Dispatch #268: Bitcoin’s biggest market movers

Oct 28, 2025•6 min read

In this patch of your weekly Dispatch:

- The biggest macro week in 2025

- Stablecoin dominance

- Bitcoin year-end predictions

Market cast

In search of the macro direction?

Bitcoin has been recovering over the past few days, climbing from around $108,000 to an early-week high near $116,000 on Monday. On the weekly chart, the asset is consolidating around the middle Bollinger Band, reflecting balance between buyers and sellers. The ADX remains below 20, signaling a weak trend, though a move above 25 would confirm stronger directional momentum. Both the RSI and Stochastic Oscillator stay neutral, while the MACD histogram lingers slightly below zero, showing limited upside pressure.

On the daily chart, sentiment appears firmer. The ADX is nearing 25, the Stochastic has entered the overbought zone without reversal signs, and the MACD has turned positive after a bullish crossover. The RSI remains mid-range, suggesting steady but cautious momentum. With the Fed’s rate decision approaching on Wednesday, volatility could increase as traders reassess risk exposure.

Support is seen at $112,000 and $108,000, while resistance lies at $115,000, now acting as former support, and $117,000.

The Bollinger Bands measure volatility, the ADX gauges trend strength, the RSI and Stochastic highlight overbought or oversold conditions, and the MACD tracks momentum shifts through moving average crossovers.

The big idea

The three fundamental drivers for BTC

At Dispatch, we love tracking the smaller signals — cooling inflation, steady ETF flows, and subtle on-chain shifts. We particularly love it when those threads converge into something bigger, like this week, for example.

Bitcoin now sits at the intersection of several forces that could define its next chapter: the Fed’s policy pivot, renewed progress in U.S.–China trade, institutional flows through ETFs, and the state of on-chain accumulation.

The setup is constructive but whether it becomes the foundation for a breakout or another round of consolidation will depend on how these four developments below evolve. Let’s unpack them one by one.

Monetary policies: the turning tide: The latest inflation reading of 3.0% Y/Y has reinforced expectations for another Fed rate cut by December, extending the easing cycle into early 2026. This shift toward cheaper capital should gradually restore liquidity to risk assets. If the Fed maintains its course and global yields drift lower, Bitcoin could reassert its role as a liquidity proxy — the first asset class to respond to easing. The path won’t be linear; volatility will likely rise before capital returns in force. The bottom line? Sustained rate cuts could transform this hesitant market into one defined by momentum.

