Dispatch #269: ETH & SOL: Heavyweights on the radar

Nov 04, 2025•6 min read

In this patch of your weekly Dispatch:

- Altcoin growth engines

- Macro data in focus

- A wave of liquidity

Market cast

Between support and resistance: Bitcoin’s crossroads

Bitcoin is testing a major support area on both daily and weekly charts. The price trades just below the lower Bollinger Band — a volatility indicator often signaling oversold conditions — while the 50-period simple moving average (SMA), a key trend gauge, sits nearby, creating potential for a short-term bounce if selling pressure eases. Still, momentum indicators remain weak: the Relative Strength Index (RSI) and Stochastic oscillators continue to turn lower, with the latter already oversold, while the MACD histogram — a trend and momentum hybrid — stays deep in negative territory. On the daily chart, Bitcoin again touches the lower Bollinger Band as RSI nears 30 and the MACD holds below zero. The $104,000–$105,000 zone, reinforced by the weekly 50-SMA and the psychological $100,000 level, remains crucial support, with resistance seen around $106,500 and $108,000.

The big idea

ETH and SOL: the heavyweights step in

October historically sees stronger performance for Bitcoin and digital assets, but this year’s short-term moves diverged from expectations. Renewed U.S.–China trade tensions, geopolitical uncertainty, and a cautious Federal Reserve signalling that a December rate cut may not materialize weighed on the market.

Bitcoin finished the month 5% lower — its weakest October since 2018 — while November opened with another pullback, bringing total crypto market capitalization back to July levels below $3.5 trillion.

After a year of steady inflows and new highs, Bitcoin’s momentum has been stalled. Profit-taking by long-term holders and softening ETF demand have weighed on sentiment. Broader altcoin performance has lagged throughout the cycle as retail attention drifts toward equities, drawn by easier gains and lower perceived risk.

The result has been a sentiment-driven correction — but not a structural breakdown. Quantitative tightening is fading, and policy expectations for 2025 continue to ease.

Short-term pressure has not altered long-term dynamics. And that’s where Ethereum and Solana step in.

Ethereum: the liquidity engine

Ethereum’s October story wasn’t about price; it was about depth. The network processed a record $2.82 trillion in stablecoin volume, up 45% from September’s all-time high. Traders rotated into stablecoins not to retreat but to capture yield and position for what’s next.

USDC led with $1.62 trillion, followed by USDT’s $895 billion, reaffirming Ethereum’s role as crypto’s liquidity heart — the chain where capital consolidates before its next deployment.

The next catalyst arrives on December 3 with the Fusaka hard fork, which quintuples Ethereum’s block gas limit (30M → 150M), doubles blob capacity, and introduces PeerDAS — a data-availability system that boosts validator efficiency. It’s a major step in strengthening Ethereum’s modular backbone just as adoption accelerates.

That infrastructure matters. Ethereum is becoming the settlement layer for real-world assets (RWAs), with Standard Chartered projecting tokenized RWAs on the network to rise from $35 billion today to $2 trillion by 2028, spanning money-market funds, equities, and private credit. With the GENIUS Act providing regulatory clarity, Ethereum’s rails are widening for the next cycle.

Solana: the speed play

If Ethereum is the system’s backbone, Solana is its engine. The chain’s first-ever spot ETFs have attracted $269 million in cumulative inflows, pushing total Solana ETF assets above $500 million — the fastest start among any new crypto ETP this year. It’s a strong signal of institutional interest in Solana’s throughput and staking-yield appeal.

This is more than a headline rotation. Solana’s monolithic design keeps all execution on one ledger, allowing instant confirmations and sub-cent fees. The upcoming Firedancer client — built for redundancy and scale — will drive finality below 150 milliseconds, making Solana one of the fastest decentralized systems in existence. The network that once buckled under congestion now runs with precision.

Resilience beyond the pullback

Even as today’s correction weighs on prices, Ethereum and Solana bring distinct strengths that underpin the broader digital assets market. One leads on liquidity and institutional integration; the other on performance and usability. Their fundamentals are diverging from short-term sentiment, setting the stage for future appreciation even if momentum takes time to rebuild.

Bitcoin’s pause doesn’t mark an end — it’s a recalibration. The market is rotating toward where value accrues next. And in this phase, Ethereum and Solana are the ones carrying the torch.

TradFi trends

A liquidity wave lifts all boats

After months of tightening liquidity, the tide is turning. The Federal Reserve injected $29 billion into the U.S. banking system — its largest single-day repo operation since the dot-com era, as stress in Treasury markets deepened and short-term funding costs spiked. Across the Pacific, China’s central bank matched the move with a record cash infusion into domestic lenders, aiming to stabilize credit growth and counter deflationary pressure. Together, these actions mark a notable turn in global liquidity dynamics — a coordinated push to ease funding stress and re-energize risk sentiment.

With yields easing and money supply expanding, markets are shifting back toward risk exposure, and Bitcoin is increasingly part of that conversation. The world’s largest crypto often mirrors global liquidity cycles, and the latest central bank moves suggest conditions could again be aligning in its favor. For now, investors gauge how far policymakers are willing to go.

Macroeconomic roundup

November’s macro barometer

Bitcoin’s macro sensitivity is back in play as traders digest a resolved U.S.–China tariff truce and a cautious Federal Reserve. Despite tariff relief and a 25-bps cut that ended QT, Powell’s warning that a December rate cut “isn’t a given” hijacked sentiment, sending BTC down 1.7% on the week.

