Dispatch #274: Will the Fed restart momentum?

Dec 09, 2025•6 min read

In this patch of your weekly Dispatch:

- ETH’s scarcity shifts

- Banks advising on BTC

- The traders’ positioning resets

Market cast

BTC: Is stability emerging?

On the weekly chart, Bitcoin is consolidating around $90,000, trading close to the lower Bollinger Band, a volatility indicator that still reflects a cautious, bearish backdrop. The RSI momentum gauge is edging toward oversold territory, and the MACD histogram, which tracks trend strength, remains firmly negative. Even so, the Stochastic oscillator, a shorter-term momentum tool, has begun to turn higher from oversold levels. If this upward crossover holds, it may be the first sign that downside momentum is starting to ease.

On the daily timeframe, conditions appear more neutral and rangebound, with price hovering near the middle Bollinger Band. Both the RSI and Stochastic remain directionless, while the MACD histogram stays positive, suggesting the underlying trend could still offer support should buyers attempt to re-engage.

Support: First at $89,000, then the $85,000-$84,000 area. The weekly 100-period SMA, a long-term trend indicator, reinforces this zone as dynamic support.

Resistance: Initial resistance comes in at $91,000-$92,000, with a stronger barrier near $94,000.

Outlook: While the weekly picture still leans bearish, early improvements in short-term momentum via the Stochastic introduce the possibility of a gradual stabilization phase. A sustained move through the nearby resistance bands would validate that shift, while a break below support would keep the corrective structure intact.

The big idea

The rate cut that could shift the market’s momentum

Bitcoin spent the past week between confidence and caution, reclaiming the $90,000s as quantitative tightening officially ended, briefly slipping into the high-$80,000s and then snapping back again. Despite the back-and-forth, it keeps gravitating toward the same level. And now, heading into Wednesday, a real tailwind may finally emerge.

This week’s Federal Reserve decision could be the most consequential in months. Markets are pricing a near-90% chance of a 25 bps cut, and while nothing is guaranteed, the macro backdrop increasingly points in one direction. If the Fed follows the data, Wednesday may mark the moment Bitcoin regains a supportive policy environment — and the first step toward a renewed climb.

Inflation cools down: The long-delayed core PCE reading arrived softer at 0.2% MoM and 2.8% YoY, preserving the disinflation trend the Fed has been waiting for. Consumer sentiment improved for the first time in months, with inflation expectations drifting toward pre-pandemic norms. For policymakers, that combination reduces the risk of easing too soon.

The labor market softens: Private payrolls are losing momentum, and the ADP report posted a surprise job decline. Weekly jobless claims hit a three-year low, yet continuing claims remain elevated – a sign the headline numbers may soon reflect the underlying slowdown. The Chicago Fed’s estimate of 4.4% unemployment adds to the picture of a market that is no longer overheating.

Business activity slows down: Manufacturing has now contracted for nine consecutive months, with the ISM index staying below 50. Services activity remains steady but subdued, with employment cooling and input prices still elevated. Historically, this type of mixed-but-slowing environment pushes the Fed toward recalibration rather than restraint.

Why the cut matters: A single rate move doesn’t transform Bitcoin, but the turning point of a cycle often does. A cut would weaken the dollar’s momentum, ease real yields, and send a signal that monetary conditions are shifting from restrictive to neutral. Bitcoin’s repeated resilience around the $90,000 zone suggests the market is already positioning for this transition.

