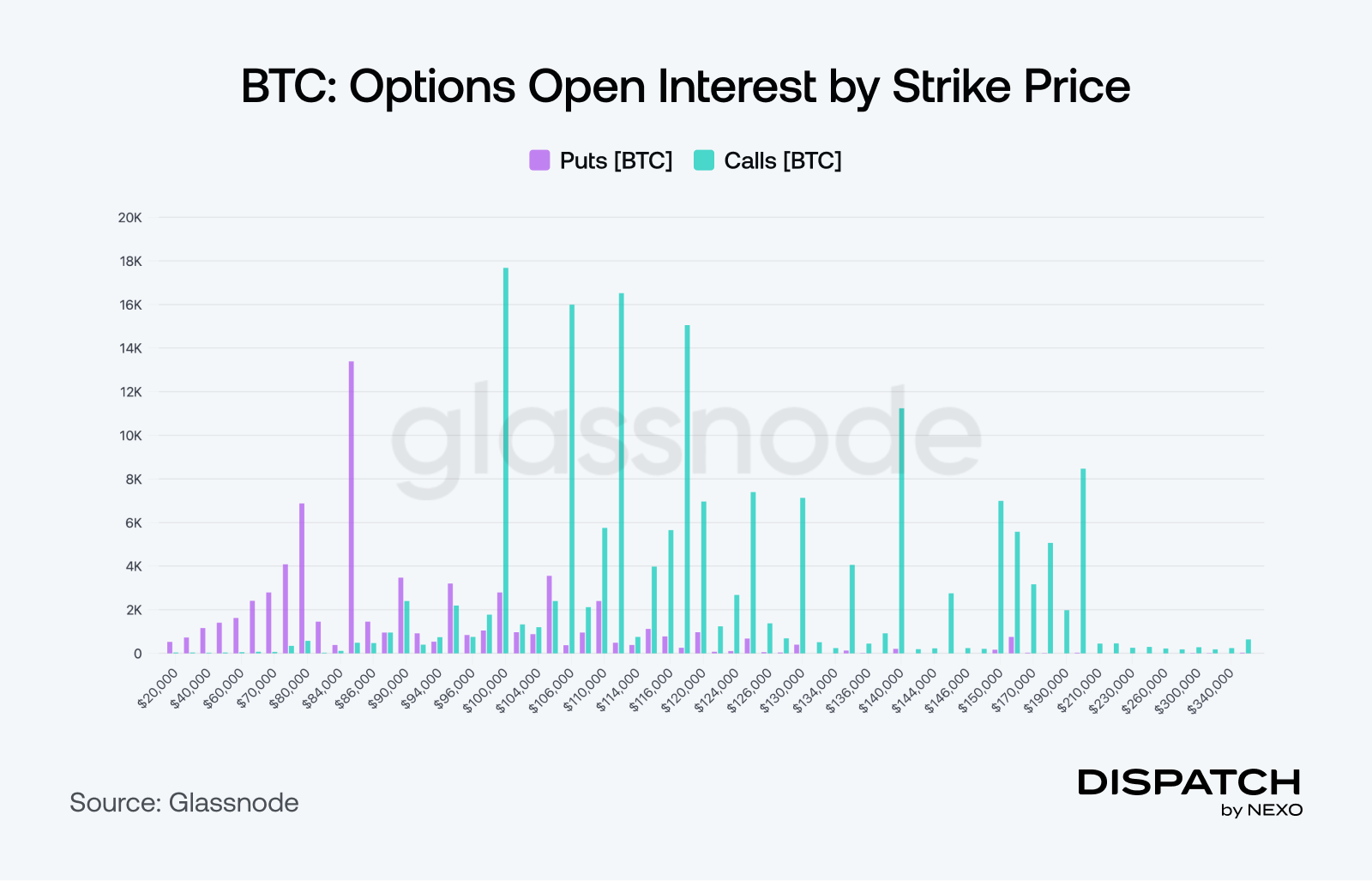

Will Christmas bring back the $100K Bitcoin?

Bitcoin options traders are positioning for a year-end rebound, but not a moonshot. Recent flow shows big players targeting a finish around $100,000, with most bets capping upside closer to the $110,000 range. It’s a sign of cautious optimism: traders see room for a recovery, just not the euphoric “Santa rally” some hoped for. The broader read is that confidence is returning, but expectations remain grounded. A move beyond $120,000 is generally viewed as a 2026 story rather than a December outcome.

The numbers

The week’s most interesting numbers

$1.07 billion — Fresh inflows into global crypto funds last week, snapping a $5.7B outflow streak and signaling revived demand.

65% — The upside some analysts see for XRP as spot ETFs draw $644M in November, even as BTC and ETH products saw selling.

$185 billion — ERC-20 stablecoin supply at all-time highs, with Binance reserves surging — major “dry powder” waiting to deploy.

$4,836 — Ether’s composite fair value across 12 valuation models, suggesting ETH is undervalued by 58%.

85% — The market’s conviction that the Fed will cut rates in December.

Hot topic

What the community is discussing

It appears the dip has been bought yet again.

Is the ETF-effect in sight for SOL and XRP?

Silver is on the move — and available to trade on Nexo and MetaTrader 5.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].