Dispatch #270: The foundations for Bitcoin’s final 2025 run

Nov 11, 2025•7 min read

In this patch of your weekly Dispatch:

- Solana’s ETF strike

- The stablecoins’ trillion-dollar projections

- November’s macro reports

Market cast

Support at $100,000: BTC holds the line

After several weeks of downward pressure, Bitcoin’s decline has paused near the 50-week simple moving average — a long-term trend indicator — which aligns with the $100,000 level and the lower Bollinger Band. This confluence suggests a strong support area for now. Still, momentum on the weekly timeframe remains weak: the Relative Strength Index (RSI) and the Stochastic oscillator, both gauges of momentum and overbought or oversold conditions, continue to trend lower, with the latter nearing the oversold zone. The Moving Average Convergence Divergence (MACD) also remains deep in negative territory, underscoring the prevailing bearish tone.

On the daily chart, short-term signals are improving. The Stochastic is rising from oversold levels, the RSI is moving toward neutral territory, and the MACD lines are nearing a bullish crossover — a setup that could precede renewed upside momentum.

Support sits around $104,000 and $100,000, where the lower Bollinger Band and 50-week SMA converge as dynamic supports, while resistance appears near $106,500 and $109,000. Bitcoin shows early signs of stabilization, but a confirmed reversal will depend on sustained strength above these key levels.

The big idea

Bitcoin’s alignment – the key elements

Bitcoin and crypto have shown their volatile side again, but optimism around Washington’s effort to end the government shutdown has given markets a small spring in their step. The week began in green, though the path ahead looks less about quick rebounds and more about whether the right mix of technical, macro, and structural conditions can align to invite the bulls back before year-end.

Fundamentals – when a market catches its breath: After drifting around the $100,000 mark, Bitcoin finds itself at a psychological crossroads. The short-term holder cost basis near $112,500 now acts as the boundary between consolidation and recovery. Around 71% of supply remains in profit—typical of a mid-cycle cooldown rather than a full-blown reversal—but momentum has waned. Long-term holders have quietly sold more than 300,000 BTC since July, an uncharacteristic move that reflects fatigue instead of euphoria.

Still, this isn’t a market in distress. The Relative Unrealized Loss ratio at just 3% suggests moderation, not capitulation. Traders are defensive, not desperate—hedging rather than exiting. Structurally, Bitcoin remains intact, though conviction is thinner than it was during the summer highs.

Market structure – the quiet forces beneath the chart: Behind the recent price swings lies a quieter driver: shifts in collateral settings, funding rates, and ETF hedging flows. The October shakeout, which saw nearly $19 billion in positions liquidated, showed how tightening basis spreads and margin adjustments can move Bitcoin just as much as any macro headline. When the basis widens, carry traders buy spot and short futures, pulling coins off exchanges and lifting prices; when it compresses, those positions unwind, releasing supply and adding pressure.

The ETFs’ tides: After six straight sessions of outflows totaling $660 million, U.S.-listed Bitcoin ETFs flipped positive with $240 million of inflows. One green print doesn’t erase a week of red, but it does mark a shift: the largest marginal buyers have stopped selling and started to accumulate again. ETF flows now serve as the clearest barometer of demand.

Sustained daily creations—five to ten consecutive days of inflows—would remove mechanical sell pressure from the market and restore a structural bid capable of lifting prices back above key thresholds like $112,000–$113,000. Until then, caution lingers.

Liquidity builds up: The world’s broad money supply has reached a record $142 trillion, up nearly 7% year-on-year. With the New York Fed signaling an end to quantitative tightening—and even hinting at renewed balance sheet expansion—the conditions for another risk cycle are quietly falling into place. If the liquidity flood resumes, Bitcoin could again serve as a magnet for speculative and institutional capital alike. The setup mirrors earlier reflation phases, when abundant cash searched for returns and crypto became the market’s pressure valve.

