Dispatch #284: Nexo returns to the world’s largest crypto market

Feb 17•6 min read

In this patch of your weekly Dispatch:

- Institutional ETF allocations grow

- Tokenized gold adoption surges

- Bitcoin’s key price bands

Market cast

BTC: From stabilization to recovery?

Following a period of heightened volatility and sharp positioning shifts, Bitcoin’s price action is beginning to show signs of stabilization across higher and lower timeframes. On the weekly chart, Bitcoin continues to trade near the lower Bollinger Band – a volatility indicator, appearing to find support around $68,000. Momentum indicators remain mixed: the Relative Strength Index (RSI), a momentum oscillator, is still in oversold territory, while the MACD histogram, a trend-following momentum indicator, remains negative, reflecting lingering downside pressure. However, the Stochastic oscillator has risen back above the 20 threshold, suggesting that bearish momentum may be starting to fade.

On the daily timeframe, price action looks more range-bound, with Bitcoin approaching the middle Bollinger Band, which may act as dynamic resistance. Short-term momentum signals are more neutral, as both the RSI and Stochastic provide limited directional bias. Meanwhile, the MACD histogram has crossed above the zero line following a bullish signal-line crossover, typically considered an early indication of strengthening upside momentum. Immediate support stands near $68,000, followed by the $66,000–$65,000 zone, while resistance levels are seen around $71,000 and then $76,000–$77,000.

How does crypto fit into your financial life?

Dear Dispatch readers,

We are gathering insights to assess long-term trends in crypto adoption and financial behavior. The survey takes 5 minutes, is fully anonymous, and responses are analyzed in aggregate. Your input will inform an upcoming Nexo research report.

Thank you for sharing your view.

Take the survey

The big idea

Nexo returns to a reshaped U.S. crypto market

The past few weeks have delivered no shortage of headlines across crypto – from macro prints to regulatory drafts to institutional positioning. Individually, each development may have felt incremental. Taken together, they point to something more structural unfolding beneath the surface.

A softer U.S. inflation print last week modestly strengthened expectations for rate cuts later this year, easing macro pressure at the margin. At the same time, Washington is advancing the foundations of digital asset oversight. Implementation of the GENIUS Act is progressing, outlining supervisory standards for payment stablecoins, while Senate negotiations around the CLARITY Act continue refining jurisdictional boundaries across DeFi, commodity tokens, and tokenized securities.

The direction is becoming clearer: fewer gray areas, more defined accountability, and a regulatory architecture increasingly integrated with the broader U.S. financial system. And within this environment, yesterday we announced our long-anticipated return to the U.S. market.

After a period of deliberate recalibration, we are relaunching our core platform – including Yield programs, an integrated Exchange, Loyalty benefits, and crypto-backed Credit Lines, within a U.S.-compliant structure built around regulated partnerships. This is not simply product expansion. It reflects alignment with a regulatory landscape that is materially different from prior cycles: more codified, more institutional, and more durable. The timing is not incidental.

Since the launch of U.S. spot Bitcoin ETFs in January 2024, liquidity and price discovery have steadily gravitated toward American venues. Regulated derivatives participation has expanded, and ETF-related flows now exert greater influence around the U.S. close. In 2026, hourly return dispersion has consistently skewed toward U.S. trading hours – a structural departure from earlier cycles when offshore sessions dominated volatility. The center of gravity has shifted.

As oversight frameworks solidify and liquidity deepens, participation broadens. The next chapter of digital asset adoption is increasingly being shaped within the United States. Our return is not merely geographic. It is structural.

Blue chips

Institutional crypto allocations deepen

Recent headline net ETF outflows mask a more nuanced trend, growing engagement by major allocators. Goldman Sachs disclosed approximately $2.36 billion in ETF-based crypto exposure, up 15% quarter-over-quarter, with Bitcoin and Ethereum comprising nearly 90% of the allocation.

Notably, Ethereum’s position sits nearly equal to Bitcoin’s, suggesting it is increasingly being treated as a distinct core asset rather than a BTC proxy.

