Dispatch #279: Аltcoins and their trades

Jan 14•6 min read

In this patch of your weekly Dispatch:

- BTC’s bullish signals

- ETH transactions surge

- Labour market data sprint

Market cast

BTC: Bullish mode restarted?

Bitcoin has cleanly broken above the $94,000 resistance, signalling that bullish momentum is rebuilding. On the weekly chart, key momentum and trend indicators are turning constructive. The Stochastic oscillator is moving higher out of oversold territory, the Relative Strength Index (RSI) is curling upward, and the MACD histogram is approaching the zero line – a setup often seen ahead of trend continuation. At the same time, the Average Directional Index (ADX) is nearing the 25 level, suggesting a stronger directional trend may be emerging.

On the daily timeframe, bulls remain in control. Price is trading above the upper Bollinger Band, signalling strong upside momentum rather than exhaustion. The Stochastic oscillator has entered overbought territory, while the RSI is also approaching overbought levels – conditions that typically reflect trend strength rather than immediate reversal risk. The MACD histogram remains positive and rising, and ADX readings near 30 confirm that the move is well supported by trend momentum.

Key levels to watch: support sits at $94,000, followed by the $90,000 psychological level. On the upside, resistance is seen near $98,000, with $100,000 marking the next major test for bullish conviction.

The big idea

Why altcoins are no longer one trade

As 2026 gets underway, the altcoin conversation is becoming less about a single “season” and more about how capital is choosing to express different crypto theses. Ethereum, XRP, and Solana are no longer moving on the same narrative track. Each is being repriced for a distinct reason – infrastructure depth, access and structure, or operational scale.

ETH and the on-chain economy thesis: Ethereum’s forward-looking case is now being framed explicitly by institutions. Standard Chartered has called 2026 “the year of Ethereum,” citing its dominance in stablecoins, tokenized real-world assets, and DeFi as key drivers of relative outperformance. That dominance is visible on-chain. Transaction counts have reached new highs, with stablecoins accounting for 35–40% of activity, reinforcing Ethereum’s role as a settlement layer rather than a speculative venue. More than half of all stablecoins and tokenized RWAs already sit on Ethereum, and Standard Chartered expects both markets to approach $2 trillion each by 2028.

With a more predictable upgrade cadence and ongoing Layer 1 throughput improvements, Ethereum is increasingly being valued as financial infrastructure – not just cycle exposure.

XRP and the ETF access trade: XRP’s strength in early 2026 has come through regulated access. While broader crypto ETF activity has been uneven, spot XRP ETFs have continued to attract both capital and liquidity.

In the first full trading week of the year, XRP ETFs recorded $38.1 million in net inflows and reached $219 million in weekly trading volume, their highest since launch. Since debuting in mid-November 2025, cumulative inflows have exceeded $1.22 billion, with total assets near $1.47 billion. The signal here is consistency. In a mixed market, XRP has emerged as one of the few altcoins where investors repeatedly choose clean, regulated exposure.

SOL’s institutional adoption and on-chain scale: In 2025, the ecosystem generated $2.39 billion in application revenue, up 46% year over year, even as SOL finished well below its peak. Usage metrics remain exceptional. Solana processed 33 billion non-vote transactions and supported the creation of over 11.6 million new tokens. At the same time, institutional engagement accelerated: Solana ETFs logged $41.1 million in net inflows in early 2026, and stablecoin supply on the network climbed to roughly $15 billion. Together, these trends position Solana as an increasingly credible high-velocity settlement and issuance layer.

That data tells a more nuanced story about altcoins in 2026. Ethereum is consolidating its role as the settlement layer for on-chain finance, processing record activity with stablecoins driving a significant share of usage. XRP is attracting capital through regulated ETF wrappers, with over $1.2 billion in cumulative inflows signaling persistent demand for clean access. Solana is pairing institutional adoption with scale, supporting trillions in transaction volume and millions of new tokens while its underlying economy continues to expand.

Bitcoin may still anchor the broader market, but the more informative shift is happening beneath it. As infrastructure, access, and operational scale begin to diverge this clearly, the altcoin market stops behaving like a single trade and starts revealing where the next phase of growth may quietly be forming.

TradFi trends

The forces shaping crypto capital

As crypto and traditional finance continue to converge, regulation, macro visibility, and monetary policy are increasingly shaping how institutional capital approaches the market.

U.S. crypto regulation moves toward clarity: SEC Chair Paul Atkins said he expects the bipartisan crypto market structure bill to reach President Trump’s desk this year, building on the GENIUS Act passed in 2025. While committee markups may extend into late January, the direction is clear: lawmakers are working to remove regulatory ambiguity and establish clearer SEC and CFTC oversight, a shift that could materially improve institutional confidence in U.S. crypto markets.

TradFi turns cautiously risk-on: VanEck argues that early 2026 is shaping up as a risk-on environment, citing improved visibility around fiscal policy, monetary direction, and regulation. While crypto’s traditional cycle signals have become less reliable, fewer policy surprises and stabilizing U.S. deficits are creating conditions that typically favor risk assets, allowing capital to re-engage more selectively with crypto. Rates remain the key fault line: JPMorgan expects the Federal Reserve to hold rates steady this year and potentially raise them in 2027, diverging from market expectations for near-term cuts. That gap matters for crypto, which remains highly sensitive to liquidity conditions. Whether rates stay higher for longer or ease later in the year could determine how quickly improving sentiment translates into sustained institutional inflows.

Macroeconomic roundup

Inflation remains in check – what’s next

This week’s key macro highlight was U.S. inflation. Headline CPI in December came in at 2.7% year-on-year and 0.3% month-on-month, unchanged from November and in line with expectations. Bitcoin held firm near $92,000 following the release, as markets digested the data ahead of further inflation and labor-market releases later this week, which will continue to shape expectations around monetary policy.

