Dispatch #254: The altcoin summer season of 2025

Jul 22, 2025•6 min read

In this patch of your weekly Dispatch:

- The BTC retirement plan

- The week in macro

- The (huge) interest in ETH

Market cast

BTC: Hold the line

The RSI nears overbought territory, and the ADX signals a strong underlying trend, while the MACD comfortably stays above zero. Price action remains elevated above key moving averages and approaches the upper Bollinger Band — a classic setup for continued upside.

On the daily chart, momentum is more nuanced. Consolidation has taken hold, and price is gravitating toward the middle Bollinger Band. Oscillators show mixed signals: both the RSI and Stochastic hint at overbought conditions, while the MACD dips just below the zero line, suggesting short-term hesitation amid a structurally strong backdrop.

Crucial support sits at $116,000, with stronger footing near $111,000. A break above $123,000 — the previous all-time high — could pave the way for an extension toward $130,000.

For now, the long-term trend remains intact, though the market may be catching its breath before the next move,

The big idea

Has the summer (altcoin) season arrived?

Every so often, the crypto spotlight shifts from Bitcoin to the broader market—a phenomenon known as Altcoin Season, when alternative digital assets begin to outperform the world’s largest cryptocurrency. Bitcoin may still be king, but it's starting to feel the summer heat. Its dominance slipped below 61% for the first time in months as the court of altcoins is throwing a royal parade. With TOTAL2 – crypto’s total market cap excluding BTC – tapping $1.5 trillion, stablecoin inflows surging past $1.7 billion, and the global crypto market cap crossing $4 trillion, this could be more than a seasonal blip. The leading alts aren’t just riding sentiment. They are backed by fresh capital, institutional love, structural tailwinds, and strategic partnerships that are hard to ignore.

$ETH: Building momentum on all fronts

ETH rallied over 20% since last week, breaking through multi-year resistance and pushing toward the $4,000 mark. Traders are even eyeing a run to $5,000 by year-end and some see it as high as $15,000.

What's driving this renewed momentum? Ethereum spot ETFs just saw their fastest-ever $1 billion inflow. SharpLink Gaming is upping its equity sale from $1 billion to $6 billion to boost ETH holdings, already accumulating 321,000 ETH worth $1.1 billion. Ethereum still dominates the RWA landscape, hosting more than 60% of all tokenized assets. Could ETH’s fundamental infrastructure and newfound treasury-asset role propel it further? There’s certainly interest in that – you will see more in this week’s data story.

$XRP: Gaining speed with clarity and capital

XRP just smashed through its 2018 peak, soaring past $3.60 and racking up over $22 billion in daily volume. The buying frenzy has been intense, with retail and institutional traders alike fueling momentum.

The backdrop? A rare combination of regulatory clarity, new ETF access, and growing institutional use. Ripple's years-long battle with the SEC is finally over, and with fresh legislation like the GENIUS and CLARITY Acts passing in Congress, XRP now has a clearer path forward than many competitors. And in the heat of altcoin season, Nexo is offering something just as enticing—a 5% bonus on your XRP inflows. It's a smooth way to grow your holdings while the market does the heavy lifting.

$SOL: From meme machine to RWA powerhouse

With its Real-World Asset (RWA) market rocketing 217% year-to-date to reach over $550 million, it’s fast becoming a major settlement layer for tokenized finance. That growth is not just eye-catching; it’s outpacing Ethereum and ZKsync by a wide margin. BlackRock has already deployed over $25 million of its BUIDL fund onto Solana, making it a key contender in the eyes of both developers and institutions. Could SOL lay the ground for a tokenized future?

$NEXO: Gaining recognition in elite sports

The $NEXO token surged over 13% last month, fueled not only by altcoin market dynamics but by a string of high-visibility moves. Nexo became the first-ever Digital Wealth Platform of the DP World Tour and title sponsor of the newly renamed Nexo Championship, taking place this August at the renowned Trump International Golf Links in Scotland. Coupled with its role as Official Crypto Partner of the Mifel Tennis Open in Mexico, Nexo’s presence is expanding across premier global arenas—and the market is taking note.

