Introducing LeverEdge: Trade short-term market moves with zero fees

Aug 21, 2025•3 min read

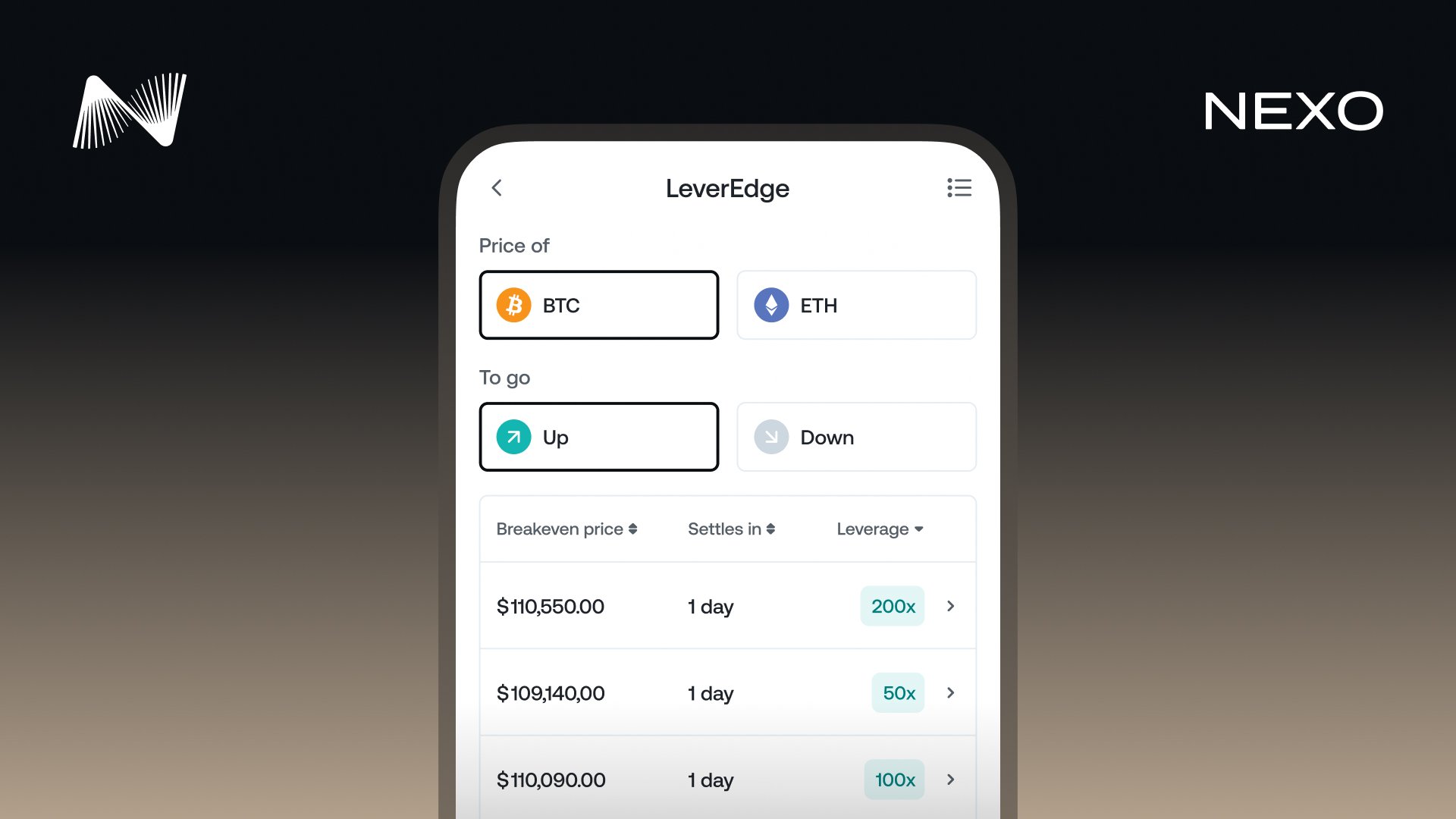

LeverEdge is Nexo’s latest product — a new way to act on short-term market movements in BTC or ETH with up to 200x leverage, no fees, and no forced liquidation before settlement.

