Dispatch #260: Rally and endurance: ETH’s road ahead

Sep 02, 2025•5 min read

In this patch of your weekly Dispatch:

- ETH’s fresh tailwinds

- Nexo leads in lending

- Economics at Jackson Hole

Market cast

BTC stabilises – what next?

Bitcoin is stabilizing after its recent pullback. On the weekly chart, the price has bounced off the middle Bollinger Band (20-week SMA), a key volatility marker. Momentum indicators—RSI and Stochastic—are turning higher from neutral levels, while the ADX trend gauge holds above 25, confirming an intact uptrend. The only drag is the MACD histogram, which remains negative.

On the daily chart, momentum is also improving. The Stochastic has rebounded from oversold territory and RSI is ticking upward, though the MACD still lingers in weakness. Resistance sits at 110,500, with 112,000 as the next hurdle. Support is seen at 107,500, with stronger demand expected in the 105,000–104,000 zone. Overall, momentum favors recovery, but the market still needs a clear break above resistance to confirm a broader move higher.

The big idea

A quick breakdown: the institutionalization of Ethereum

On Dispatch, we’ve been upbeat on Ethereum’s momentum for some time — and it didn’t disappoint. Over the past two months, ETH has surged 88%, breaking into a new all-time high. But something tells us this isn’t the end of the story. If anything, it feels like the opening chapter of a much bigger idea: the institutionalization of Ethereum.

ETFs: the relentless bid

Ethereum’s rally is being fueled by ETFs and treasuries. Since their U.S. debut in July 2024, spot ETH funds have pulled in nearly $10 billion, including $4 billion in August alone. Collectively, ETH ETFs now manage over $30 billion in assets, with flows running ten times ahead of Bitcoin funds in recent weeks. Crucially, spot ETFs now account for more than 5% of Ethereum’s supply, with volumes spiking to late-month peaks.

Institutional adoption inside ETFs is surging. In Q2 alone, big players added nearly 388,000 ETH, worth about $1.35 billion, bringing their total holdings close to 540,000 ETH.

Hedge funds more than doubled exposure, and Goldman Sachs emerged as the single largest holder with 288,000 ETH. ETF inflows set new records into late August, underscoring the depth of demand.

Meanwhile, corporate treasuries have quietly emerged as a massive buyer. Public companies’ cumulative ether holdings climbed from about $4 billion in early August to more than $12 billion by month-end, led by large additions from BitMine Immersion and SharpLink Gaming. Companies now hold nearly 4.4 million ETH, or 3.7% of supply, worth more than $19 billion. As Standard Chartered’s Geoffrey Kendrick notes, these treasuries “won’t sell,” making them a structural demand force that underpins price.

Predictions: ETH is Wall Street’s token

The strength of this adoption wave is inspiring bold forecasts. Consensys CEO and Ethereum co-founder Joseph Lubin predicts ETH could “100x from here” as Wall Street builds directly on Ethereum rails. VanEck’s CEO has already dubbed Ether the “Wall Street token.”

Most notably, Standard Chartered has set a target of $7,500 for ETH by year-end, positioning Ethereum as one of the bank’s highest-conviction digital asset calls. Others, like Arthur Hayes, see scope for $20,000 this cycle.

Behind this optimism are two booming sectors already dominated by Ethereum: stablecoins and real-world assets. Stablecoins have doubled to $280 billion since 2023 and could hit $2 trillion by 2028, with more than half of them running on Ethereum. Their adoption means Ethereum’s growth is increasingly tied to global payments and transaction volume.

Technicals & network strength

On-chain momentum confirms the rally’s depth. Monthly adjusted transfer volume surged past $320 billion in August, the highest since May 2021 and the third-largest on record. Thirty-day transactions set new highs, monthly active addresses reached their second-highest level ever, and TVL remains near ATH. Transaction fees are near a five-year low thanks to upgrades like Dencun (proto-danksharding) and Pectra, which cut rollup costs, enhanced account abstraction, and improved usability.

Analysts at banks like Standard Chartered argue that the market is still undervaluing Ethereum relative to these drivers. It seems that in crypto today, Ethereum is no longer just the smart contract platform — it is becoming Wall Street’s chosen infrastructure, with ETFs, treasuries, and real-world adoption creating a structural demand base. That makes ETH the Big Idea right now.

Hot in crypto

An upgrade in tech, a rise in price

Solana (SOL) rallied nearly 6% last week as validators began voting on the Alpenglow upgrade, described as the network’s most significant overhaul yet. The proposal aims to cut block times to 150 ms, introduce a new consensus mechanism (Votor), and simplify block propagation with Rotor — changes designed to boost speed and efficiency across decentralized apps.

Alongside the technical push, institutional interest is gathering pace. Bitwise projects SOL could trade between $2,300 and $6,600 by 2030, citing ETF flows, growing developer activity, and Solana’s expanding role in payments and gaming as drivers of long-term adoption.

Macroeconomic roundup

A (labor) market rally ahead?

A busy week of U.S. labor-market data lies ahead, with traders watching closely for signals on growth, inflation, and the Fed’s policy path. These releases could shape liquidity expectations and, in turn, market sentiment across risk assets and crypto.

JOLTS (Wed): Job openings are expected at 7.4 million, unchanged from June. A steady print would highlight labor market resilience, reinforcing the Fed’s “higher for longer” stance and limiting liquidity upside.

ADP Employment (Thu): Forecast at 75,000, down from July’s 104,000. A weaker print could point to softer labor demand, easing yields, and supporting crypto, though sharp slowdowns risk sparking volatility.

