Dispatch #265: The logic in Bitcoin’s all-time high

Oct 08, 2025•6 min read

In this patch of your weekly Dispatch:

- Bitcoin’s true bull-market signal

- The stablecoin record

- A dozen of ETFs await

Market cast

Strong buying pressure keeps BTC's momentum

After setting a new all-time high, Bitcoin is testing the upper Bollinger Band, signaling sustained bullish momentum. The momentum indicators — the Relative Strength Index (RSI) and the Stochastic Oscillator — are both rising toward overbought levels, reflecting strong buying pressure. The trend indicator, the Average Directional Index (ADX), is approaching the key 25 level, which typically confirms the presence of a strong trend. Meanwhile, the Moving Average Convergence Divergence (MACD), which bridges both momentum and trend analysis, is close to a bullish crossover, reinforcing the positive setup.

On the daily chart, the trend remains intact. The ADX sits above 30, confirming a mature uptrend, while the RSI and Stochastic show no signs of exhaustion. The MACD histogram continues to strengthen, indicating persistent upside momentum. A decisive break above the recent peak could pave the way toward the $130,000 psychological level, while former resistance zones near $120,000 and $117,000 are likely to provide support on any short-term pullbacks.

The big idea

Bitcoin’s Uptober conquest

Bitcoin surging to record highs above $126,228. has once again become the clearest reflection of market sentiment, a macro barometer, and a safe haven born of scarcity.

The logic is simple: when the overall market environment is dynamic, investors turn to what’s finite, namely Bitcoin. This year’s Uptober isn’t driven by euphoria but by caution. A U.S. government shutdown, weak employment data, and fading confidence in fiscal discipline have reignited the debasement trade — capital rotating toward assets that stand outside the traditional system. Investors aren’t chasing hype; they’re searching for a hedge against economic uncertainty. Though with a Fear & Greed reading of 62, market conviction is clearly flirting with market greed. This is validated by a rise in open interest, which at over $50 billion, is also flirting with all-time highs.

Behind the move lies the ETF machine. U.S. spot Bitcoin funds absorbed $3.2 billion in inflows last week, the second-largest haul on record, pushing cumulative 2025 inflows near $60 billion. These vehicles have reshaped market structure, converting speculative bursts into steady, regulated accumulation. As supply on exchanges continues to thin, ETFs have become the engines of Bitcoin’s ascent, pulling liquidity from the traditional system onto the chain.

Institutional adoption is reinforcing the same dynamic. Morgan Stanley now recommends allocating 2–4% of portfolios to Bitcoin, a move that could channel up to $80 billion in new inflows given the firm’s $2 trillion in advised assets. JPMorgan’s models point to a fair value of $165,000 on a gold-adjusted basis, while Standard Chartered projects between $135,000 and $200,000 by year-end as ETF demand and institutional exposure deepen. Each new forecast underscores the same conclusion: Bitcoin’s role in the macro ecosystem is no longer experimental — it’s structural.

This rally isn’t about short-term speculation; it’s about a market recalibrating to a new economic reality. Bitcoin continues to rise. In an age defined by instability, it’s not surprising that investors are choosing the one asset that was built for it. Scarcity, it turns out, is the most reliable hedge against uncertainty.

Hot in crypto

$300 billion and counting: stablecoins reach all-time high

They may not swing like altcoins, but stablecoins are quietly powering one of crypto’s biggest shifts this year. The sector’s total market capitalization just surpassed $300 billion, a new all-time high that highlights accelerating inflows beneath an already buoyant market.

According to DeFiLlama, supply is up 6.5% in the past month, led by Tether (USDT) with 58% share and USDC with nearly a quarter. Stablecoins now represent over 7% of the crypto market, cementing their role as the ecosystem’s settlement and liquidity backbone.

TradFi trends

Is an ETF wave in sight?

A flood of new crypto ETFs is waiting for the green light, while the U.S. government shutdown has put them on hold. At least two dozen funds were filed last week, covering assets from XRP, Litecoin (LTC), and Bitcoin Cash (BCH) to Sui (SUI) and Hype (HYPE), with some including staking features.

The timing was ideal: the SEC’s recent approval of new listing standards means these ETFs could skip the slow 19b-4 review process, paving the way for faster launches once operations resume.

When the government reopens, the agency could clear multiple products in batches — setting the stage for the broadest expansion of crypto ETFs yet, spanning both blue-chip and emerging tokens, and signaling how deeply traditional finance is embedding into the digital-asset market.

Macroeconomic roundup

Macro still sets the tone

Bitcoin’s macro sensitivity is back in play this week, with the Fed once again setting the tone. Traders will parse the latest FOMC minutes, Powell’s remarks, and jobless claims for clues on the central bank’s policy path — signals that could steer both liquidity expectations and crypto sentiment.

FOMC Minutes (Wed): The September meeting marked the first rate cut in nine months, lowering the federal funds rate to 4.00–4.25%. This week’s minutes may reveal whether policymakers view the move as a one-time adjustment or the start of a longer easing cycle. A dovish tone could extend Bitcoin’s rally, while a cautious stance may cool appetite for risk.

Jerome Powell Remarks (Thu): Hours after the minutes’ release, Fed Chair Powell will speak, an event that often proves decisive for short-term market direction. Traders will listen for whether he frames policy as “risk management” or signals patience. Dovish hints could lift crypto alongside equities; a firmer tone could spark a pullback.