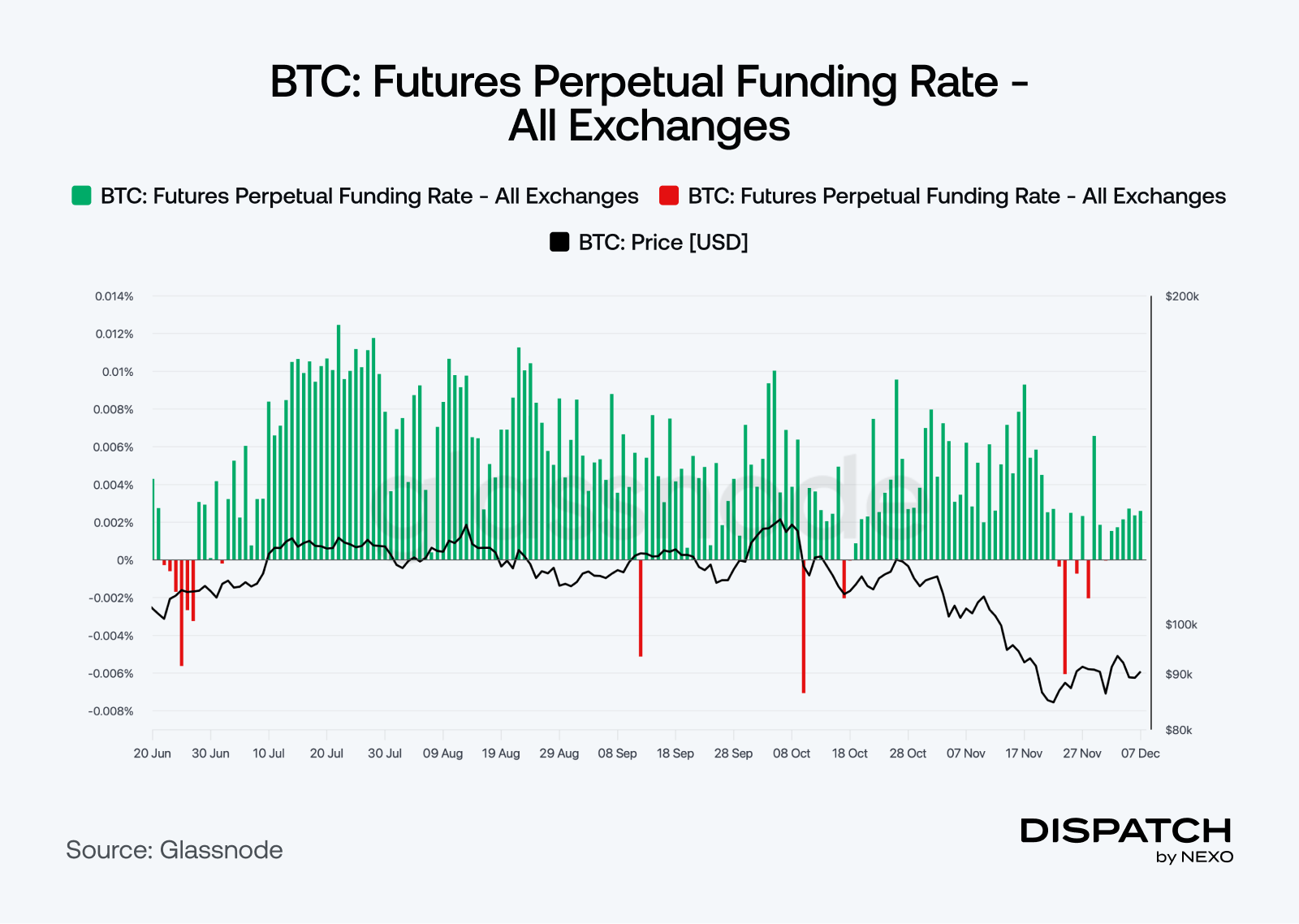

And further down in this newsletter, our look at balanced, near-neutral funding rates shows how quietly this anticipation is building. With leverage light and positioning cautious, the market is waiting rather than chasing – conditions that can accelerate quickly if the macro winds change.

If the Fed not only cuts but frames it as the start of a gradual reset, Bitcoin could finally regain the macro alignment it has lacked. The path to six figures never begins with fireworks – it begins with the first policy shift. And that moment may arrive on Wednesday.

