Dispatch #283: Why the $98 trillion liquidity reality trumps the noise?

Feb 10•6 min read

In this patch of your weekly Dispatch:

- BTC ETFs flows flip positive on February 6

- ETH network activity surges

- Derivatives positioning resets

Market Cast

BTC: Consolidation near key levels

On the weekly chart, the price of Bitcoin recently dipped toward the two-hundred-period simple moving average before rebounding and is now consolidating around the $69,000 level, which may function as near-term support. Broader conditions remain skewed to the downside. Momentum indicators continue to reflect bearish pressure, with both RSI and Stochastic in oversold territory and the MACD histogram deeply negative, indicating that downside momentum has not yet fully reset.

The daily chart presents a more balanced picture. Price action has stabilized over recent sessions, while both RSI and Stochastic have moved back above oversold levels, consistent with easing bearish momentum. Although the MACD histogram remains below zero, its gradual convergence toward the neutral line suggests that downside pressure may be weakening rather than accelerating.

The Big Idea

Market noise vs. the $98 trillion liquidity reality

There is never a single reason why the market moves. While headlines love a singular 'why,' the truth is always found in the intersection of multiple, often conflicting, drivers.

Take Bitcoin’s recent drawdown. It reflects a repricing of near-term liquidity expectations following Kevin Warsh’s nomination as Fed Chair, alongside broader volatility in technology-linked risk assets, rather than a deterioration in underlying fundamentals.

This volatility is further colored by the market’s historical four-year rhythm, which often sees investors recalibrate their positions as we approach the math-driven pivots of the halving cycles.

However, beneath short-term market noise, the global liquidity backdrop remains constructive. Aggregate M2 across major economies stands near all-time highs at approximately $98.6 trillion, indicating that system-wide liquidity remains ample even as the pace of expansion moderates.

Importantly, while Warsh’s nomination has introduced some near-term uncertainty as markets interpret his stance as structurally hawkish, his appointment also removes a key policy unknown. Warsh brings institutional credibility through crisis-era Fed experience and a strong commitment to central bank independence, while any near-term policy impact is likely to be limited by the committee-driven nature of FOMC decisions.

Outside the U.S., global liquidity dynamics remain broadly supportive. In China, the PBOC maintains a policy bias toward accommodation amid subdued inflation and weak domestic demand. In Europe, last week’s softer eurozone inflation print and a stronger euro leave room for potential ECB insurance cuts. In the UK, faster-than-expected disinflation has increased the likelihood of a March rate cut. Japan may prove to be less of a residual risk than markets currently assume. Improving fiscal fundamentals, predominantly domestic JGB ownership, and a gradual approach to policy normalisation reduce the likelihood of disorderly tightening.

Overall, recent crypto volatility has been amplified by market structure effects and a leverage reset in derivatives markets. Bitcoin open interest has fallen by more than 50% from October’s all-time highs, with an even larger reset across altcoins. With much of the negative news already priced in and global liquidity remaining supportive, markets appear better positioned, pending a clearer macro catalyst.

The takeaway is simple: don't mistake a tactical recalibration for a structural breakdown. While the headlines focus on the friction of new nominations and the historical four-year cycle, the plumbing of the global financial system tells a different story.

Blue chips

Network activity & ETFs lead recovery

Altcoins declined 8–10% alongside Bitcoin, but network fundamentals remain comparatively resilient. Ethereum activity continues to expand, with daily transactions reaching a record ~2.8 million in early February. Exchange-held ETH has fallen to ~12% of supply while staked ETH approaches 37 million, reinforcing reduced near-term sell pressure and Ethereum’s continued dominance across DeFi, RWAs, and stablecoins.

XRP has also diverged from price weakness, with Ripple recently securing a full EU EMI license and growing RLUSD stablecoin supply to ~$1.5 billion, alongside rising on-chain volumes.

Despite last week’s consolidation, spot Bitcoin ETFs recorded $371 million in net inflows on February 6, with no outflows across any product. Altcoins remain highly correlated with Bitcoin, but ETF flows show early signs of differentiation. XRP spot ETFs saw $39 million in weekly inflows, led by XRPZ, while SOL ETFs posted net weekly outflows despite a modest rebound on February 6. These patterns are consistent with gradual capital concentration in assets with clearer institutional positioning.

TradFi trends

Macro data shapes near-term market sentiment

Markets enter a data-heavy week with delayed U.S. labour releases in focus, after stronger-than-expected PMI readings last week contrasted with soft sentiment and declining job openings. The January U.S. employment report has been postponed again due to the government shutdown, complicating near-term assessment of labour market conditions following the weakest year for U.S. job growth since 2020.

U.S. inflation data also remain under scrutiny after recent CPI prints were questioned due to shutdown-related data gaps. The BLS carried forward missing shelter prices under its standard procedures; given shelter’s roughly one-third weight in the CPI basket, this methodological choice may have understated reported rent inflation and dampened recent CPI readings.

Together, delayed labour market data and lingering questions around inflation measurement raise the stakes for upcoming macro releases. Until clarity improves, markets are likely to remain sensitive to incremental signals on the monetary policy outlook.

Macroeconomic roundup

U.S. jobs and inflation data in focus

U.S. Retail Sales (Tue)

December retail sales will gauge consumer resilience into year-end, informing the balance between soft-landing and downside growth risks.

U.S. Nonfarm Payrolls & Labour Market Data (Wed): The rescheduled jobs report will test whether labour market cooling is continuing without a sharp slowdown, with direct implications for Fed policy expectations, USD pricing, and risk sentiment.

China Inflation & Activity Data (Wed): Subdued CPI and negative PPI readings are expected to reinforce China’s disinflationary backdrop and support expectations of continued policy accommodation.

