Dispatch #236: Bitcoin’s global market movers

Mar 18, 2025•6 min read

In this patch of your weekly Dispatch:

- ETH’s support zone

- XRP’s latest recognition

- SOL’s fifth birthday

Market cast

The great Bitcoin distribution

Bitcoin’s price action has been following cycles of accumulation and distribution, with capital rotating between investor groups. The latest distribution phase began in January 2025, coinciding with Bitcoin’s correction from $108,000 to $93,000, and the current accumulation trend score indicates that distribution may still be in effect. BTC has moved within a few percent over the past week, with choppy price action preventing any meaningful gains, currently trading below $83,000. However, spot Bitcoin ETFs saw their largest daily inflow in six weeks on Monday, with $274 million added – a potential sign of renewed investor confidence.

Technical oscillators remain in a neutral zone, though the underlying momentum appears somewhat cautious. The support level at $80,000 has proven resilient, having been tested multiple times with the price now consolidating above it. A sustained move below $80,000 could put downward pressure on Bitcoin, potentially guiding it first to the recent low near $76,600 and then further toward a major zone around $72,500.

Conversely, a breakout above the $84,000 resistance may indicate emerging bullish momentum, potentially opening the door for tests of the $86,500 and $90,000 levels. Additionally, this week’s Federal Reserve interest rate decision, along with the accompanying statement and press conference, could offer further direction for Bitcoin’s price action.

The big idea

BTC three-way play to six-figures

President Trump's Strategic Bitcoin Reserve may have provided a tailwind for Bitcoin, but as a maturing asset, it needs more than headlines to soar back into six-figure territory. In today's complex financial landscape, Bitcoin's price is increasingly driven by a blend of fundamental economic forces that shape global markets – central-bank decisions, liquidity dynamics, and its alignment with tech market’s performance. Here’s how these key drivers could propel Bitcoin:

- Macroeconomic indicators and monetary policy: Shifts in consumer spending, retail sales, and employment data could encourage central banks to adopt a more supportive policy stance. Lower-than-expected inflation and softer economic growth may prompt the Federal Reserve to consider rate cuts. Such adjustments not only improve market sentiment but also enhance Bitcoin's appeal as both a hedge and a growth asset.

- Liquidity and interest rates: Bitcoin's performance has historically thrived amid expanding liquidity. As central banks inject more money into the economy – reflected in rising M2 levels – and ease interest rates, the surplus liquidity can spill over into digital assets. This influx could boost demand for Bitcoin as investors seek higher returns when traditional fixed-income yields fall, potentially driving the digital asset's price upward.

- The tech stock market correlation: Bitcoin has shown a notable correlation with major tech stocks, especially during periods of robust market performance. This week, Nvidia’s GPU Technology Conference could fuel fresh optimism, with CEO Jensen Huang set to unveil the Blackwell Ultra GB300 AI chips. As Nvidia drives innovation in AI and high-performance computing, the ripple effect could bolster Bitcoin’s appeal among tech-focused investors.

One more crucial factor to consider is Bitcoin's four-year cycle, which still holds sway, according to market observers. The 2024 Bitcoin halving reduced the Bitcoin network’s block reward to 3.125 BTC per block, while BTC’s price rose over 31%. And while the next event is more than three years away, each halving slashes in half the supply of new Bitcoin entering circulation, reinforcing its scarcity and long-term value proposition. As always with Bitcoin, it's about the big (macro) picture.

Ethereum

Stepping on solid ground?

Ethereum (ETH) has been trading flat for the past seven days, hovering around the $1,900 mark. This lack of significant price movement could indicate that Ethereum has found a bottom, with analysts highlighting strong support at $1,886. The recent rise in accumulation from 1.6 million to 1.9 million ETH suggests that investors are building positions at these levels, reinforcing the potential for a price floor in the short term.