Ethereum

ETH’s supply-and-demand game

Ethereum is quietly shifting into one of its strongest supply dynamics to date. Exchange balances have dropped to just 8.8% of total supply – the lowest level since Ethereum’s launch, after falling 43% since July as staking, restaking, L2 activity, DAT accumulation, and long-term custody continue absorbing supply. With more than a 10% gain in the past 10 days and ETH holding above $3,000, the backdrop increasingly resembles the early stages of a supply squeeze.

Technical momentum: ETH continues to consolidate around $3,050, but the ETH/BTC pair has turned upward, and volume indicators such as OBV show underlying buying strength even as price meets resistance.

Fusaka rolled out: Ethereum’s Fusaka upgrade successfully went live last week, unlocking major data-capacity improvements and lower costs for L2s. For those who missed it, we’ve broken down the upgrade’s impact in our latest blog post.

TradFi trends

Are banks giving Bitcoin the thumbs-up?

Bank of America is opening a new chapter in traditional finance, formally recommending that wealth clients allocate crypto in their portfolios. The bank will also begin research coverage on a select group of spot Bitcoin ETFs, reflecting a broader strategic shift toward incorporating regulated digital-asset products into mainstream portfolio construction.

The move reverses BoA’s previous policy that prevented more than 15,000 advisers from recommending crypto unless clients specifically requested it. Now, the bank falls into line with peers such as Morgan Stanley, BlackRock, and Fidelity, reinforcing a growing consensus around modest, professionally guided crypto exposure.

And while Bitcoin remains about 10% below last year’s levels after its pullback from the $126,000 highs, long-term conviction from major institutions, including JPMorgan and Standard Chartered, signals that positioning for the next cycle is already underway.

Macroeconomic roundup

Countdown to the Fed’s decision of the year

A packed mid-December calendar brings a cluster of data and central-bank decisions that will shape expectations heading into Tuesday’s pivotal FOMC meeting. With markets heavily pricing a U.S. rate cut and Bitcoin holding above $90,000, the macro setup leans quietly supportive and the anticipation is building across risk assets. This week’s releases will determine whether that momentum carries into year-end or stalls in front of the Fed.

FOMC Statement & Fed Rate Decision (Tuesday): The main event. Markets assign an 87% probability of a 25 bps cut. Forward guidance will determine whether easing expectations extend into 2026.

FOMC Press Conference (Tuesday): Powell’s tone will matter as much as the move. Any shift in confidence about inflation or labor could sway risk sentiment sharply.

Initial Jobless Claims (Wednesday): A clean measure of labor momentum. Rising claims strengthen the case for further easing; lower claims argue for patience.

U.K. GDP October (Thursday): A snapshot of whether the U.K. economy is stabilizing into year-end.

German CPI November (Thursday): Another step in Europe’s disinflation path, adding to the broader picture of global easing cycles emerging.

The week’s most interesting data story

Funding rates: A true signal for markets

Funding rates, the payments between long and short perpetual traders, offer a quick read on market positioning. Recently, they’ve moved back toward neutral as falling open interest unwinds the substantial long positioning from earlier in the rally. Brief dips below zero have been mild, suggesting traders aren’t shifting aggressively short despite the pullback. This reset leaves the market more balanced and less vulnerable to downside shocks, creating a healthier setup if demand begins to recover.

The numbers

The week’s most interesting numbers

$716 million — Another week of strong net inflows into global crypto funds, signaling a clear turn in sentiment.

$3.7 trillion — Potential size of the stablecoin market by 2030, highlighting how digital dollars are becoming a major force in global liquidity.

$150 million — New ETH added to BitMine’s treasury this week, reinforcing long-term accumulation as the firm pushes toward 5% of total supply.

$8.69 billion — Fresh monthly realized-cap inflows into Bitcoin, showing steady conviction returning even as spot activity cools.

$898 million — Inflows into XRP spot ETFs since launch, cementing them as one of the breakout winners of this ETF cycle.

Hot topic

What the community is discussing

Inside info from BlackRock’s CEO?

Are these whales onto something?

Did someone say altcoin season?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].