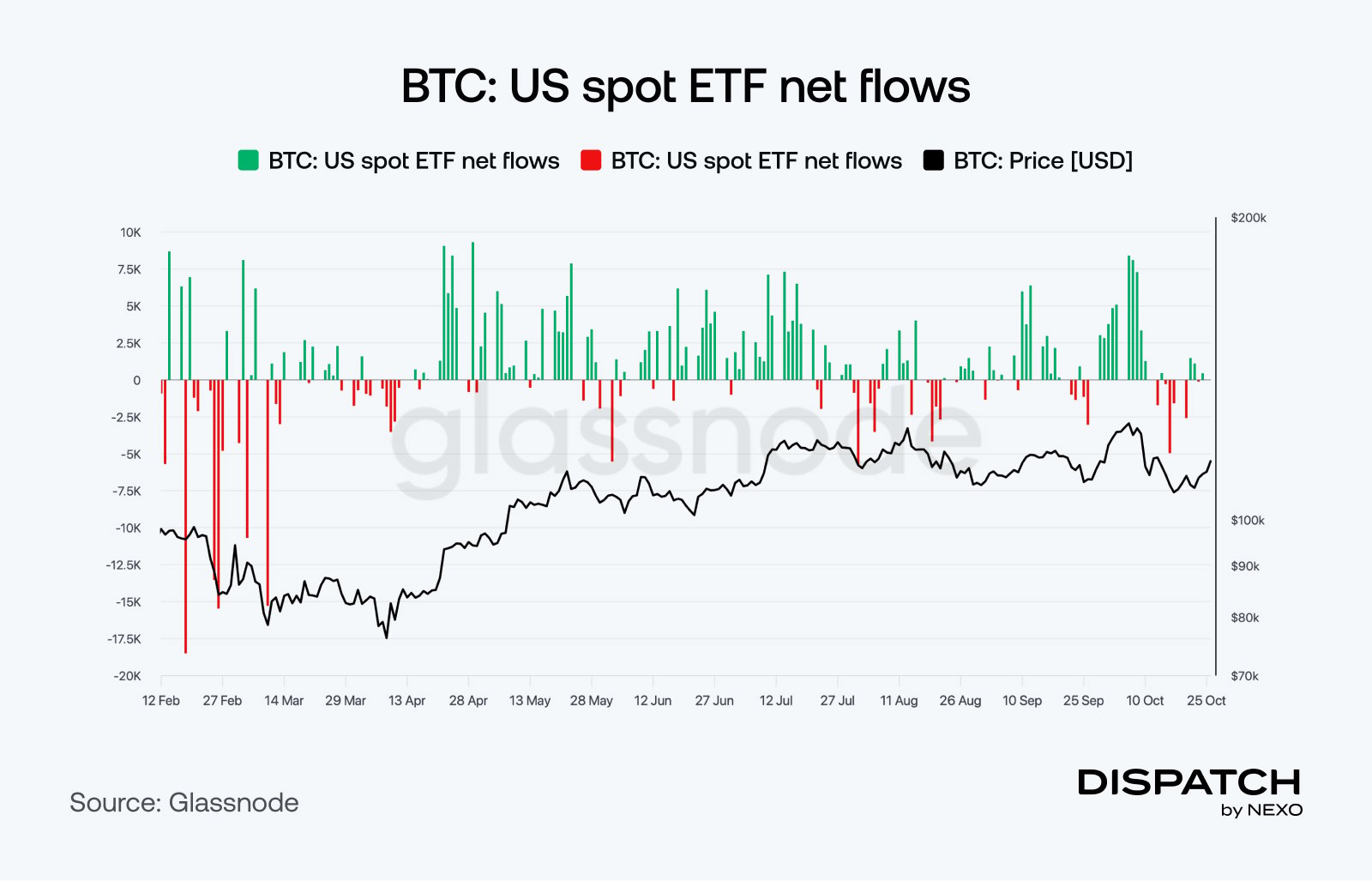

ETFs: the institutional barometer: Spot Bitcoin ETFs have provided the market with a floor, but not yet a spark. BlackRock’s IBIT remains the main engine of inflows, while others lag. Participation must broaden for the next leg of this cycle to form. A pickup in ETF inflows in the next few months would confirm a genuine re-risking environment — one that could propel Bitcoin toward new all-time highs. Conversely, if ETF flows stagnate, Bitcoin could remain range-bound, mirroring a broader market still waiting for a catalyst.

Geopolitics: will trade find a truce?: U.S. and Chinese officials have reached a preliminary framework aimed at easing tariffs and restoring trade cooperation ahead of the upcoming Xi–Trump meeting in South Korea. The tone marks a shift from confrontation to collaboration. A durable U.S.–China trade thaw could ease pressure on global growth and supply chains, restoring confidence and supporting cross-border liquidity. That scenario would reinforce Bitcoin’s macro appeal as a global risk asset. If talks falter, however, renewed friction could reignite risk aversion and stall crypto’s recovery.

Accumulation: the market’s heartbeat: Mid-tier “dolphins” (100–1,000 BTC) now control roughly 26% of supply, quietly stacking while the crowd hesitates. When accumulation returns in force, that’s the market’s tell. If these mid-sized players keep adding and long-term holders stay anchored, Bitcoin’s rhythm could shift from pause to push. Falling rates, thawing trade tensions, and steady ETF demand all hum in the background — separate markers that could soon sync into a breakout. When conviction, liquidity, and fundamentals finally move in tune, the real bull run begins.

Hot in crypto

Stablecoins continue their surge

Stablecoins stole the spotlight this year. A new TRM Labs report shows their transaction volume jumped 83% year-on-year, topping $4 trillion and now making up 30% of all crypto activity.

That surge isn’t just happening on-chain — it’s hitting the checkout counter. According to Nexo’s 2024 Card Report, 65% of all debit transactions made with the Nexo Card last year were settled in stablecoins, covering everything from groceries and travel to daily spending.

The market remains U.S.-dollar dominant and tightly held — Tether (USDT) and Circle (USDC) control 93% of the sector — but adoption is accelerating fast, especially across South Asia, where India leads global crypto uptake.

TradFi trends

Here is how the Fed warms to crypto

The Fed just made its most crypto-friendly move yet. Governor Christopher Waller said the central bank is entering “a new era” where crypto is no longer on the fringes of finance.

Speaking at the Payments Innovation Conference, Waller unveiled plans for a “skinny master account” — a prototype that could let fintechs and stablecoin issuers access Fed payment rails directly, bypassing intermediary banks.

It’s a sharp pivot from the Fed’s past caution. With talk of tokenization and stablecoins now on its own agenda, the Fed is signaling that digital assets are becoming part of the financial core, not its periphery.

Macroeconomic roundup

Is this the biggest macro week in 2025?

Bitcoin’s macro sensitivity is back in focus as traders brace for a data-heavy week. With the FOMC rate decision, Powell’s press conference, jobless claims, and PCE inflation on deck — all against a month-long U.S. government shutdown — every release could sway liquidity and sentiment.

FOMC Decision (Wed): Markets price a 96.7% chance of a 25-bps cut to 4.00%. A confirmed move would anchor easing bets and lift risk assets; a surprise hold could hit crypto’s momentum.

Powell Speaks (Wed): His tone will shape 2026 rate-cut expectations. Hints that QT is ending and more cuts are coming would weaken the dollar and favor Bitcoin.

Jobless Claims (Thu): Federal filings have spiked since the shutdown. A higher print would reinforce a cooling labor trend and stronger liquidity hopes — a mild tailwind for BTC.

PCE Inflation (Fri): Still the Fed’s gauge to watch. A softer read would validate CPI relief and cement dovish momentum; sticky data could delay deeper cuts.

Macro is messy, but it’s still driving the market. For now, Bitcoin remains its barometer.

The week’s most interesting data story

Bitcoin’s barometer turns green

Bitcoin ETFs are back on the offensive, with weekly inflows climbing to $445 million as institutional demand strengthens ahead of the Fed’s October 29 rate decision. With a 97% probability of a 25-bps cut, risk appetite is improving and Bitcoin is holding near $115,000. The combination of easing policy and renewed ETF accumulation suggests a potential higher low forming — a setup that could pave the way toward the $125,000 range if inflows continue into November.

The numbers

The week’s most interesting numbers

$100,000 — Standard Chartered says Bitcoin may never fall below six figures again as U.S.–China relations and ETF inflows anchor its new price floor.

51 — The Fear & Greed Index returned to neutral for the first time in two weeks as Bitcoin climbed to $115K.

$7 billion — Around 62,000 BTC moved out of long-term wallets since mid-October, loosening supply as whales quietly accumulated.

$921 million — Net inflows into global crypto investment products last week, led by U.S. Bitcoin ETFs — a sharp rebound from prior outflows.

$46 trillion — The value of on-chain payments settled via stablecoins over the past year, now 2.3% of global payment flows.

Hot topic

What the community is discussing

When have we not been optimistic?

Will this turn into a strong signal for SOL?

Who’s arguing?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].