Gold’s rally spurs digital gold adoption

Gold’s rally has reclaimed investor attention, with prices holding near record levels despite recent volatility. Beneath the surface, a structural shift is unfolding across its digital rails. In 2025, tokenized gold – led by PAXG and XAUT, grew roughly 177%, expanding from $1.6 billion to $4.4 billion, about 2.6x faster than physical gold’s price appreciation. Trading volumes surged 1,550% year-on-year to $178 billion.

Supply dynamics reinforce the trend: adjusted for spot prices, issuance accelerated into late 2025 and early 2026, with both XAUT and PAXG skewing toward younger supply cohorts. On Nexo, 44% of purchasers in the past 60 days were first-time gold buyers. Explore tokenized gold on Nexo.

TradFi trends

When would the Fed’s next cut be?

Shifting U.S. monetary policy expectations have driven volatility since October, with major moves clustering around Fed communication and key data releases. Bitcoin and broader digital assets have remained highly sensitive to rate repricing, rebounding on softer inflation prints and falling Treasury yields. Concentrated liquidity, positioning, and ETF flows have amplified these reactions, intensifying intraday and session volatility around macro events.

January’s inflation data modestly strengthened the case for easing later this year. Headline CPI rose 0.2% month-on-month, below expectations, while core CPI increased 0.3%, bringing year-on-year rates to 2.4% and 2.5% — four-year lows. Core goods prices were flat, signaling limited tariff pass-through. This week’s Core PCE is expected near 0.2%, which, if confirmed, would reinforce the disinflation trend.

Macroeconomic roundup

Focus turns to the Fed’s preferred inflation gauge

Japan’s latest GDP data has already set the tone in Asia, but attention now shifts to the United States and Friday’s Core PCE release – the Federal Reserve’s preferred measure of inflation. Markets will be watching closely for confirmation that disinflation remains intact as rate expectations continue to evolve.

U.K. CPI & Labour Data (Tue–Wed): January inflation and wage figures will test whether price pressures remain sticky, with implications for rate expectations and GBP sensitivity.

Eurozone PMIs & Sentiment (Wed–Fri): Industrial production and February PMIs will gauge whether stabilization is extending into Q1, amid still-fragile consumer confidence.

U.S. Core PCE & GDP (Fri): Core PCE, the Fed’s preferred inflation gauge, will be closely watched for confirmation that disinflation continues, while Q4 GDP and durable goods data will help assess whether growth resilience remains intact.

For a fuller breakdown of this week’s macro events and timings, see our full macro calendar on X.

