Latin America crypto tax guide: Brazil and Argentina

Mar 07, 2025•8 min read

With recently updated guidance, figuring out crypto tax in Latin America can be complicated. That’s why we have partnered with Koinly to break down the essentials of crypto taxation in these two major Latin American economies for 2025. Below is key information provided by Koinly, one of the market’s leading crypto tax solutions, as well as details on how Koinly’s integration can help streamline tax reporting.

Important: Nexo and Koinly do not offer tax advice. This article is for general information purposes and not intended as financial advice or a personalized recommendation. Always consult a tax professional for guidance specific to your situation.

Brazil

How is crypto taxed, and what constitutes a taxable event?

In Brazil, cryptocurrency is considered an asset rather than a currency, meaning transactions involving digital assets are subject to taxation. The Receita Federal do Brasil (RFB) requires individuals to report crypto holdings and transactions, especially if they exceed BRL 5,000 a month.

A taxable event occurs when you:

Sell crypto for fiat (e.g., BRL)

Exchange one cryptocurrency for another

Use crypto to purchase goods or services

Receive crypto as income, including mining rewards

Profits from crypto transactions are subject to capital gains tax, but only if monthly profits exceed BRL 35,000. If your gains stay below this threshold, you may be exempt.

How much tax will you pay?

Income tax in Brazil is between 7.5% to 27.5%: Here are the current income tax and capital gains tax rates in Brazil:

How to calculate your crypto taxes

To calculate your capital gain or loss from a cryptocurrency transaction, apply the following formula:

Capital gain/loss = Selling price - Purchase price

The selling price refers to the fair market value of your cryptocurrency at the time you part with it. Conversely, the purchase price represents the fair market value of the crypto when you initially acquired it.

If you have income from crypto, you’ll need to determine the fair market value of your holdings first.

Accounting methods for crypto

For most investors, you will be dealing with multiple assets of the same kind and tracking cost basis in these instances can become trickier, which is where an accounting method comes in.

In Brazil, you can choose between FIFO (First-In, First-Out) or ACB (Average Cost Basis).

FIFO: The earliest acquired cryptocurrency is considered the first to be sold.

ACB: The purchase price is calculated as the average cost of all acquired cryptocurrency.

Are different digital assets taxed differently?

The guidance from the RFB is pretty limited but does not distinguish between different types of digital assets. As such, it’s likely that digital assets are treated the same from a tax perspective, so whether you’ve got coins, tokens, stablecoins, NFTs, or otherwise, it’ll all come down to the specific transaction as to how it’s taxed.

How are airdrops and forks taxed?

The limited guidance from RFB does not clarify how airdrops, including those from a hard fork, are taxed. In some countries, these are considered a kind of additional income and subject to Income Tax. Of course, any later disposals of airdropped tokens that result in a gain (over BRL 35,000 monthly) would be taxable. You should speak to an experienced accountant for advice on the tax implications of airdrops and other transactions where guidance is yet to be issued.

How to report your crypto taxes?

In Brazil, the financial year is the same as the calendar year and your tax return is due on the last business day of April. You must report cryptocurrency profits, capital gains, and other income earned throughout the year, including employment income.

You can report your crypto taxes through the eCac online portal, where you may need to submit the following forms:

Personal income tax return

This form is used to declare income from all sources during the tax year, including employment earnings. It must be submitted by the last business day of April. If you hold cryptocurrencies with an acquisition cost exceeding BRL 5,000, they must be reported as assets on your annual income tax return. However, if your total crypto holdings remain below this threshold, you are not required to declare them.

Annual capital gains statement

Capital gains from cryptocurrency transactions must be reported on your annual capital gains statement.

If you made a profit from crypto sales during the month, you must report it, even if the total sales volume was below BRL 35,000.

However, you will only owe taxes if your monthly profit exceeds BRL 35,000.

If no profit was made, submitting a capital gains statement is not required.

Monthly statement of cryptocurrency operations

If your total crypto transaction volume outside Brazilian exchanges exceeds BRL 30,000 in a month, you must submit a monthly statement of cryptocurrency operations. This requirement does not apply to transactions made on Brazilian-based exchanges. The statement must be submitted by the last business day of the following month.

Argentina

How is crypto taxed, and what constitutes a taxable event?

