Dispatch #259: How Jackson Hole tested Bitcoin and boosted Ethereum

Aug 26, 2025•6 min read

In this patch of your weekly Dispatch:

- ETH’s fresh tailwinds

- Nexo leads in lending

- Economics at Jackson Hole

Market cast

BTC: Hold on support, bounce on macro?

On the weekly chart, Bitcoin has eased back to the middle Bollinger Band, a level that often acts as a springboard for renewed momentum. The Average Directional Index (ADX), a gauge of trend strength, remains above 25, suggesting the broader trend is still intact. Momentum indicators are cooling, with the Relative Strength Index (RSI) and the Stochastic oscillator drifting lower from neutral zones, while the Moving Average Convergence Divergence (MACD) histogram has slipped just under the zero line.

On the daily chart, price action is extending lower and currently sits beneath the lower Bollinger Band, often a sign of stretched conditions. The Stochastic has moved into oversold territory, the MACD histogram is firmly negative, and the RSI is approaching 30 — levels that in the past have preceded potential stabilization.

Key levels to watch include support around $109,000, with stronger footing near $104,000 to $105,000, while resistance is seen at $112,000 and then $115,000.

The big idea

Jackson Hole and the crypto reaction

If you’ve been reading Dispatch, you know we’ve been tracking Bitcoin’s moves, Ethereum’s rise, and Powell’s every word — and this weekend, all three storylines came into one. At the center of it stood Jackson Hole, where Jerome Powell struck a dovish chord, opening the door to a September rate cut as growth cools, tariffs push up prices, and labor-market momentum stalls.

Powell described the U.S. economy as resilient but facing a “shifting balance of risks.” Inflation has fallen sharply from its post-pandemic highs to 2.6%, yet remains sticky in core services, and tariffs are beginning to filter into consumer prices. Meanwhile, job creation has slowed dramatically to just 35,000 a month — down from 168,000 last year — leaving the labor market in what Powell called a “curious balance”.

The message was clear: risks to jobs are now rising faster than risks from inflation. The Fed is preparing to pivot toward support, even if tariffs complicate the inflation picture. Powell also scrapped the 2020 “makeup strategy” of tolerating inflation overshoots, returning to flexible inflation targeting. In short, the Fed is getting ready to cut rates while reasserting it won’t let short-term price spikes morph into lasting inflation. Markets took it as a green light.

Bitcoin: Tested and trusted

The dovish tilt lifted BTC nearly 4% to $117,000, echoing equities’ rally. But whales had the last word. An early investor wallet that once held over 100,000 BTC has been unloaded, depositing nearly 23,000 BTC — worth $2.6 billion, into markets over just five days. The sales triggered a flash crash below $111,000, leaving Bitcoin at its weakest level since early July and erasing its Jackson Hole gains. On a relative basis, BTC has slipped 5% over the past month, with dominance falling to 58.2%, its lowest since January.

Yet, even as short-term flows weigh, the long-term case for Bitcoin continues to deepen. Allianz, a $2.5 trillion asset manager, declared BTC a “credible store of value” citing its deflationary design, decentralized governance, and low correlation to traditional markets. And institutions prove it too: allocations into Bitcoin ETFs climbed to $33.6 billion in Q2, with investment advisors now holding more than hedge funds and even university endowments like Harvard adding BTC exposure — in some cases larger than gold.

Ethereum reaches ATH

Much of the capital pulled from Bitcoin is flowing into Ethereum. That same whale bought roughly 473,000 ETH worth $2.2 billion, opened sizable long positions, and kept adding spot — another 23,500 ETH just this week. Even after taking partial profits, the address continues to hold over 40,000 ETH in leveraged longs with healthy gains, signaling conviction in Ethereum’s upside.

