What can you actually do with Bitcoin in 2025?

Aug 26, 2025•5 min read

The first question every bitcoin holder asks.

You’ve bought Bitcoin. Now what?

For years, the answer was simple: hold it and hope the price goes up. But in 2025, Bitcoin has evolved into more than just “digital gold.” It’s something you can actually use — for spending, borrowing against, or even earning passive income.

Let’s break down exactly what you can do with Bitcoin today and how it fits into the bigger picture of building long-term wealth.

Borrowing against your Bitcoin.

Selling Bitcoin to cover an expense can feel like parting with a piece of your future — especially if you believe its value will rise over time. That’s why more people in 2025 are turning to crypto-backed credit lines.

You use your Bitcoin as collateral, and in return, you get access to cash or stablecoins without selling your BTC. It’s like unlocking liquidity while keeping your investment intact.

For example, say you’ve been holding Bitcoin for years but need funds for a home renovation. Instead of cashing out (and possibly triggering a taxable event), you can borrow against your holdings. You’ll repay over time, and your Bitcoin remains in your possession — potentially appreciating in the background.

Of course, borrowing always comes with responsibility. Monitor your loan-to-value ratio, understand the risks of volatility, and only borrow what you can comfortably repay.

Want to borrow against your BTC without selling it? Nexo offers flexible crypto-backed credit lines that let you access funds while keeping your Bitcoin in play.

Earning with Bitcoin.