The week's most interesting data story

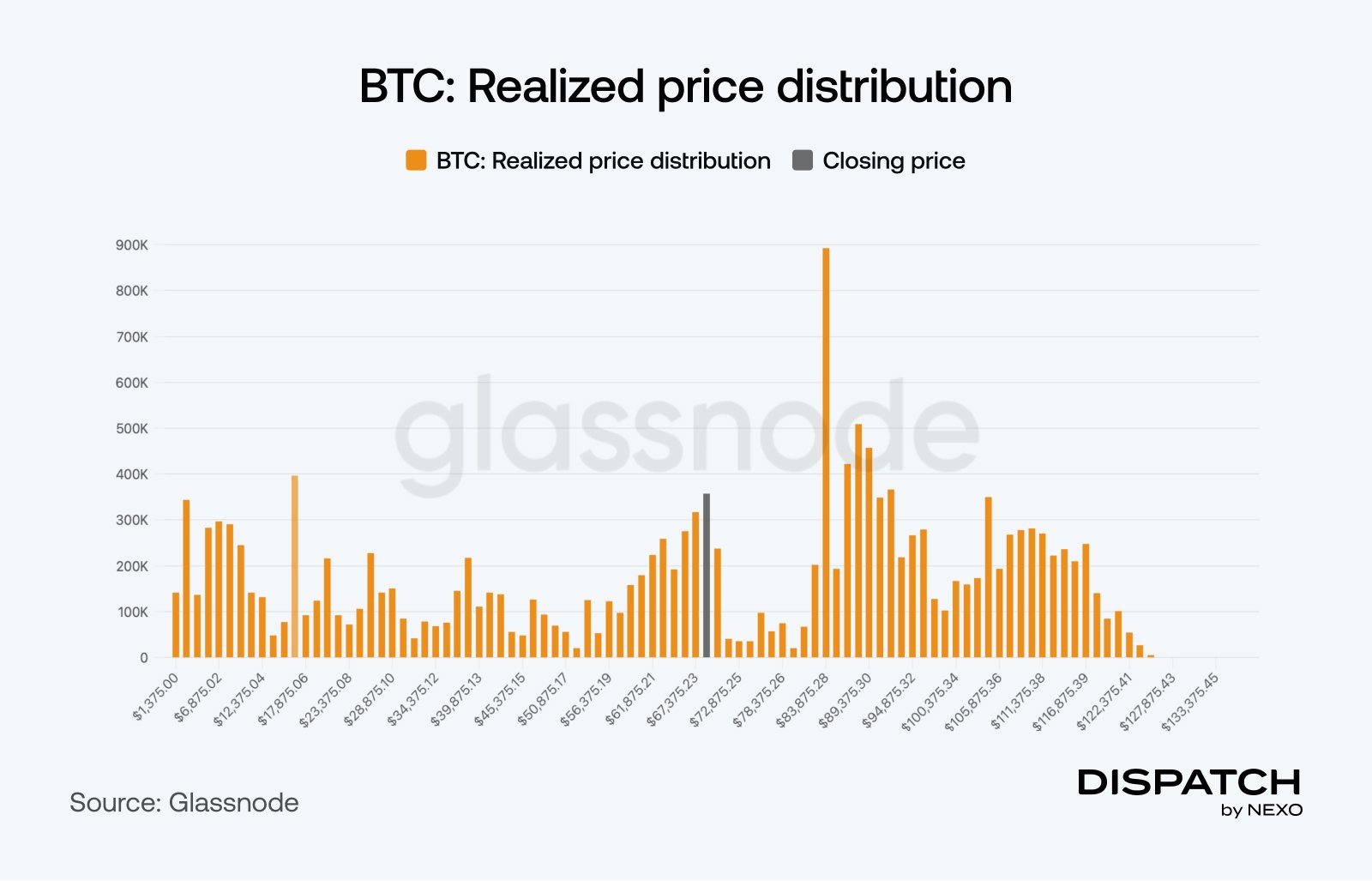

Bitcoin’s consolidation corridor

Bitcoin’s realized price distribution continues to point toward a market quietly building structure within a defined corridor. While price remains range-bound for now, several price bands appear comparatively underrepresented, highlighting lighter realized supply zones where price discovery could become more fluid as new demand steps in. The range between the Realized price at $55,000 and the True market mean around $79,200, reflects an ongoing phase of absorption and cost-basis realignment, typical of consolidation periods that often precede expansion. As volatility compresses, these underrepresented cost-basis bands may offer constructive positioning opportunities within a steadily maturing market structure.

The numbers

The week’s most interesting numbers

$24.7 billion — Total distributed, publicly transferable on-chain real-world assets, excluding stablecoins.

0.012% — RWAs’ share of global wealth (≈$200 trillion+), underscoring how early penetration remains relative to total addressable markets.

69.9% — Share of XAUT market cap younger than three months (vs. ~3–4% a year ago), highlighting a sharp shift toward newly issued supply.

$100,000 — Standard Chartered’s revised Bitcoin year-end 2026 target, despite near-term downgrade.

$82.9 billion — BTC spot ETFs net assets despite 51% drop since early October.

Hot topic

What the community is discussing

XAUT and PAXG are available on Nexo.

Technical analysis suggests Bitcoin has reached a bottom.

Bitcoin whales are buying the dip.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].