The effect is clear in the broader market. ETH touched a record $4,946 last week, is still up 23% over the past month, and has pushed Ethereum dominance to 14.98%, its highest since 2024. JPMorgan highlights four drivers: expected approval for ETF staking, corporate treasuries adding ETH, regulatory clarity around liquid staking tokens, and in-kind ETF redemptions that make the products more efficient. And the momentum is visible in real time: U.S. spot ETH ETFs just logged $443.9 million in daily net inflows, more than double Bitcoin’s on the same day to mark their third straight session of gains.

The narrative is one of a market split. Bitcoin is cementing its role as digital gold, with institutional giants now openly embracing it as a cornerstone of global finance. And Ethereum is carving out a different path — as a yield-bearing, institution-friendly asset with growing treasury adoption and regulatory momentum. Jackson Hole gave crypto a dovish nudge, but what followed wasn’t just volatility: it was a reminder that Bitcoin is laying the foundation, while Ether looks ready to lead the charge.

TradFi Trends

Central banks turn to crypto blockchains

The ECB is now weighing Ethereum and Solana as potential settlement layers for a digital euro, a notable shift that puts public blockchains on the table for Europe’s flagship CBDC project. While no decision is imminent — legislation would be required after 2025 — the signal is clear: crypto-native infrastructure is entering the central banking playbook.

In Asia, South Korea’s “Big Four” banks met with Tether and Circle to discuss stablecoins and the distribution of USD tokens. The talks come as Seoul pivots away from its CBDC pilot and toward private-issuer models.

Hot in Crypto

Here come Solana tresuries

Galaxy Digital, Multicoin, and Jump Crypto are reportedly lining up $1 billion for a Solana treasury, with Cantor Fitzgerald advising on a public-company structure. If completed, it would be the largest dedicated SOL balance sheet to date.

Macroeconomic roundup

More macro, more volatility?

A packed U.S. calendar will test whether Powell’s dovish tilt carries into September:

CB Consumer Confidence (Aug 26): Expected to dip to 96.5 from 97.2, pointing to softer household demand and weaker risk appetite.

Nvidia Earnings (Aug 27): The AI bellwether reports after the close — a beat could stoke another tech rally, while a miss risks spilling into broader risk sentiment, including crypto.

Initial Jobless Claims (Aug 28): Forecast at 230,000 vs. 235,000 prior; resilience could temper cut hopes, while sticky continuing claims highlight labor-market cracks.

PCE Inflation (Aug 29): Headline seen at 2.6% YoY, with core edging to 2.9%. A hotter print would weigh on cut bets, while sticky inflation could reinforce Bitcoin’s hedge appeal.

Chicago PMI (Aug 29): Gauges Midwest manufacturing; consensus sees a modest slowdown, another data point on growth fatigue.