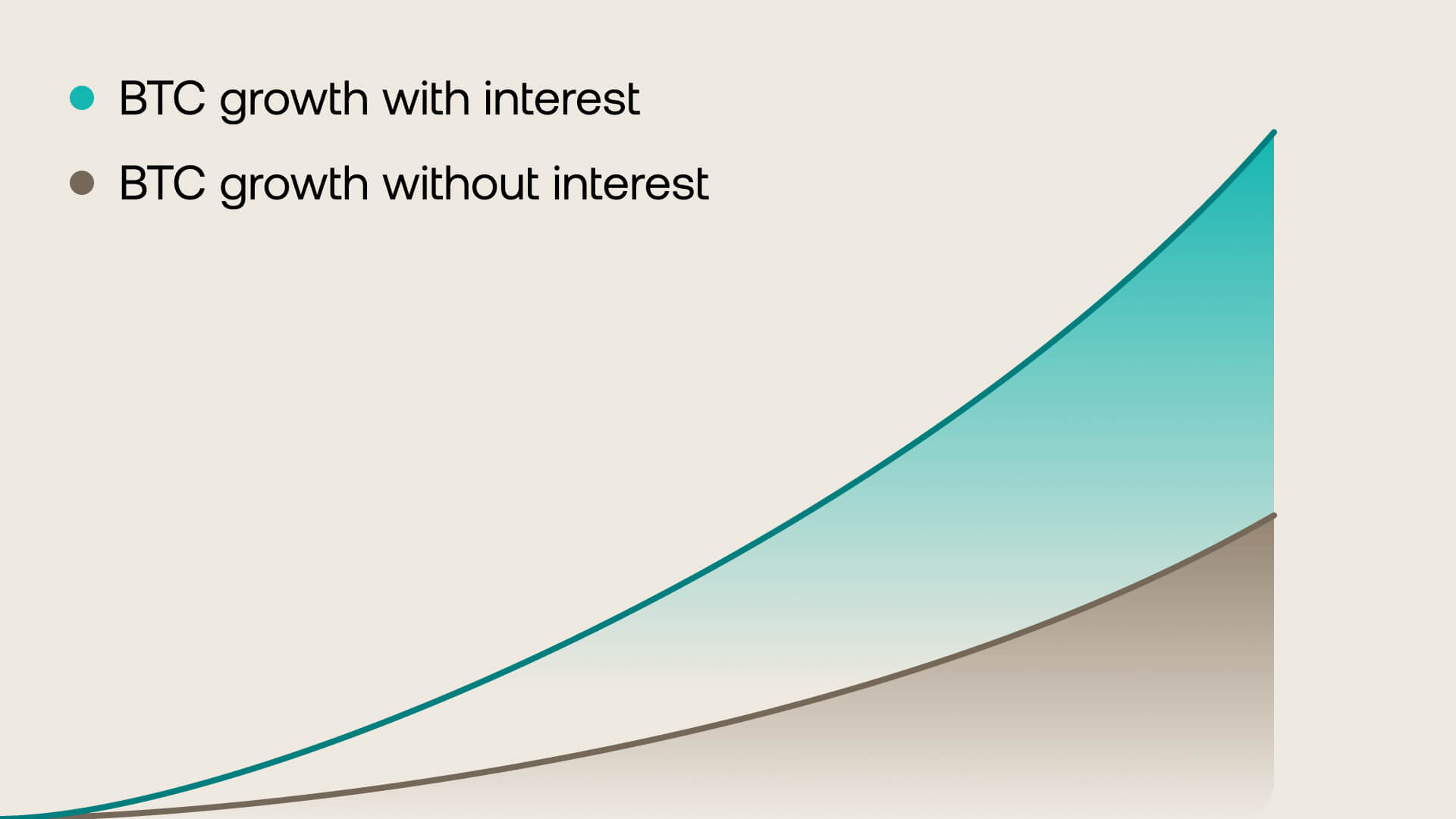

One of Bitcoin’s most underestimated roles in 2025 is as an income-generating asset. Gone are the days when “holding” was the only strategy. Now, you can put your Bitcoin to work and earn a return without selling it.

- Flexible Savings accounts let you accrue daily interest, paid out in either BTC or another crypto.

- Fixed-term Savings offer higher yields if you’re comfortable locking your BTC for a set period.

For long-term holders, this can offset volatility: even if the market dips, your overall balance grows. For newcomers, it’s a way to participate without making complex trades.

Spending BTC in everyday life.

In Bitcoin’s early days, the idea of buying your morning coffee with crypto felt like science fiction. In 2025, it’s as normal as tapping your debit card — at least in the places that have caught up.

From coffee shops in Berlin to online electronics stores in Tokyo, merchants are embracing Bitcoin, often without you even noticing. Payment processors now let you use Bitcoin through Apple Pay, Google Pay, and even physical crypto cards.

It’s not just the hip cafés anymore. Airlines accept it for tickets, subscription services like VPNs and streaming platforms take it for monthly fees, and you can book entire holidays without touching a bank account.

For many, this is the answer to “What is Bitcoin used for today?”: it’s money you can actually spend — borderless, instant, and free from intermediaries.

Trading strategies.

Not all Bitcoin holders are content to simply store their coins. In 2025, tools for trading are more accessible than ever.

Dollar-cost averaging (DCA) lets you buy small amounts at regular intervals, reducing the impact of price swings. Many beginners start here.

Target price swaps allow you to set buy or sell orders that trigger automatically at your chosen price.

Futures trading goes a step further — it lets you speculate on price moves without owning the asset directly, or hedge against price drops if you already hold Bitcoin.

Bitcoin’s place in 2025.

Fifteen years ago, Bitcoin was a bold experiment. In 2025, it’s a working part of the global financial system — a currency you can spend, an asset you can borrow against, and a store of value you can grow.

Do you think we’ve answered “What is Bitcoin, and what is it used for?” If so, the next step is seeing how its different uses could align with your own approach to managing and growing wealth.

Explore Bitcoin’s full potential with Nexo.

Frequently asked questions.

1. What is Bitcoin used for in 2025?

Bitcoin is used for everyday payments, borrowing against as collateral, earning interest through savings products, and as a long-term store of value.

2. What is Bitcoin used for today compared to the past?

In its early days, Bitcoin was mainly a niche payment tool. Today, it has grown into a multi-purpose asset: people spend it with merchants worldwide, use it to secure crypto-backed loans, and earn yield.

3. Can you earn interest on Bitcoin?

Yes, many platforms now offer interest-bearing accounts for Bitcoin. By holding your BTC in such accounts, you can earn passive income while keeping ownership of your coins.

4. Is it better to sell Bitcoin or borrow against it?

Selling Bitcoin gives you immediate access to funds but may mean missing out on future price growth. Borrowing against it lets you access liquidity while keeping your BTC exposure. Each option has risks and depends on your financial goals and risk tolerance.

These materials are accessible globally, and the availability of this information does not constitute access to the services described, which services may not be available in certain jurisdictions. These materials are for general information purposes only and not intended as financial, legal, tax, or investment advice, offer, solicitation, recommendation, or endorsement to use any of the Nexo Services and are not personalized, or in any way tailored to reflect particular investment objectives, financial situation or needs. Digital assets are subject to a high degree of risk, including but not limited to volatile market price dynamics, regulatory changes, and technological advancements. The past performance of digital assets is not a reliable indicator of future results. Digital assets are not money or legal tender, are not backed by the government or by a central bank, and most do not have any underlying assets, revenue stream, or other source of value. Independent judgment based on personal circumstances should be exercised, and consultation with a qualified professional is recommended before making any decision.