In Argentina, cryptocurrency is classified as an intangible asset, meaning transactions involving digital assets are subject to taxation. The Administración Federal de Ingresos Públicos (AFIP) requires individuals to report their crypto holdings and transactions, particularly when they generate taxable income.

A taxable event occurs when you:

Sell crypto for fiat (e.g., ARS)

Trade one cryptocurrency for another

Earn crypto as income, including staking or mining rewards

Capital Gains Tax applies when you sell or exchange cryptocurrency at a profit, while Income Tax applies when you earn crypto, such as mining or staking rewards.

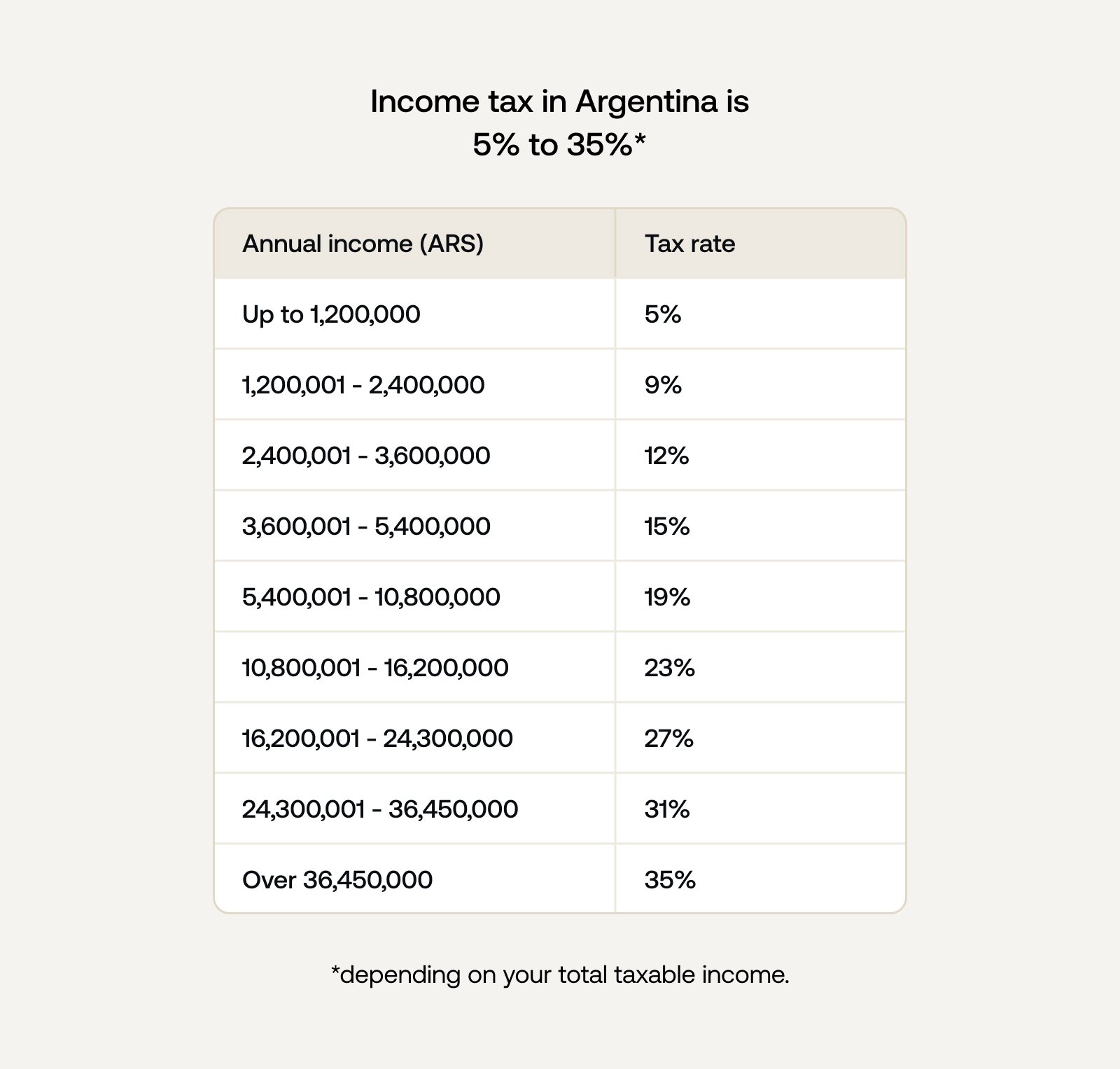

How much tax will you pay?