Initial Jobless Claims (Thu): Seen at 231,000, slightly above last week. More claims would raise dovish Fed bets, while stable readings keep the focus on inflation.

Nonfarm Payrolls & Unemployment (Fri): Payrolls expected at 75,000 vs. 73,000K prior, with unemployment edging up to 4.3%. The combination suggests modest hiring alongside rising slack, a setup often seen as liquidity-friendly for risk assets.

The week’s most interesting data story

Amid the clusters: Ethereum’s path

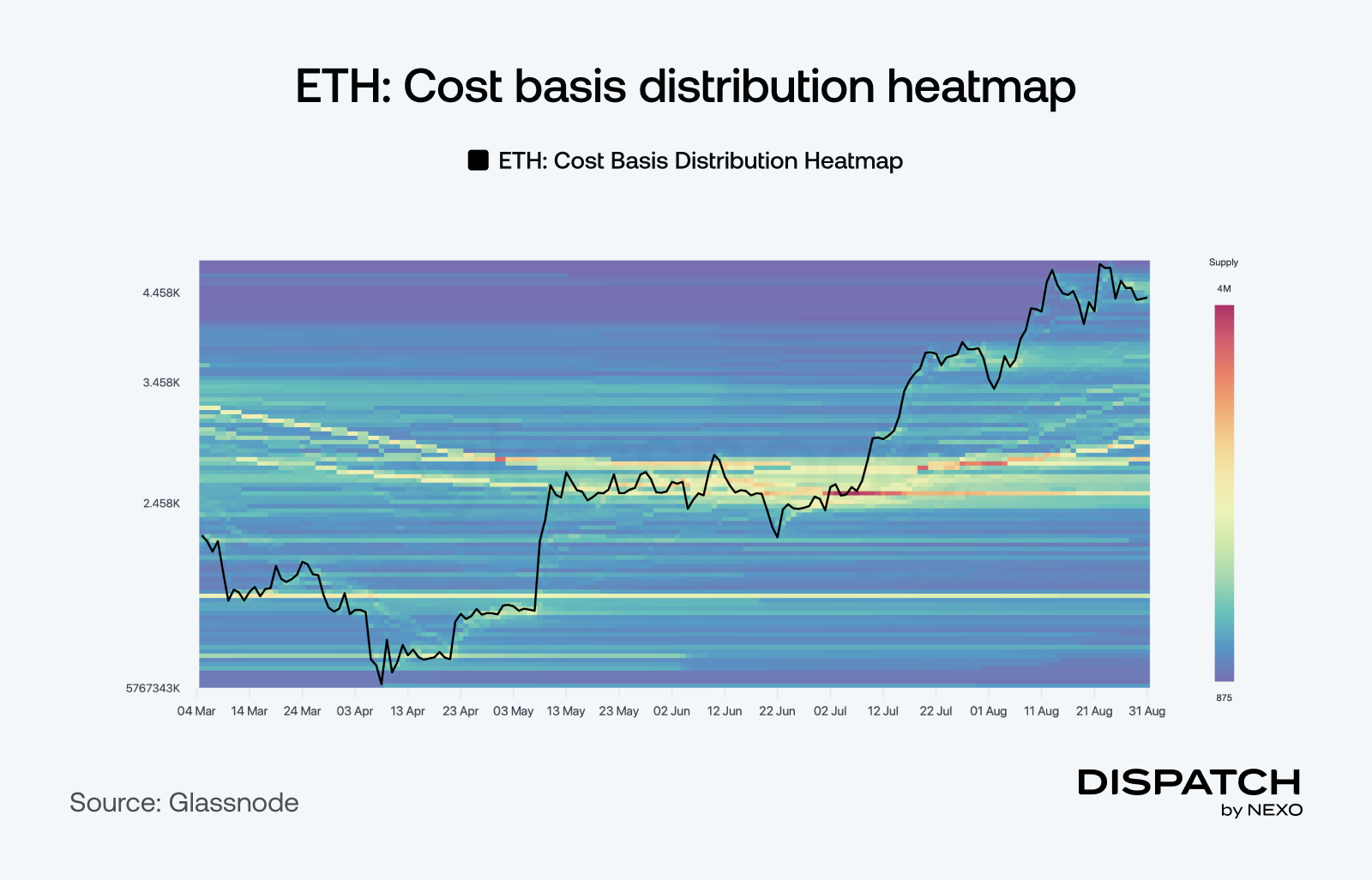

Ethereum ended August with a 23% gain, snapping three years of negative seasonality. The Cost Basis Heatmap shows strong support layers around $4,300–$4,375, while the main resistance cluster at $4,482–$4,592 could be the final hurdle before a run toward the $5K milestone. With corporate treasuries and ETFs continuing to absorb supply, Ethereum looks well-positioned to defend its base and press higher.

The numbers

The week’s most interesting numbers

- 690,000 BTC — Absorbed by institutions this year, more than six times 2025’s new mined supply.

- $2.5 billion — Weekly inflows into crypto funds, led by $1.4 billion for Ethereum vs. $748 million for Bitcoin.

- $4 billion — ETH accumulated by a whale rotating out of multi-billion BTC holdings since August.

- 20,000 BTC — Metaplanet’s stash after a $112 million buy, making it the sixth-largest public BTC treasury.

- 92 — Crypto ETF filings with the SEC, from majors like Solana to meme coins like Bonk.

Hot topics

What the community is discussing

About those Bitcoin cycles.

So retail is the whale after all?

Could this be the start of a new ETF wave for BTC?