The anticipated Pectra upgrade could serve as a propeller for Ethereum’s price recovery from this market bottom. With the third testnet, Hoodi, now live and helping finalize the Pectra upgrade, expectations are high for the improvements in Layer 2 scaling it will bring. If the upgrade goes live as early as April, it could spark the momentum necessary for Ethereum to regain its market footing – banking giant Standard Chartered projects ETH at $4,000 by the end of 2025, and higher in 2026 and 2027.

XRP

Ripple leads with landmark license

Ripple has made a significant regulatory breakthrough by securing a full license from the Dubai Financial Services Authority (DFSA), marking the first time a blockchain payment provider has achieved this milestone in the Middle East. This achievement highlights Ripple’s strategic focus on compliance and innovation, paving the way for expanded services in a region vital to global finance. The UAE, a major global financial hub, boasts a cross-border payments market worth around $40 billion, according to World Bank data.

Markets appear to take note too, as this regulatory win appears to be reflected in XRP’s recent price rally – nearly 10% up on the past 7 days. Analysts suggest that as confidence grows from these positive regulatory developments, XRP may continue to build momentum.

Hot in crypto

A SOL ETF: Solana’s birthday present?

Solana (SOL) just turned five, and the celebrations come with a bullish twist – major asset managers are now eyeing SOL for a potential ETF. Franklin Templeton recently filed an application with the SEC to list a Solana ETF, signaling growing institutional interest in the asset. If approved, this would mark another milestone in Solana’s journey, following in the footsteps of Bitcoin and Ethereum ETFs. Similarly, asset manager Hashdex has amended its S-1 regulatory filing to include Solana in its crypto index ETF.

Meanwhile, beyond the ETF buzz, Solana’s network continues to evolve. The much-anticipated Firedancer update from Jump Crypto is set to enhance transaction speeds and resilience, pushing the network closer to its ambitious 1 million transactions-per-second goal.

TradFi trends

The continued adoption of crypto

Digital assets are increasingly gaining recognition in traditional finance, with each development reinforcing their growing influence:

- Regulatory shift: Blockchain mentions in SEC filings hit record highs in February as the agency, under Acting Chair Mark Uyeda, takes a more engagement-driven approach, closing major crypto investigations and forming a dedicated task force.

- Wealth managers in play: Bloomberg analyst James Seyffart sees financial advisers and wirehouses as the next big drivers of Bitcoin ETF adoption, with BlackRock already pushing BTC allocations for high-net-worth clients.

- Institutional Bitcoin boom: Public companies now hold over 592,000 BTC – double the past five years’ accumulation – while institutions and governments collectively own nearly 2.8 million BTC, solidifying Bitcoin’s status in TradFi.