The week’s most interesting data story

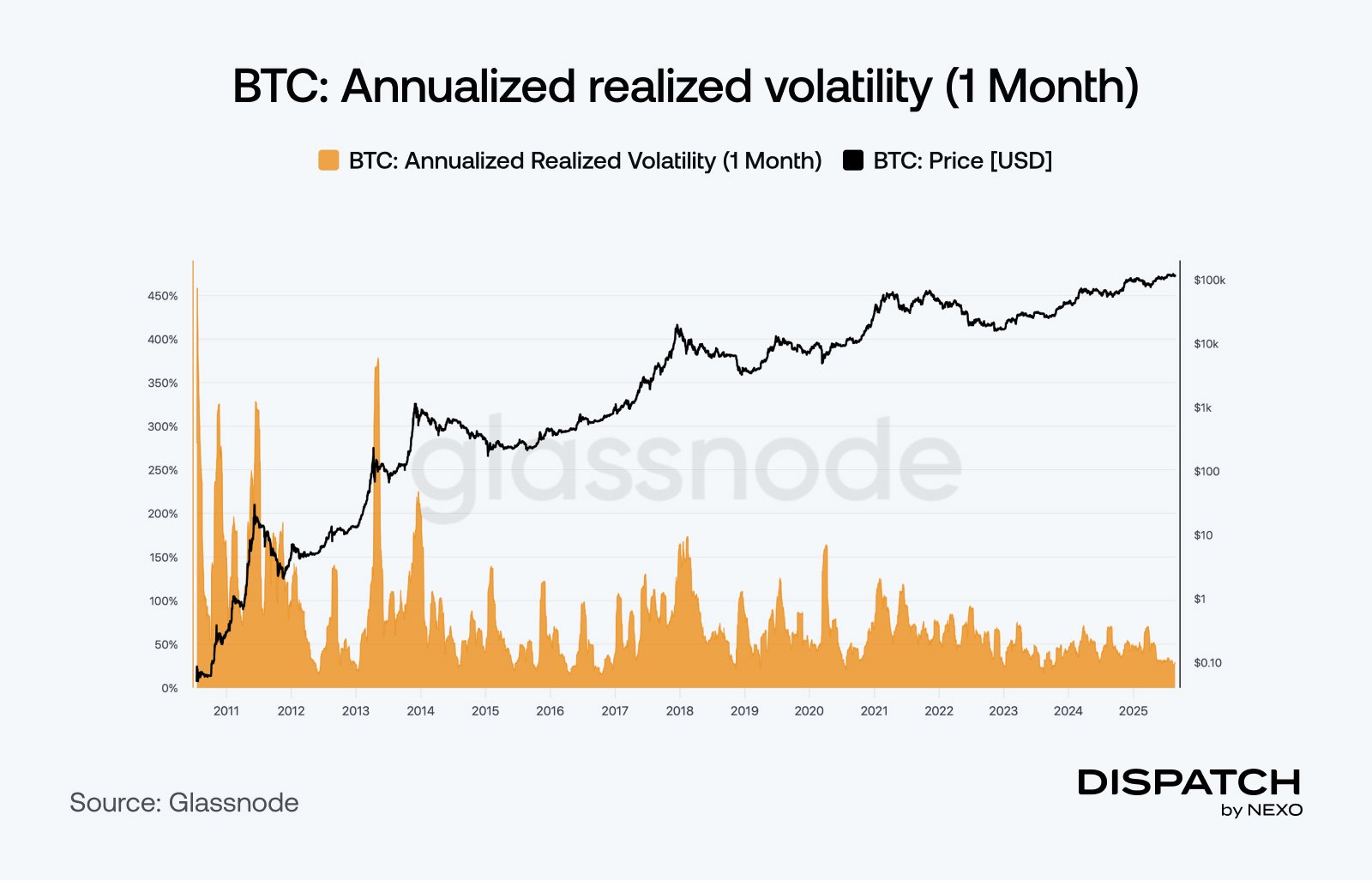

Bitcoin’s maturity

Bitcoin is shedding its wild-child reputation. Its 30-day realized volatility has fallen to a five-year low — sometimes even below mega-cap tech stocks like Nvidia. That shift is striking given Bitcoin’s surge to fresh highs and subsequent pullbacks, which in past cycles would have produced much sharper whipsaws. Instead, broader ETF ownership, institutional allocations, and integration into retirement portfolios are dampening the extremes. The result is a market that looks less like a speculative rollercoaster and more like a maturing asset class finding its place in mainstream portfolios.

The numbers

The week’s most interesting numbers

- 10,000 BTC — Target of the Philippines’ proposed Strategic Bitcoin Reserve Act.

- 40% — Ethereum’s YTD gain in 2025, outpacing Bitcoin.

- $400 trilion — TradFi market size that could be tokenized, vs. just $26.5B on-chain today.

- $2.2 billion — Ethereum bought in that spree, including 473K ETH spot and leveraged longs.

- $2.6 billion — Bitcoin offloaded by a whale in five days, much of it rotated into ETH.

Hot topics

What the community is discussing

Here’s one way to look at the last pull-back.

What do you see, Dispatch readers?

By now, you should know where to park your assets.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].