Dispatch #281: Bitcoin and macro: A waiting game

Jan 27•5 min read

In this patch of your weekly Dispatch:

- ETH’s hidden all-time high

- BTC’s stability

- The all-important FOMC

Market cast

BTC: Setting up for a rebound?

On the weekly chart, Bitcoin is testing its 100-period simple moving average, a key trend indicator that has historically acted as reliable dynamic support. While the broader weekly structure remains mildly bearish, early signs suggest downside momentum may be easing. Momentum and oscillator signals are stabilizing: the Stochastic oscillator is near oversold territory, the RSI remains neutral, and the MACD histogram, though still negative, is gradually converging toward the zero line — pointing to fading selling pressure and the potential for a rebound to form.

The daily chart supports this cautiously stabilizing view. Price action remains capped below most key moving averages, keeping the short-term bias slightly bearish to neutral, while momentum indicators suggest consolidation rather than fresh downside acceleration. Stochastic readings remain oversold, RSI holds neutral ground, and the MACD histogram stays below zero without renewed bearish expansion.

From a levels perspective, immediate support sits in the $87,000–$86,500 zone, with $85,000 below as the next downside reference, while the weekly 100-period SMA continues to act as dynamic support. On the upside, initial resistance is clustered around $90,000–$91,000, with $94,000 marking the next meaningful hurdle should a rebound gain traction.

The big idea

Bitcoin takes a (macro) break

This week’s Federal Reserve meeting is the most closely watched macro event on the calendar – not because markets expect a dramatic policy shift, but because the Fed’s messaging will be closely parsed. While interest rates are widely expected to remain unchanged, attention will centre on how policymakers assess inflation, growth, and the path forward.

After easing policy late last year, the Fed now appears content to pause and reassess. With economic growth holding up and inflation still not fully back at target, policymakers see little urgency to move again. In that sense, this FOMC meeting is less about action and more about patience.

Strong growth, tighter conditions: Strong economic data has pushed expectations for further rate cuts further out, with U.S. GDP expanding at a 4.4% annualised pace in the third quarter and consumer spending continuing to carry the economy. The labour market is cooling but not breaking, giving the Fed room to wait. Markets have responded accordingly. Treasury yields have edged higher, gold has pushed to fresh all-time highs, and Bitcoin has struggled to regain momentum, hovering below the $90,000–$91,000 range even as equities grind higher. Spot Bitcoin ETFs have seen more than $1.5 billion flow out in recent sessions, underscoring how closely institutional positioning remains tied to macro signals.

Measured participation: Derivatives markets reflect a restrained tone. Funding rates are positive but subdued, leverage remains limited, and options activity has leaned toward volatility strategies rather than strong directional conviction. Traders remain active — but selectively. Importantly, that caution hasn’t translated into meaningful selling. Long-term Bitcoin holders remain largely inactive, with little evidence of broad-based distribution. Price discovery has increasingly shifted toward spot markets, while leverage plays a smaller role than in previous cycles. Volatility has adjusted at the short end, pointing to near-term uncertainty rather than a reassessment of Bitcoin’s broader setup.

Why the longer-term case still holds: A Fed on pause doesn’t weaken Bitcoin’s longer-term case; it simply delays its next macro tailwind. Strong growth lowers recession risk, but policy cycles still evolve as conditions normalise. Over time, shifts in growth momentum, consumption patterns, and borrowing costs tend to guide monetary policy back toward a more neutral stance. As policy normalises, Bitcoin’s structural advantages come back into focus. Its supply is fixed and tightening by design, its portability exceeds that of traditional hard assets, and its market capitalisation remains only around 10–12% of gold’s, underscoring meaningful catch-up potential as it matures. Waiting, with a calendar: For now, the Fed waits. Markets wait. And Bitcoin consolidates — not because its thesis is broken, but because liquidity remains tight. Rate cuts aren’t a prerequisite for Bitcoin’s role, but easier financial conditions tend to amplify momentum when they arrive. The next real checkpoint comes on March 28, when the Fed meets again. Until then, waiting isn’t uncertainty – it’s just part of the cycle.

Ethereum

ETH’s hidden all-time high

Ethereum saw a pullback this week, with ETH easing around 7% as higher global yields and shifting rate expectations weighed on broader risk sentiment. Importantly, the adjustment was driven by positioning rather than fundamentals. On-chain data show large holders adding, as total value locked across Ethereum also remains elevated, pointing to a rebalancing of exposure.

Under the surface, Ethereum’s fundamentals continue to improve. The network is processing more transactions than ever, while average fees remain near recent lows – a sign that recent upgrades and layer-2 adoption are allowing Ethereum to scale more smoothly. That progress continues to resonate with institutions, with Ethereum still hosting roughly two-thirds of all tokenised real-world assets and serving as the primary settlement layer for large-scale financial experimentation.

Near-term volatility may persist, but the broader picture remains intact: leverage has been reduced, adoption is still rising, and Ethereum’s role as core digital infrastructure continues to strengthen.

Macroeconomic roundup

The one and only: Fed’s interest rate decision

Markets head into the week focused on a handful of key macro signals, with central bank guidance, inflation data, and labour market updates shaping expectations around growth, rates, and near-term risk appetite.

U.S. Consumer Confidence (Jan) – Tue, Jan 27: A timely snapshot of household sentiment as consumer spending continues to underpin U.S. growth.