The week’s most interesting data story

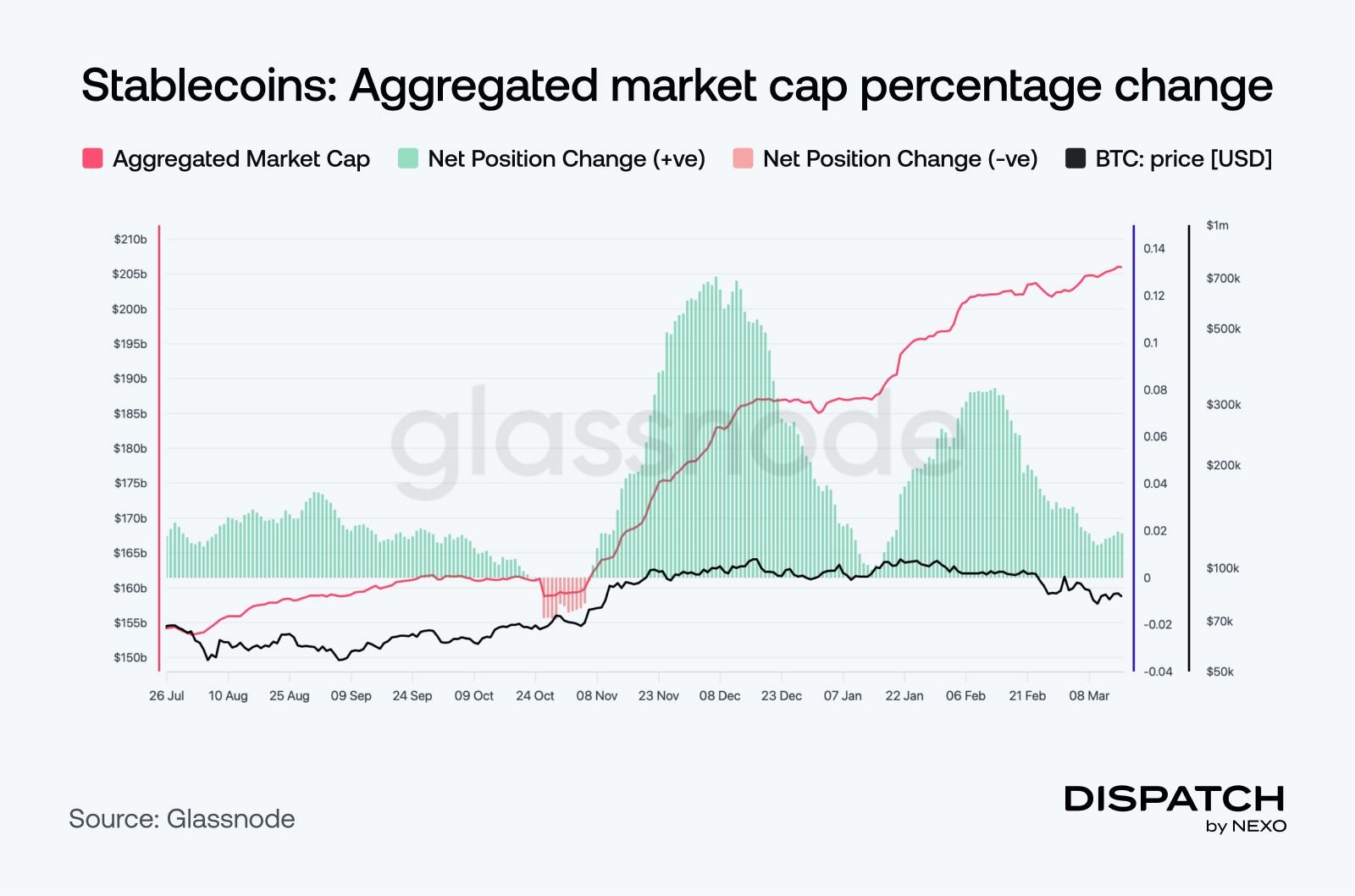

Stablecoins are the ones to watch

The stablecoin market is expanding rapidly, signaling a fresh wave of liquidity that could fuel the next leg of the crypto cycle. Over the past 60 days, the total stablecoin market cap has surged 11% to $226.1 billion. With stablecoin liquidity rising and selling pressure easing, the conditions for a potential market recovery are taking shape, making stablecoins a key factor to watch in the coming weeks, media highlight.

The numbers

Top 5 stats of the week

- 65,000 BTC – Over the past 30 days, Bitcoin whales have been accumulating to signal buying pressure despite the broader market correction.

- $3,000 – Gold surged past the key mark on Friday, setting a new all-time high for the 13th time this year.

- $240 billion – XRP's fully diluted value (FDV) has surpassed ETH’s $231 billion – a major shift in the altcoin space.

- 2.8% – US CPI inflation eased in February, below the expected 2.9% YoY, sparking optimism for potential Fed rate cuts.

- $126,000 – Network economist Timothy Peterson projects Bitcoin could reach an ATH by June if historical patterns repeat.

Hot topics

What the community is discussing?

So banks also buy the dip?

Could the Fed surprise the markets?

The four-year market cycle equivalent in the TradFi world.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].