JOLTS Job Openings (Tuesday): A soft read would hint at labor cooling and revive easing hopes; stronger data could cement a December hold.

ADP Employment (Wednesday): A key preview for Friday’s payrolls — an upside surprise risks tightening liquidity sentiment.

ISM Services PMI (Wednesday): Gauges demand and business resilience; a dip would support the Fed’s dovish bias.

BoE Rate Decision (Thursday): Markets expect a hold at 4.00%. Any dovish signal could bolster global risk appetite.

Geopolitical clarity may have returned, but monetary uncertainty keeps the market on edge. For now, Bitcoin remains the barometer.

The week’s most interesting data story

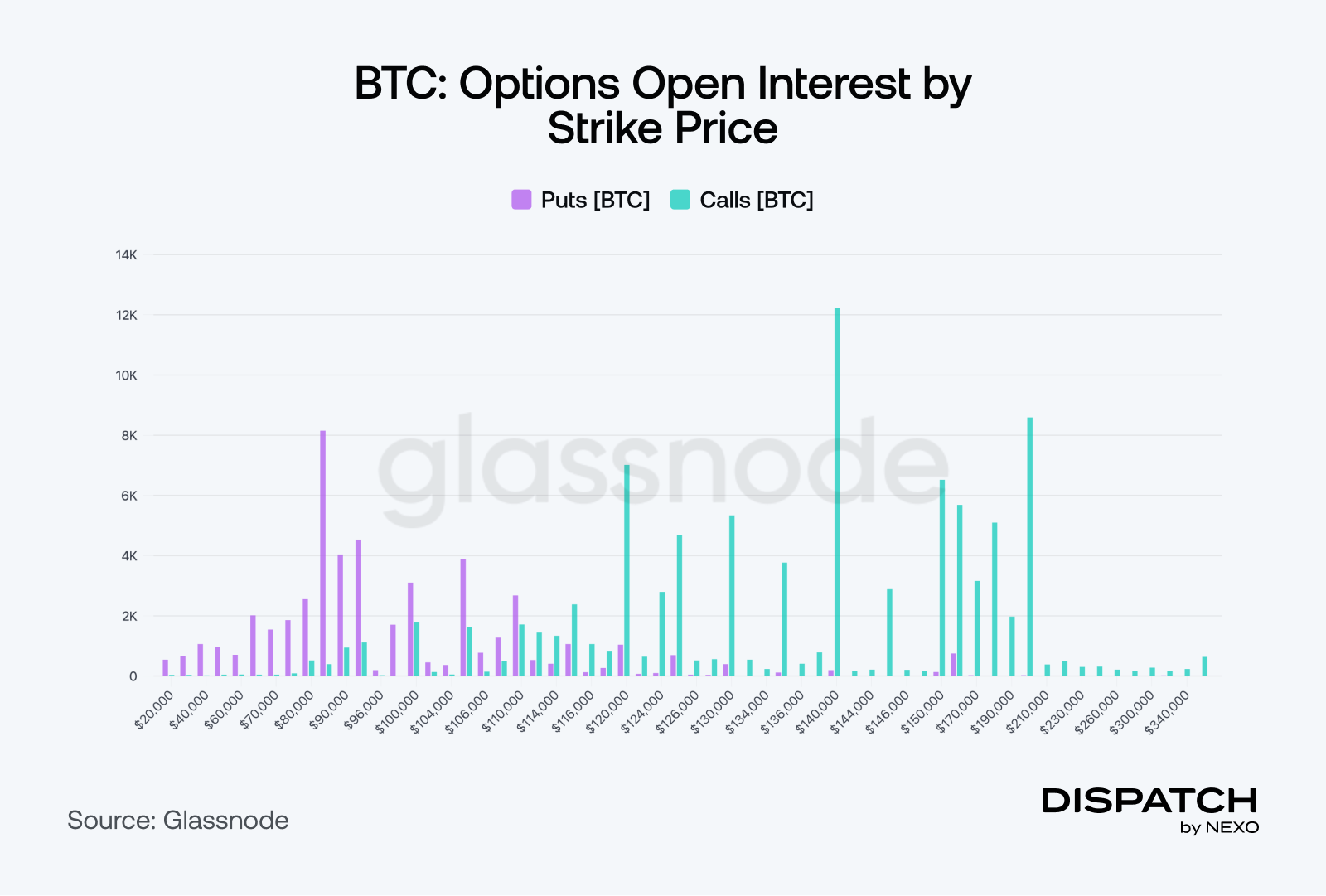

What are the options for BTC in 2025?

Positioning in Bitcoin remains broadly bullish despite a soft start to November. BTC is hovering below $108,000 after weekend range-trading and renewed ETF outflows, but traders are largely viewing the pullback as consolidation within an ongoing uptrend. Many still target $140,000 by Christmas, betting that fresh spot demand and improving liquidity will revive momentum. Whale cohorts continue to hold the bulk of supply, derivatives leverage has eased, and volatility has cooled — a setup that suggests the market is resetting, not reversing.

The numbers

The week’s most interesting numbers

$10 billion — Tether’s year-to-date profit surpasses Bank of America and nears Goldman Sachs, driven by returns on United States Treasuries.

$1 trillion — OpenAI is preparing a 2026 initial public offering that could ease its reliance on Microsoft’s 27 percent stake.

70 million — Solana now handles tens of millions of daily transactions, with decentralised exchange activity exceeding $143 billion this month.

Hot topic

What the community is discussing

So it’s only up now?

Bitcoin for treasury!

Are we going to see a scale-up in price?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].