With ETH rallying on treasury demand, XRP rising on real utility, and SOL scaling with speed, the script is flipping fast. This isn’t just rotation—it’s a reawakening. And the altcoin season is always a Big Idea.

Bitcoin

Building and retiring on BTC wealth

Bitcoiners just crossed a quiet milestone. The network’s realized cap, a better measure of actual capital stored on-chain, has topped $1 trillion for the first time. That’s $1 trillion in “real money” people have willingly parked in BTC, not counting the moon-boy fantasies.

And if this Bitcoin Retirement Guide is anything to go by, that trillion may go further than you think. According to his projections, by 2035, one bitcoin might be enough to retire in dozens of countries—under 0.1 BTC in some, if you don’t mind roughing it.

And while we’re on the subject of sats: a few extra percent in yield can go a long way, too. With Nexo’s flexible and fixed-term savings, your bitcoin keeps working—helping you preserve and grow your wealth while you plan the escape.

Of course, Monaco will still cost you seven coins and a yacht license. But hey, if the realized cap keeps growing and you’re stacking sats, early retirement might not just be a meme—it could be a line on your calendar.

TradFi trends

Crypto’s regulatory reset

Last week was dubbed "Crypto Week" on Capitol Hill, and rightly so. Now that the dust has settled, it’s worth revisiting what got done. Spoiler alert – it was a lot.

In a rare show of bipartisanship, the House passed three landmark crypto bills: the Clarity Act, which outlines regulatory roles for the SEC and CFTC; the GENIUS Act, a sweeping stablecoin framework; and the Anti-CBDC Act, aimed at stopping the Fed from issuing a digital dollar to individuals.

Republicans called GENIUS a “major milestone,” with Senate Banking Chair Tim Scott and SEC Chair Paul Atkins praising its consumer protections and strategic alignment. Even more striking: over 100 Democrats joined in, and Trump is expected to sign it imminently.

For the industry, this trio signals a tectonic shift. SEC Chair Paul Atkins praised the GENIUS Act for offering "clear rules of the road" and emphasized its role in enabling stablecoin innovation under robust risk safeguards.

Macroeconomic roundup

Rates, jobs, and earnings

Markets are on edge this week as macro events line up fast. Here's what to watch:

Fed Chair Jerome Powell speaks (Jul 22): Investors will dissect every word ahead of the July 30 FOMC meeting. Rate cut speculation remains elevated amid political pressure and internal Fed scrutiny.

Initial Jobless Claims (Jul 24): Expected to rise to 229K. A surprise spike could revive recession fears and support crypto hedge flows.

S&P Global Flash PMIs (Jul 24): Services expected at 53.2 and manufacturing slightly below 52.4. Strong data could buoy equities and weigh on crypto sentiment.

Eurozone Rate Decision (Jul 24): The ECB is likely to hold steady, but forward guidance could hint at cuts into Q4.