Holder activity: The latest wave of “OG whale dumping” headlines tells only part of the story. On-chain analysts note that much of the movement from legacy wallets reflects address upgrades, custody migrations, or collateral use rather than liquidation. Meanwhile, ETF investors—the so-called “boomers”—have stayed remarkably steady through a 20% drawdown. In other words, conviction hasn’t vanished; it’s just changed hands. Where the old guard trims, institutional channels quietly absorb. And as our Nexo users know well, there are smarter ways to access liquidity without parting with your Bitcoin. The Big idea – patience is a virtue: For bulls to make a comeback, two conditions must align: renewed liquidity and consistent demand. With macro winds shifting and ETF appetite flickering back to life, the ingredients are emerging—but not yet mixing. The groundwork for the next leg higher may already be forming beneath the surface. What remains to be seen is whether patience can outlast caution long enough for the bulls to charge again.

Hot in crypto

Solana’s ETF start: Two weeks of demand

Solana (SOL) started the week with a 2% rise, extending over 4% gains from Sunday to rebound from the $150 level. The rally comes alongside 10 straight days of inflows into U.S. spot Solana ETFs, totaling $335.7 million — a standout run of institutional demand.

Futures markets echo the optimism: open interest has risen to $7.8 billion, with short liquidations outpacing longs as traders lean bullish. Still, the $175–$185 zone now acts as resistance, and a break above it would open a path toward $200.

Beyond price action, Solana’s narrative is shifting. The same traits that once fueled retail speculation — speed, low fees, sub-second finality — are now seen as institutional-grade strengths. Analysts have dubbed it “the new Wall Street,” as tokenization and on-chain settlement gain traction.

Eleven days of inflows may not crown Solana the institutional chain yet — but they’ve certainly put it in the conversation.

TradFi trends

From niche to necessity: The Fed recognizes stablecoins

As crypto regulation finally enters the mainstream, the Federal Reserve is beginning to take stablecoins seriously — and not just as a niche digital asset.

Newly appointed Fed Governor Stephen Miran says stablecoins could soon become a “multitrillion-dollar elephant in the room” for monetary policy. In his first major speech since joining the Board, Miran cited internal Fed estimates projecting $1–$3 trillion in stablecoin uptake by the end of the decade, much of it driven by foreign demand for dollar exposure.

That scale, he noted, would rival half the outstanding U.S. Treasury bill market — a shift too large for policymakers to ignore. Stablecoins, Miran added, could even “reboot” U.S. financial infrastructure, facilitating global dollar use and payments. For the Fed, that means crypto’s quiet plumbing may soon matter as much as interest rates.

Macroeconomic roundup

Can macro data keep the rally dreams alive?

Bitcoin hovers near $106,000 as optimism over Washington’s deal to end the government shutdown lifts sentiment. But the week ahead is packed with economic signals that could decide whether BTC’s rebound extends toward $110,000 or stalls below resistance.

Fed Speakers (Tue–Wed): A full roster of officials — Barr, Williams, Waller, Bostic, and others — will shape expectations for early-2026 policy. Chair Powell’s recent hint that the Fed may soon resume balance sheet expansion has reignited talk of quantitative easing. More dovish confirmation could unleash fresh crypto liquidity; pushback could tighten risk appetite again.

CPI Inflation (Thu): October’s CPI release (pending the shutdown’s formal end) is the week’s main event. A reading below 3.0% YoY would strengthen disinflation momentum and rate-cut bets — bullish for Bitcoin. A hotter print, on the other hand, would reinforce the Fed’s cautious stance and likely stall crypto’s advance.

Jobless Claims (Thu): A higher jobless number would signal labor softening and support the case for policy easing — a near-term tailwind for risk assets. Strong data, however, would delay dovish expectations and test BTC’s $106,000 support.