U.S. CPI Inflation (Fri): Inflation remains the primary constraint on Fed easing. Markets will focus on whether shelter inflation re-accelerates after prior data gaps, given its outsized contribution to core CPI. The release is likely to drive near-term moves in rates and risk assets.

For a fuller breakdown of this week’s macro events and timings, see our full macro calendar on X.

The week's most interesting data story

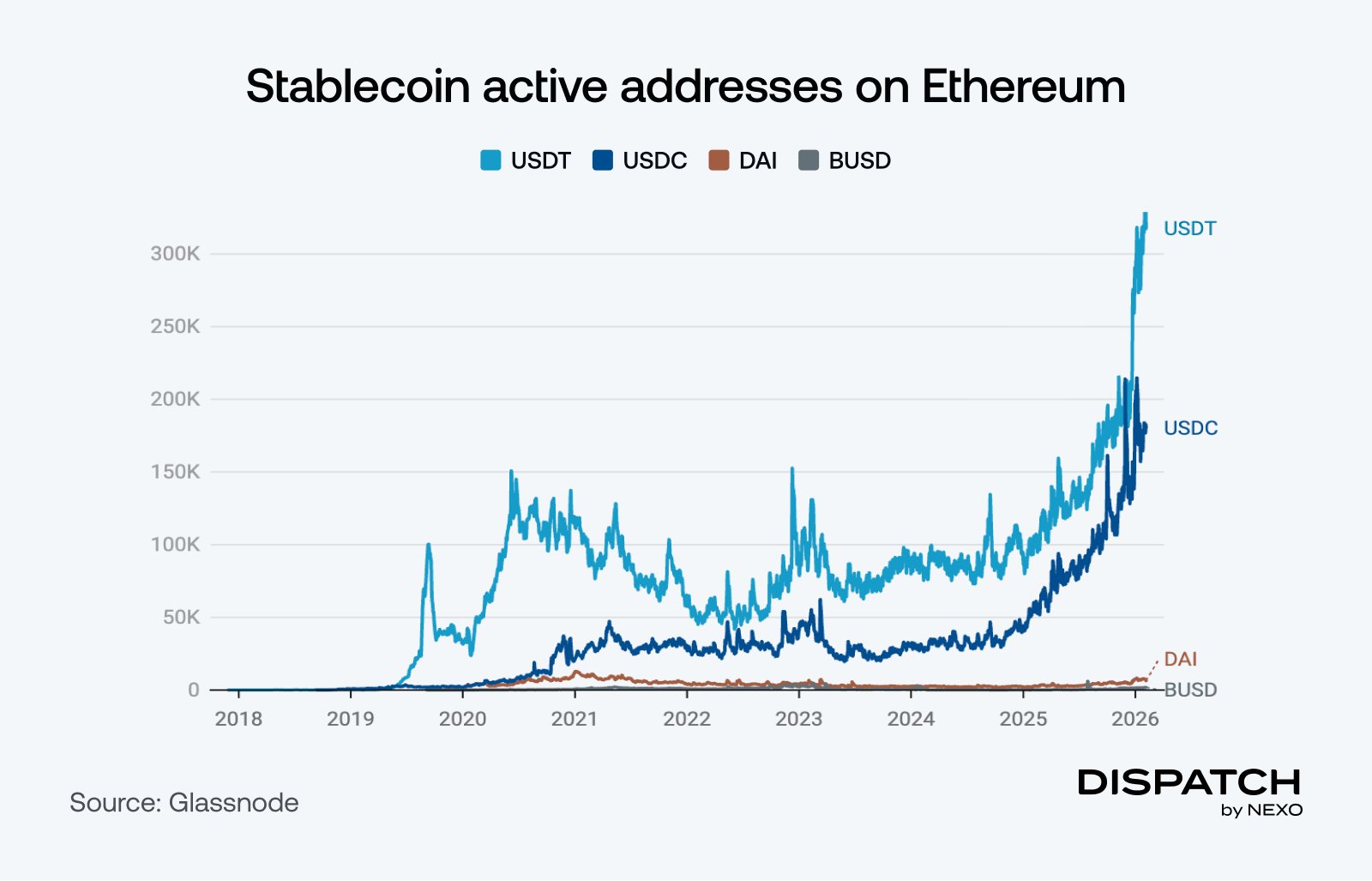

Stablecoin activity points to resilient underlying liquidity

On-chain activity across major stablecoins remains resilient, indicating that the crypto ecosystem’s core liquidity and settlement layer continues to function despite softer risk sentiment. Daily active address data for USDT, USDC, BUSD, and DAI point to sustained engagement rather than broad-based contraction.

Consistent with this, aggregate stablecoin supply across the five largest issuers is down only ~2% year to date, holding near $261 billion. This decline appears driven by the lagged impact of the broader crypto market cap drawdown rather than material capital outflows.

The numbers

The week’s most interesting numbers

1.5 - Bitcoin to gold volatility ratio has fallen to record lows, making Bitcoin more attractive on a relative basis, according to JP Morgan.

$21.4 billion - BTC perpetual futures open interest in early February, more than halved from October highs, indicating a sizable leverage reset.

170,000 - Net increase in ETH held by treasury companies since the start of the year.

408,000 contracts - The Average Daily Value (ADV) of CME crypto futures and options traded in January ($10.8 billion notional), highlighting continued institutional engagement.

$2,000 - Standard Chartered’s end-2030 price target for Solana, reflecting long-term conviction in its shift toward payments and micropayments despite a more cautious near-term outlook.

What the community is discussing

Crypto ETF investors show strong holding conviction.

XRP Ledger sees sustained whale activity.

Crypto VC funding doubled in 2025.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].