Initial Jobless Claims (Thu): Labor remains the key macro gauge for Bitcoin. Claims around 260,000–300,000 on the four-week average would raise recession concerns and fuel expectations of further easing. In short, macro will set the stage this week — but Bitcoin is back in the starring role.

The week’s most interesting data story

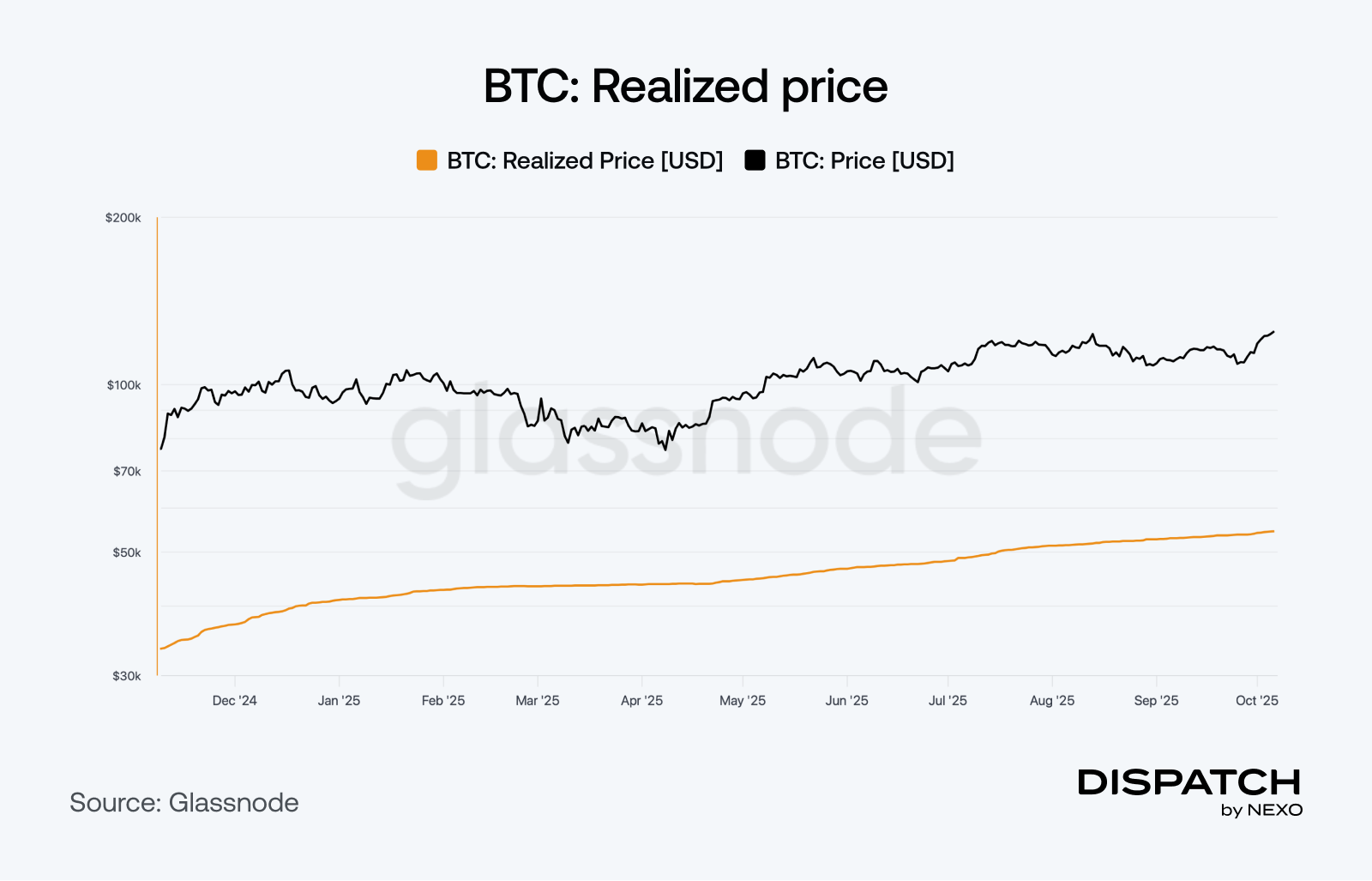

Bitcoin’s floor of conviction

Bitcoin’s realized price — the chain’s true cost basis — just hit a record $54,000, a strong on-chain signal that the bull market is real. It means coins are changing hands at higher prices across both short- and long-term holders, with old supply moving into ETF and institutional custody. This kind of synchronized rise only happens when demand is deep and structural, not speculative. The network’s “average cost” has shifted higher — raising Bitcoin’s floor, tightening profit margins, and showing that ownership is rotating into stronger hands. When realized price rises, Bitcoin’s floor of conviction moves up with it — making each dip costlier, and every rally more anchored in genuine ownership rather than hype.

The numbers

The week’s most interesting numbers

- $4010 — Gold’s newest all-time high, after gaining 51% year-to-date.

- $5.95 billion — Record weekly inflows into crypto funds, as investors sought refuge from soft U.S. jobs data.

- $530 million — Combined value of Solana Company’s Solana holdings and cash reserves.

- $1 trillion — Estimated shift from emerging-market bank deposits into stablecoins over the next three years.

- 10% — Of all Ethereum now sits in ETFs and corporate treasuries, a milestone for institutional adoption.

Hot topics

What the community is discussing

Does that make the Bitcoin ETF the best ETF?

There’s only one answer to a weak USD.

$644,000 per BTC is a nice round number.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].