Dispatch #261: Looking ahead: What could restart the bulls?

Sep 10, 2025•6 min read

In this patch of your weekly Dispatch:

- ETH dominates stablecoins

- A crucial inflation report

- Textbook BTC dip-buying

Market cast

Recovery in motion, conviction on hold

On the weekly chart, Bitcoin is showing signs of recovery after bouncing off the middle Bollinger Band (BB), a volatility gauge. Momentum indicators are starting to lean bullish: both the Relative Strength Index (RSI) and the Stochastic oscillator are neutral but turning upward. Still, the Moving Average Convergence Divergence (MACD) remains in negative territory, while the Average Directional Index (ADX)—a measure of trend strength—continues to fade, pointing to a market that’s stabilizing but not yet trending with conviction.

On the daily chart, the bullish case looks sharper. The MACD histogram is firmly positive, the Stochastic oscillator sits in overbought territory without showing exhaustion, and the RSI is climbing higher, all suggesting buyers have the upper hand in the short term. The only caution flag comes from the ADX, which remains subdued, signaling that momentum is building but hasn’t translated into a strong directional trend just yet.

Resistance sits at $113,500 and $115,000, while support holds at $110,000 and $107,500—levels that will define the next decisive move.

The big idea

The missing pieces of the crypto (bull) market

The market is in a brief pause after the strong run earlier this year, making it a good moment to look ahead and ask what could reignite that momentum. A lasting bull market never builds itself out of thin air — a few critical signals need to come into focus first. In this Dispatch, we look at the most fundamental drivers that could set the stage.

Rates that support digital assets: The most important shift is happening in monetary policy. The U.S. labor market is cooling fast: August’s payrolls grew by just 22,000, while unemployment climbed to 4.3%, the highest since 2021. That has put the Federal Reserve under mounting pressure to move. Markets are already pricing in a roughly 90% chance of a 25bps cut at next week’s meeting, and there is still a non-trivial chance of a larger 50-basis-point “catch-up” move. Standard Chartered now expects the Fed to cut by 50 basis points this month, while Barclays, Bank of America, and others forecast a series of quarter-point cuts through December. Citi even sees the Fed delivering reductions at five consecutive meetings, arguing that inflation risks will be tolerated in favor of supporting jobs.

For markets, the size of the cut matters less than the direction of travel. Once real yields begin to drift lower, liquidity usually returns to risk assets first. Historically, these early stages of easing have been some of the most supportive environments for crypto, as investors look for alternatives to low-yielding bonds and cash.

A dollar that drifts weaker: The dollar has held most recently, but that might be misleading. Morgan Stanley notes the greenback’s bear cycle is “barely halfway through,” pointing to U.S. GDP growth slowing toward 1% by late 2025 and a Fed more tolerant of inflation. With Europe and the U.K. still hawkish, the dollar may be overvalued—opening room for crypto demand as global buyers gain relative purchasing power.

Corporate adoption moves from headlines to habit: Corporate demand isn’t just anecdotal—it’s dominant. Just last week, Strategy and Tokyo-listed Metaplanet combined to buy 2,091 BTC, worth about $230 million and equal to 66% of all Bitcoin mined during that period. Strategy now holds more than 638,000 BTC, valued at over $71 billion, while Metaplanet has built a stash of 20,000 BTC. Add that to River Financial’s finding that corporations as a whole now control around 6% of total BTC supply, and it is clear that business demand has become a structural feature of the market.

Crypto adoption is going global: It isn’t just crypto enthusiasts piling in. Chainalysis reports a broader, global wave: India remains number one in crypto adoption, with the United States climbing to number two. Asia-Pacific volume jumped 69% year-over-year to $2.36 trillion, while North America and Europe led in absolute terms, with $2.2 trillion and $2.6 trillion, respectively. That growth points to a maturing, geographically diverse base of crypto users beyond traders.

Rules of the road start to settle: The GENIUS Act has finally given stablecoins a clear federal framework, with full-reserve backing and monthly disclosures, opening the door for integrations like Visa and Mastercard’s settlement rollouts. The Fed is underscoring this shift with an October conference on stablecoins and tokenization, while the SEC and CFTC will meet in September to coordinate oversight. Together, these moves signal that digital assets are moving from regulatory ambiguity to structured rules — a shift that can reduce uncertainty and unlock new capital.

The bigger picture: While fireworks are not guaranteed, these developments are becoming an attractive checklist. If even two or three of these forces align, the outlines of the next bull market may soon come into sharper focus.

Bitcoin

US inches closer to a Bitcoin Reserve

Washington is edging forward with plans for a strategic Bitcoin reserve. A new House appropriations bill directs the Treasury to deliver a report within 90 days on the feasibility, custody, and cybersecurity of holding digital assets on the government’s balance sheet.

The move follows President Trump’s March order to establish a Bitcoin reserve using confiscated crypto. Treasury Secretary Scott Bessent has since hinted at “budget-neutral pathways” to grow the stockpile.

The U.S. isn’t alone: Kazakhstan is weighing a state crypto fund, and the Philippines has floated a 10,000-BTC reserve. Countries already hold more than 517,000 BTC, about 2.5 % of supply — a number that could rise if these proposals take root.

Ethereum

Ethereum sets records

Ethereum just set fresh records across multiple fronts. Stablecoin supply on the network has doubled since early 2024, now topping $165 billion and giving Ethereum a commanding 57% market share. Tokenized gold has also surged to $2.4 billion, cementing Ethereum’s dominance in tokenized assets from commodities to Treasurys.

Staking momentum is picking up too: the validator entry queue has flipped above exits, with nearly $4 billion in ETH waiting to stake versus $3.3 billion set to withdraw.

With treasuries, gold, and stablecoins all moving onchain, Ethereum’s role as the backbone of tokenized finance looks stronger than ever.

Macroeconomic roundup

A most important US inflation report

Investors are watching a packed data calendar this week, with Thursday’s Consumer Price Index taking center stage. Inflation is expected to rise to 2.9% in August from 2.7% in July, the highest since January. Core inflation is forecast to remain at 3.1%, reflecting the ongoing impact of tariffs on goods prices.

The report lands just before the Federal Reserve’s September 17 meeting, where markets expect a 25-basis-point rate cut. A stronger-than-expected CPI print could give officials reason to move more cautiously, while a softer reading would reinforce expectations for further easing.

The week’s most interesting data story

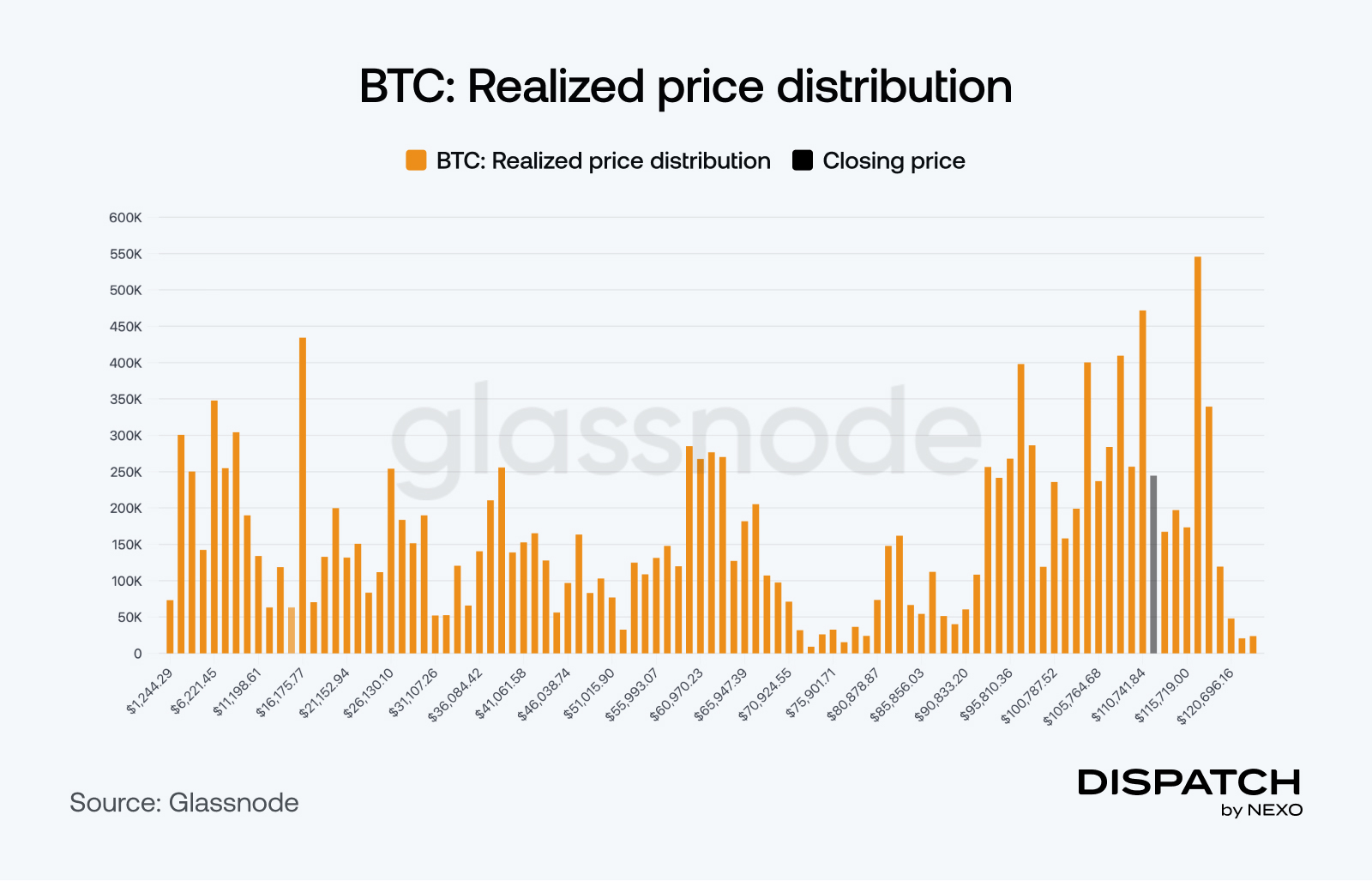

The BTC dip has been bought

Bitcoin’s slide to $108,000 looked like the start of deeper trouble, but on-chain data shows the opposite. Investors quickly accumulated in the $108,000–$116,000 “air gap,” a zone that had little prior activity, effectively turning a void into a base of support.

This dip-buying has helped steady prices near $112,000 and reflects growing conviction among holders. While the range remains fragile and further consolidation is possible, the fact that buyers filled the gap so decisively points to underlying demand waiting to step in on weakness.

The numbers

The week’s most interesting numbers

- $350,000 — Rewards won by a solo miner against odds of once in 100 years.

- $3,635/oz — Gold futures hit a new record as Fed rate cuts loom.

- $1.6 billion — Scale of institutional Solana treasuries from Nasdaq-listed SOL Strategies and peers.

- $12.2 billion — Solana’s total value locked hit an all-time high, up 57% from June lows.

- $6 billion — Extra Bitcoin ETF inflows modeled if the Fed delivers 100–125 bps of cuts by year-end.

Hot topics

What the community is discussing

Could this be a hidden catalyst for another bull run?

It’s all about the macro, apparently.

That’s a decent projection.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].