U.S. PPI (Wednesday): Producer prices are seen near 2.7% YoY. A benign reading would validate cooling inflation and extend any post-CPI risk-on move, while an upside surprise could revive persistence concerns and cap crypto upside.

Initial Jobless Claims (Thursday): Claims are forecast around 220,000. Higher claims would bolster rate-cut odds and support BTC via liquidity expectations, while a lower print could push yields higher and limit upside.

The week's most interesting data story

Is this Ethereum’s springboard?

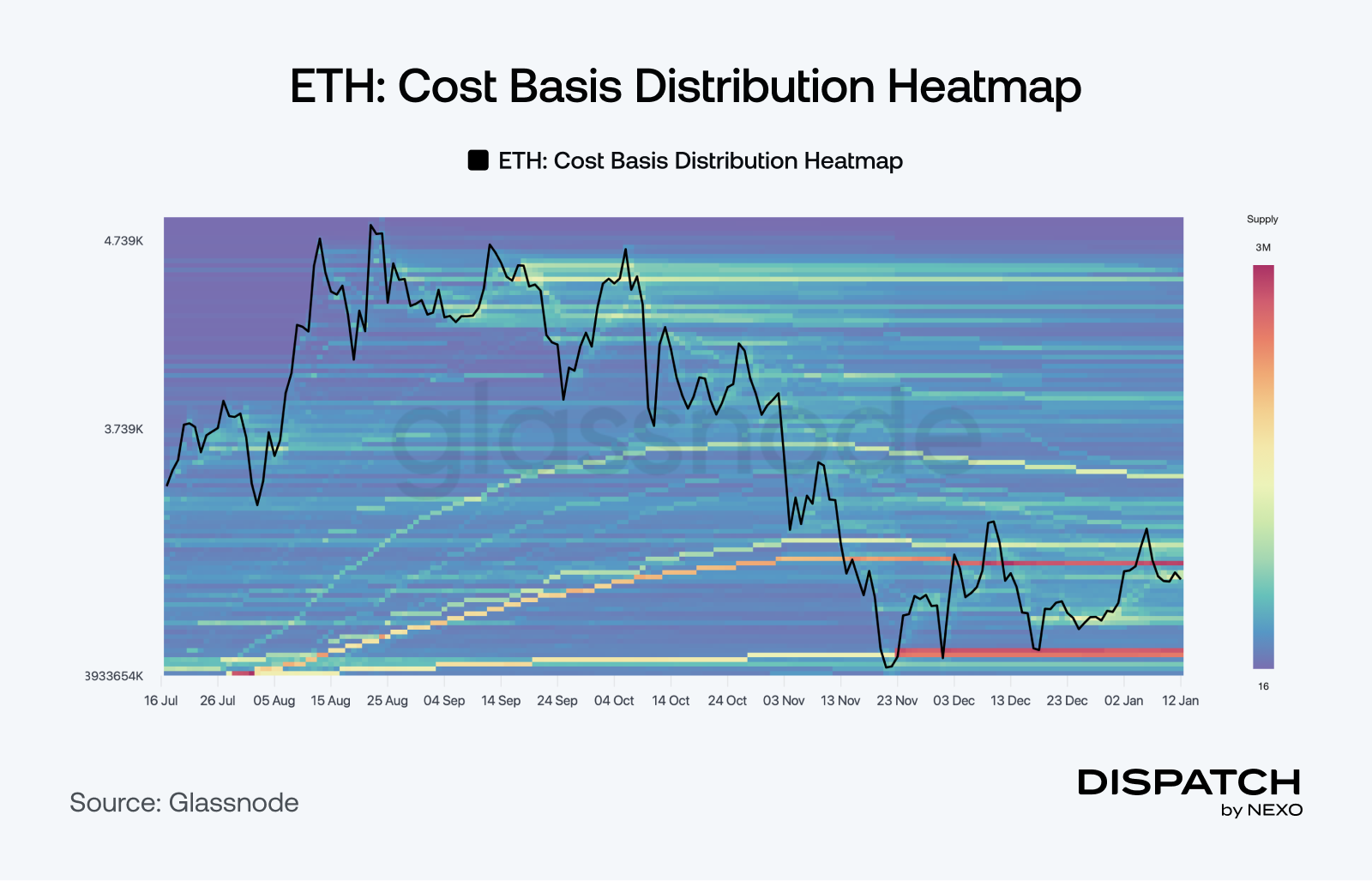

A dense cost-basis cluster just below $3,000 highlights where a large share of ETH has been accumulated, reinforcing that area as a structural support rather than a transient level. That support is being underpinned by improving market structure: futures open interest has rebuilt with lower leverage, while the recovery has been driven by spot buying rather than derivatives. Set against Standard Chartered’s view that 2026 could mark Ethereum’s return as core on-chain financial infrastructure, this alignment suggests any next move higher is more likely to emerge from sustained accumulation and consolidation than speculative excess.

The numbers

The week’s most interesting numbers

$4,600/oz – Gold’s record high as geopolitical risk and policy uncertainty drove safe-haven demand.

5% – The market-priced odds of a January 28 Fed rate cut, per CME FedWatch.

11% – Goldman Sachs’ projected 12-month return for global equities, including dividends.

$2.9 million – VanEck’s long-term Bitcoin valuation under a global settlement and reserve adoption scenario.

$85/oz – Silver’s spike after a near-7% surge, sharply outperforming during the defensive move.

Hot topic

What the community is discussing

Saylor never said buying is over.

When it comes to collateral, Nexo users are decisive.

Will ETH gain momentum now?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].