Whether you anticipate the market going up or down, LeverEdge lets you select predefined strategies that match your view while knowing one key fact: you can only lose what you allocate.

If you’re looking to amplify exposure without margin management or liquidation events, LeverEdge offers a more straightforward approach.

How LeverEdge works

LeverEdge uses built-in leverage to amplify your potential profit or loss (PnL) based on BTC or ETH price movements. Here, leverage simply means your PnL changes proportionally more for each price movement.

For instance, with 100x leverage, a 1% change in the asset price equals roughly a 100% change in your PnL.

Unlike Futures, LeverEdge doesn’t involve borrowed funds or maintenance margin. You allocate a fixed amount, choose your direction, and let the strategy run its course. There’s no realized loss before settlement — and no fees along the way.

Each strategy is defined by:

- The asset: BTC or ETH

- The direction: up (bullish) or down (bearish)

- The allocation currency: BTC, ETH, or USDC

- A predefined breakeven price, leverage multiplier, and duration (1–30 days)

Your result depends on the asset’s price at the end of the strategy.

A practical example

Let’s say you allocate 1,000 USDC to a 7-day, 50x BTC-Up strategy with a breakeven price of $100,000.

- If BTC settles at $102,000, you receive your 1,000 USDC plus a leveraged return.

- If BTC closes below $100,000, your result decreases in proportion to the drop.

- Whatever happens, your maximum loss is capped at 1,000 USDC.

Formula: Payoff = Allocation + [ Allocation × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price ]

Example outcome: 1,000 USDC + (1,000 × 50 × 0.02) = 2,000 USDC total return.

What makes LeverEdge different

- Zero fees — no subscription, redemption, or funding charges.

- Up to 200x leverage — act on short-term trends with minimal capital.

- Risk capped at allocation — you can never lose more than you put in.

- Early redemption — close your strategy before settlement to lock in profits or cut losses.

- Predefined structure — choose from curated strategies with fixed duration and breakeven levels.

- PnL projection — see your potential outcomes before subscribing.

LeverEdge vs. Futures

Both LeverEdge and Futures let you capitalize on market direction. They simply approach leverage differently.

.png)

If you enjoy precise order tools and continuous control, Futures let you manage every move.

If you prefer defined outcomes, zero fees, and capped downside, LeverEdge gives you that clarity from the start.

How to start

- Complete a short quiz (required in some jurisdictions*).

- Add funds in BTC, ETH, USDT, or USDC.

- Choose your strategy — asset, direction, and one of the predefined options that fit your view.

Frequently asked questions.

Can I lose more than I allocate? No. The amount you allocate is the maximum you can lose.

Are there fees? No. There are no subscription, funding, or redemption fees.

Can I exit early? Yes. You can redeem early if your projected payoff is at least $10 — available after 2 hours and until 5 minutes before expiry.

Is this the same as Futures? No. LeverEdge has predefined outcomes, no margin, and no liquidation risk. You can only lose what you allocate.

Does it work for ETH, too? Yes. You can select ETH strategies in addition to BTC.

Before you start.

The content and examples presented in this article are for informational and educational purposes only and include no warranties. They should not be interpreted as financial advice or a recommendation to engage in transactions involving specific assets. Please note that digital assets are volatile, and the value of the funds you subscribed with may fluctuate with market conditions. LeverEdge does not guarantee any returns, as all outcomes depend entirely on the price movement of digital assets. You may lose the full amount you subscribe to. Please use advanced earning strategies responsibly.

*The LeverEdge product is unavailable for clients residing in Australia, the United Kingdom, the United Arab Emirates, and some countries in the EEA.