The week’s most interesting data story

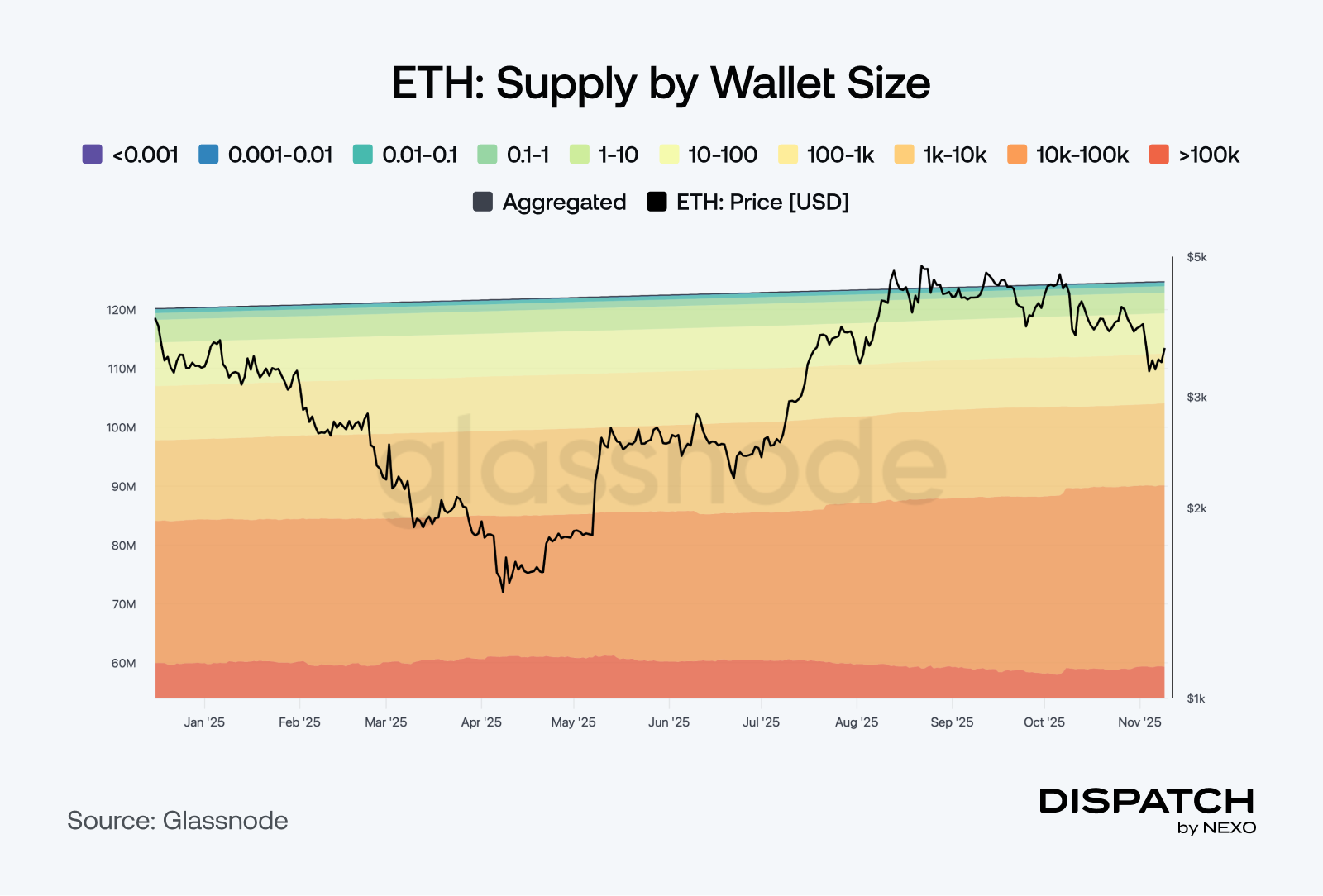

ETH whales in the dip-buying zone

Ethereum (ETH) fell more than 12% in early November, but large holders treated the drop as a buying opportunity, adding roughly $1.37 billion worth of ETH in just three days. The steady accumulation highlights renewed confidence even as the broader market remains under pressure. This can be seen on the right side of the chart, where holdings by major addresses have edged higher. At the same time, exchange reserves have fallen to their lowest level since 2016, suggesting coins are moving into long-term storage rather than being sold. With both short- and long-term MVRV metrics in negative territory, on-chain data indicate that Ethereum may be entering an attractive accumulation phase if market conditions stabilize.

The numbers

The week’s most interesting numbers

$112,500 — The price Bitcoin must reclaim — short-term holders’ cost basis — to shift from correction to recovery.

$1 trillion — The scale of stablecoin use driving digital dollarization across emerging markets.

5 — Spot XRP ETFs listed under DTCC’s active and pre-launch category, hinting at altcoin ETFs’ next wave.

87,296 BTC — Tether’s Bitcoin stash, now worth $8.8 billion, cementing its place among the world’s largest holders.

Hot topic

What the community is discussing

BTC whales show up around $100,000?

ETH bulls in the house?

A brief (50-post thread) on Ethereum’s Fusaka.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].