Fed Interest Rate Decision – Wed, Jan 28: Rates are widely expected to remain unchanged. Attention will be on the Fed’s guidance and how policymakers frame the outlook for inflation and economic momentum.

U.S. Producer Price Index (Dec) – Fri, Jan 30: An important update on producer-level inflation, offering clues on whether price pressures are easing further.

Initial Jobless Claims – Thu, Jan 29: A high-frequency check on labour market conditions, with recent data pointing to gradual cooling rather than sharp deterioration.

Chicago PMI (Jan) – Fri, Jan 30: A regional read on manufacturing activity, often used as an early indicator for broader industrial trends.

The week’s most interesting data story

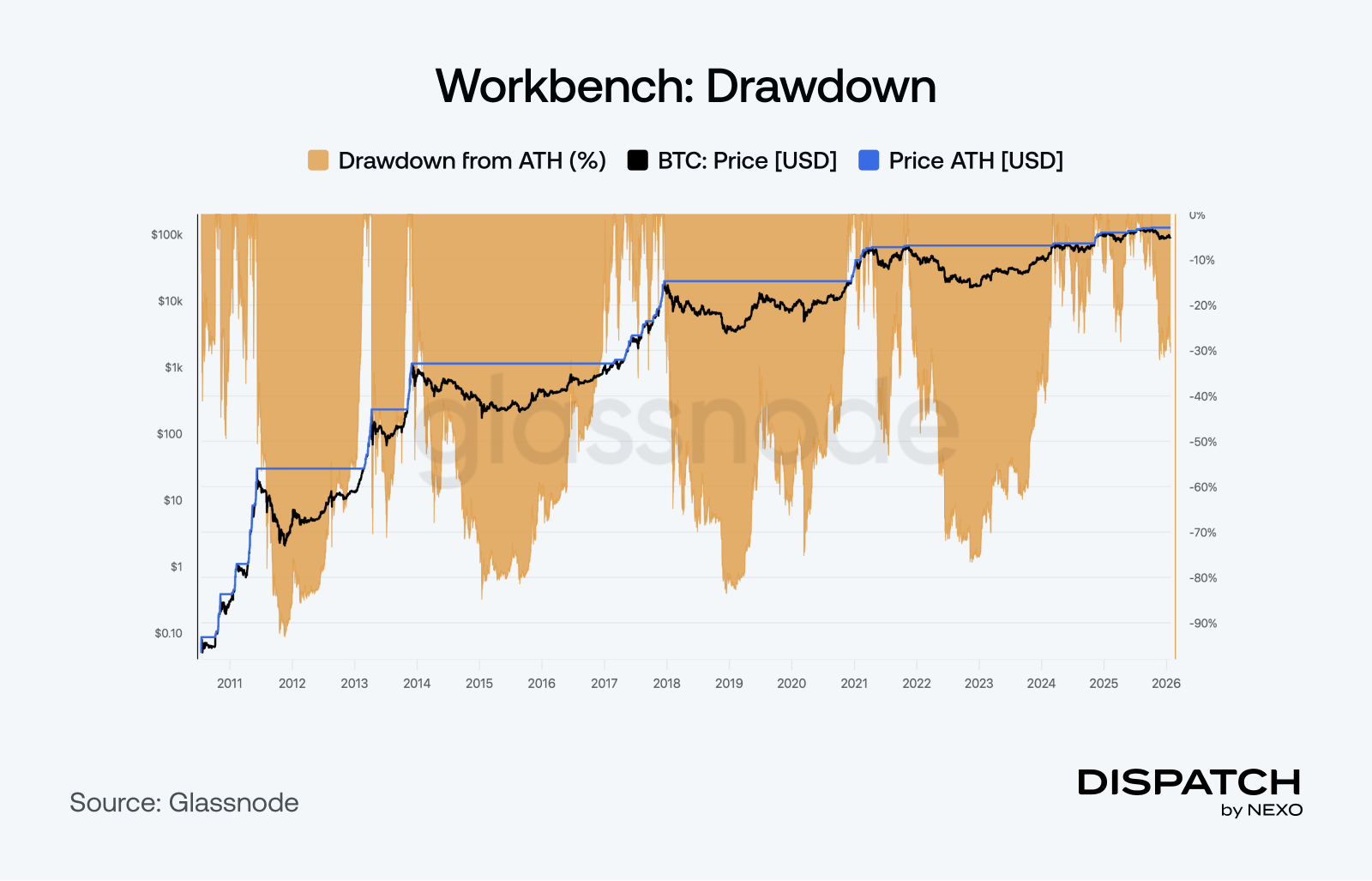

Bitcoin’s easing drawdowns

Bitcoin’s price action has been more active in recent weeks. Seven-day annualised volatility rose from around 21% in early January to nearly 39% by January 20, before easing back toward the mid-20s – a reminder that short-term swings remain part of the market’s character. Stepping back, however, puts that movement into perspective. Since the ETF-led rally began in October 2023, Bitcoin has avoided the deep drawdowns that defined earlier cycles. The largest pullback from prior all-time highs has been roughly 40%, a clear improvement from the near-70% decline seen in late 2022, and a sign that downside risk has become more contained. That shift reflects a market structure that has gradually strengthened. Long-term holders continue to anchor supply, while growing corporate balance-sheet demand has added a new layer of support.

Hot topic

What the community is discussing

Respect to our community – each and every NEXO-holder.

Here come the Bitcoin whales.

That’s bullish, right?

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].