For capital gains, you’ll pay 5% or 15% depending on whether the transaction is made in pesos or a foreign currency. If the income is from a foreign source, you’ll pay 15%.

How to calculate your crypto taxes?

To determine your capital gain or loss on a cryptocurrency transaction, use the following formula:

Capital Gain/Loss = Selling Price - Purchase Price

The selling price is the fair market value of your cryptocurrency when you dispose of it, while the purchase price is the fair market value of your cryptocurrency when you acquired it.

If you receive crypto as income (e.g., through mining, staking, or payments), you must calculate its fair market value at the time of receipt and report it as taxable income.

Accounting methods for crypto.

If you’ve purchased multiple units of cryptocurrency of the same kind (for example, 3 ETH) at different price points, you’ll need an accounting method to determine your cost basis.

The AFIP is clear that when determining the cost to be allocated for multiple units, the oldest acquisition price is used first. This is what’s known as the First In, First Out (FIFO) accounting method, where the first crypto acquired is considered the first to be sold.

Are different digital assets taxed differently?

The AFIP does not differentiate between various digital assets for tax purposes. As a result, all digital assets—including cryptocurrencies, stablecoins, tokens, and NFTs—are treated as financial assets and taxed based on the specific transaction.

The key factor determining taxation is the type of transaction rather than the nature of the asset.

How are airdrops and forks taxed?

The AFIP has not issued specific guidance on the taxation of airdrops or forks, but based on general tax principles, airdrops may be considered a form of income and taxed upon receipt based on fair market value. If later sold, capital gains tax would apply.

Given the lack of clear regulations, consulting a tax professional for guidance on airdrops and forks is highly recommended.

How to report your crypto taxes?

Argentina’s financial year runs from January 1 to December 31, and tax returns are due by June of the following year. You can report your crypto through AFIP’s online tax portal.

Some notable changes are coming to reporting your crypto in 2025, though. Back in 2024, the government enacted a law mandating that citizens declare their cryptocurrency holdings to enhance financial transparency and combat tax evasion. The legislation requires that digital assets be held on exchanges registered with the National Securities Commission (CNV). Assets declared before March 31, 2025, will be taxed solely on capital gains, exempting the holdings themselves.

How to calculate your crypto taxes using Nexo & Koinly

Easily calculate your crypto taxes and generate reports with Nexo’s integration with Koinly. Simply import your Nexo transaction history into Koinly, and it will automatically determine your capital gains, losses, income, and more. There are two methods to do this, and we’ll guide you through both step by step.

Step 1: Create a free Koinly account and link it to your Nexo account

Nexo connects to Koinly through SSO or via CSV file upload. To use single sign-on (SSO), navigate to the Wallets section in Koinly and search for Nexo.

Step 2: Enable auto-sync and proceed to Nexo

You'll be redirected to the Nexo website to grant Koinly read-only API access. Once authorized, Koinly will automatically fetch your Nexo transaction history.

If you prefer manual import, you can download a CSV of your Nexo transaction history. Log into Nexo, go to the Transactions tab in the top menu, and select a date range that covers your complete Nexo trading history. Ensure all transaction types and assets are selected, then click export. After downloading your file, head to Koinly, search for Nexo in the wallets section, and choose import from file to upload your CSV.

Remember, you need to repeat this process for Nexo and all other exchanges, wallets, or blockchains you use so Koinly can accurately calculate your crypto taxes.

Step 3: Let Koinly compute your capital gains, losses, and income

Once your transaction data is imported, Koinly will process and calculate your tax liabilities.

Step 4: Download your crypto tax report

After reviewing your tax summary and ensuring its accuracy, you can download the necessary tax report when needed—just upgrade to a paid plan.

Final Tips

Keep records of all transactions, including timestamps, values, and fees.

Consult a tax professional if you engage in complex trading or DeFi activities.

Use Koinly to automate calculations and ensure compliance.

📌 Start calculating your crypto taxes with Koinly today!

* According to Koinly’s tax guides and general blog posts:

The information in this article is for general information only. It should not be taken as consulting professional advice from either Nexo or Koinly. Neither Nexo nor Koinly is a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances.