Genera ganancias sólidas con cada movimiento.

desde 2018

personalizada 24/7

$11,000 millones en activos

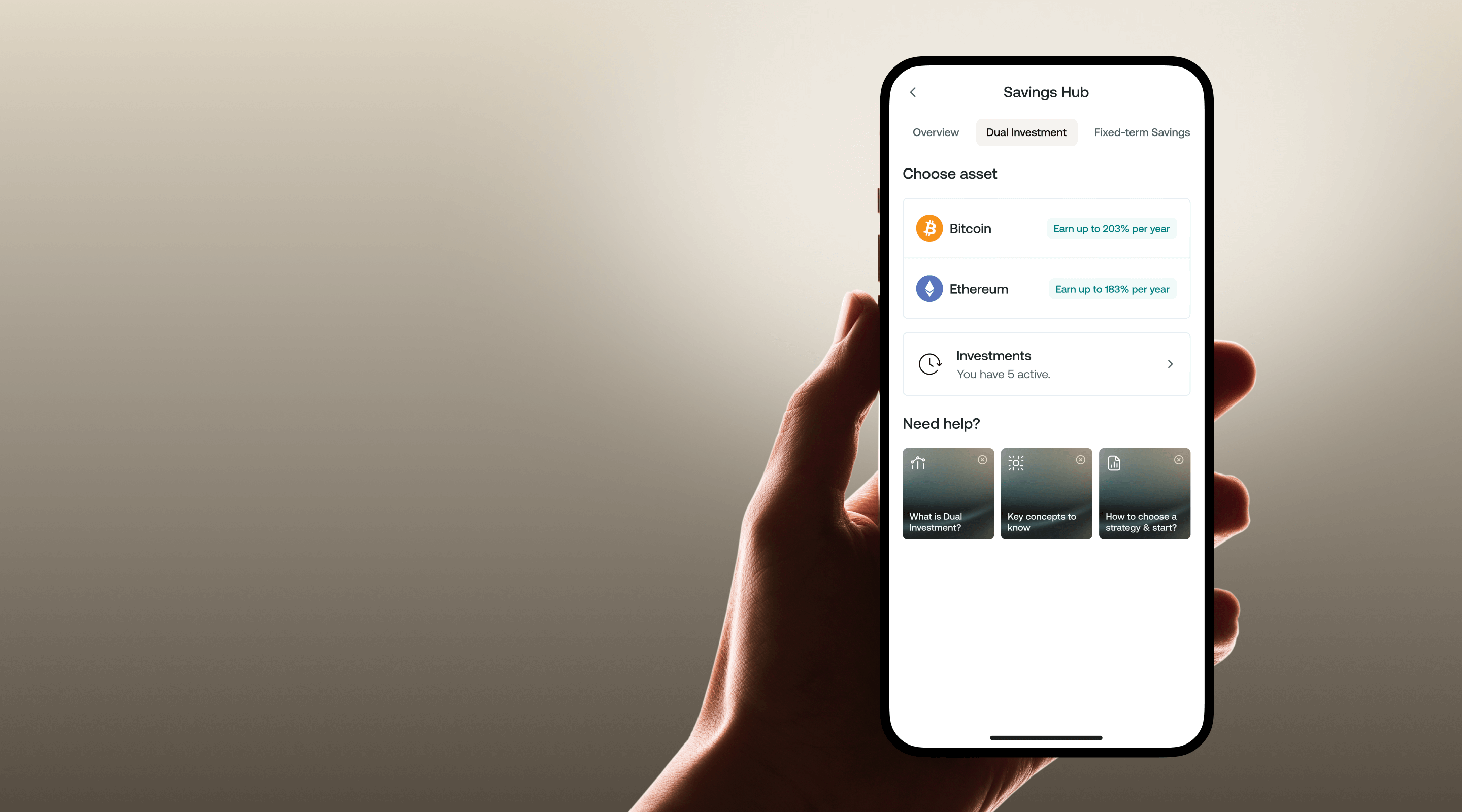

Suscríbete a una estrategia Comprar barato o Vender caro y obtén una perspectiva clara de tus ganancias potenciales.

Dual Investment te permite intercambiar los principales pares de criptomonedas en una fecha futura si se alcanza cierto precio. Mientras esperas un posible intercambio, ganas intereses por tus activos suscritos.

Según el precio que esperes para esa fecha, puedes optar por comprar barato y vender caro.

Para más información, visita nuestro Centro de ayuda.

Dual Investment incluye algunos términos clave que debes conocer antes de suscribirte a una estrategia.

Precio objetivo: el precio al que quieres comprar o vender tu cripto.

Fecha de liquidación: la fecha en la que se podría comprar o vender tu cripto.

Interés: la ganancia que obtendrás sobre tus tenencias. El interés se recibe en la moneda de liquidación.

Moneda suscrita: la moneda que utilizarás para suscribirte a Dual Investment.

Moneda de liquidación: la moneda que recibirás en la fecha de liquidación.

Para suscribirte a una estrategia de Dual Investment, primero debes completar un cuestionario para afianzar tus conocimientos sobre Dual Investment. Después de completarlo con éxito, podrás comenzar a utilizar Dual Investment directamente desde tu panel en la plataforma de Nexo o acceder desde el Portal de ahorros de tu app de Nexo.

Para conocer más sobre las estrategias de Dual Investment, consulta nuestro artículo del blog.

La tasa de interés depende del activo, de qué tan próxima esté la fecha de liquidación al momento de suscribirte y del precio objetivo. Algunas estrategias a corto plazo con un precio objetivo cercano al precio existente pueden, en ocasiones, ofrecer tasas de tres cifras.

Actualmente, el monto mínimo depende del activo con el que te suscribas. El mínimo para BTC es 0.01, para ETH es 0.2, para XRP es 1,000 y para SOL es 10. Si te suscribes a una estrategia Comprar barato, el monto mínimo depende del precio objetivo.

Para conocer más sobre las estrategias de Dual Investment, consulta nuestro artículo dedicado del Centro de ayuda.