The week’s most interesting data story

ETH market activity breaks records

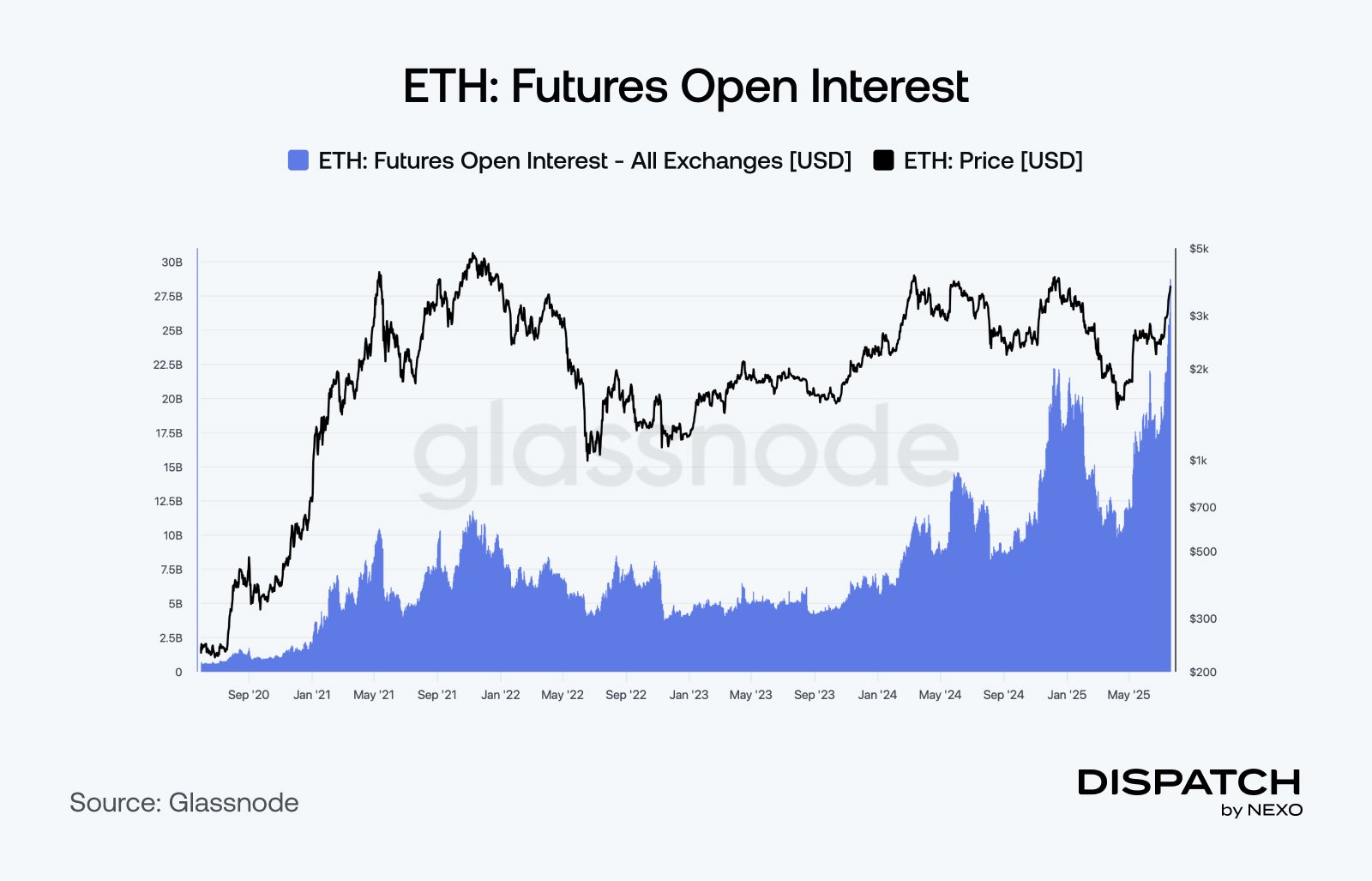

Ethereum's rise is being mirrored in the derivatives market, where open interest has surged past $24.5 billion – an all-time high. The 24% price rally over the past month appears tightly linked to this build-up, with strong speculative flows supporting the move. Open interest now accounts for around 6.4% of ETH’s circulating supply, and the 90-day correlation between price and open interest stands at 0.96 – a sign that leverage is acting as a powerful accelerant. While the structure remains healthy for now, momentum is clearly building on both spot and derivatives fronts.

The numbers

The week’s most interesting numbers

- $4.39 billion – Record weekly inflows into crypto investment products, the highest since CoinShares began tracking in 2014.

- $160 billion – Tether's all-time high USDT market cap, with most of it now circulating on Tron.

- 37.3 million – Ethereum’s current gas limit average, as validators push toward a 45 million units target to boost throughput.

Hot topic

What the community is discussing

More altcoin season perspective.

The power of a short-squeeze.

Target in-sight, then.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].