How to Do Your Nexo Taxes with Koinly

Feb 22, 2024•4 min read

Wherever you live, your tax office wants you to declare your crypto investments including any capital gains and your income from crypto. If your tax deadline is looming, don’t worry, we’ve got everything you need to know about how to do your crypto taxes for transactions made on Nexo with crypto tax calculator Koinly.

How to calculate and report your crypto taxes

There are two main ways to calculate and report your crypto taxes; you can do it yourself by calculating each taxable transaction, or use a crypto tax calculator to do it for you.

If you’re calculating your crypto taxes yourself, you’ll need to:

- Identify each taxable crypto transaction throughout the financial year you’re reporting on. You’ll need to do this not only for your Nexo transactions, but for each exchange, wallet, or blockchain you use.

- Figure out whether your transaction would be subject to Capital Gains Tax or Income Tax.

- Identify the cost basis of your crypto, or the fair market value on the day you received it, including the fair market value of any crypto income in your fiat currency on the day you received it.

- Calculate your subsequent capital gains and losses throughout the financial year, as well as separate these into your short and long-term capital gains and losses if applicable in your country.

- Report all of this to your tax office, usually with additional forms to complete beyond your annual tax return.

That’s a lot of work that most investors don’t have the time to bother with, that’s why Nexo has partnered with Koinly to make your crypto tax simple.

All you need to do is import your Nexo transaction history into Koinly and it’ll calculate your capital gains, losses, income, and more from your Nexo transactions. There are two ways you can do this, and we’ll cover how to do both step by step.

1. Sign up for your free Koinly account and connect your Nexo account to Koinly

Nexo connects to Koinly via SSO or you can upload a CSV file of your transaction history.'

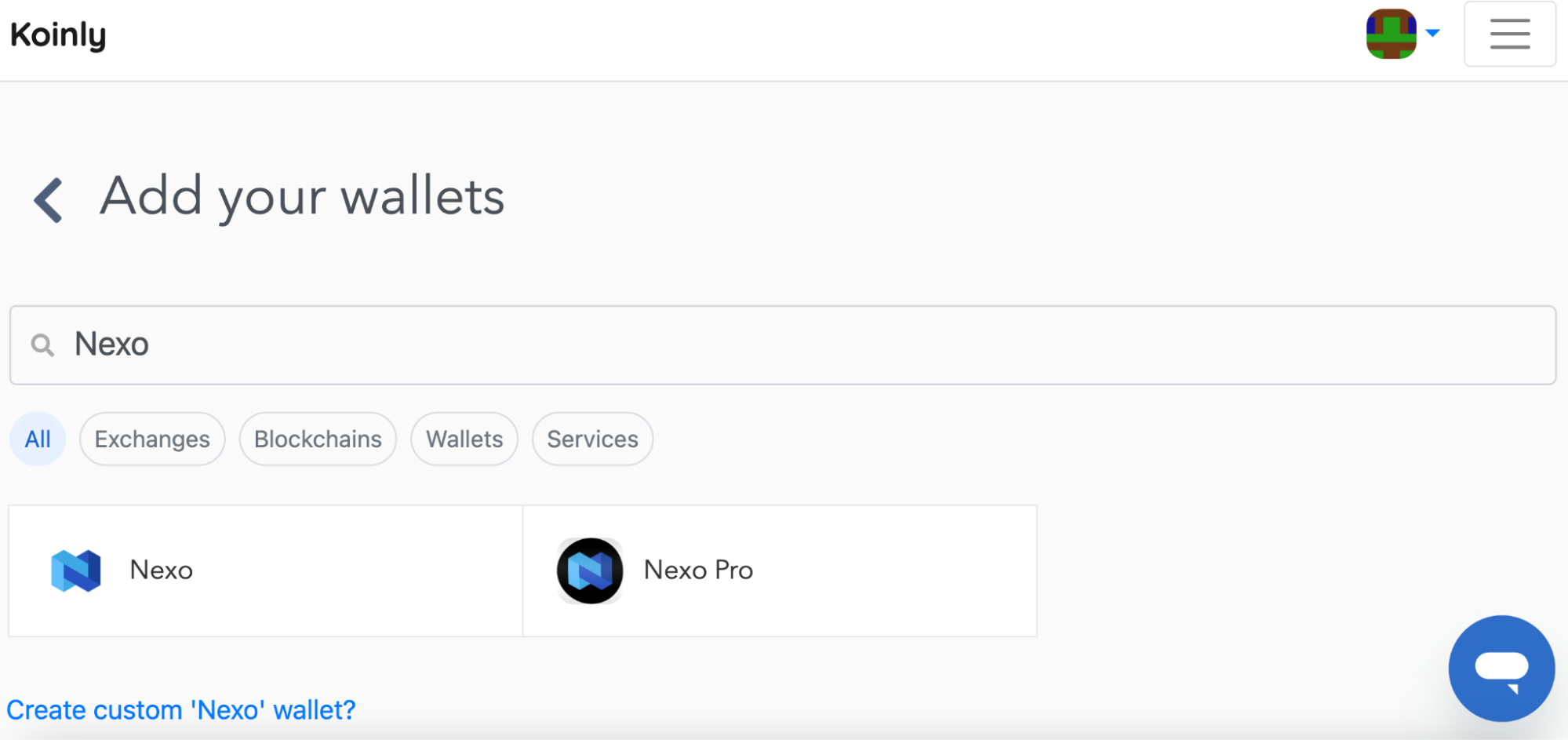

For single sign-on (SSO) it’s as simple as heading to the wallets page in Koinly and searching for Nexo.

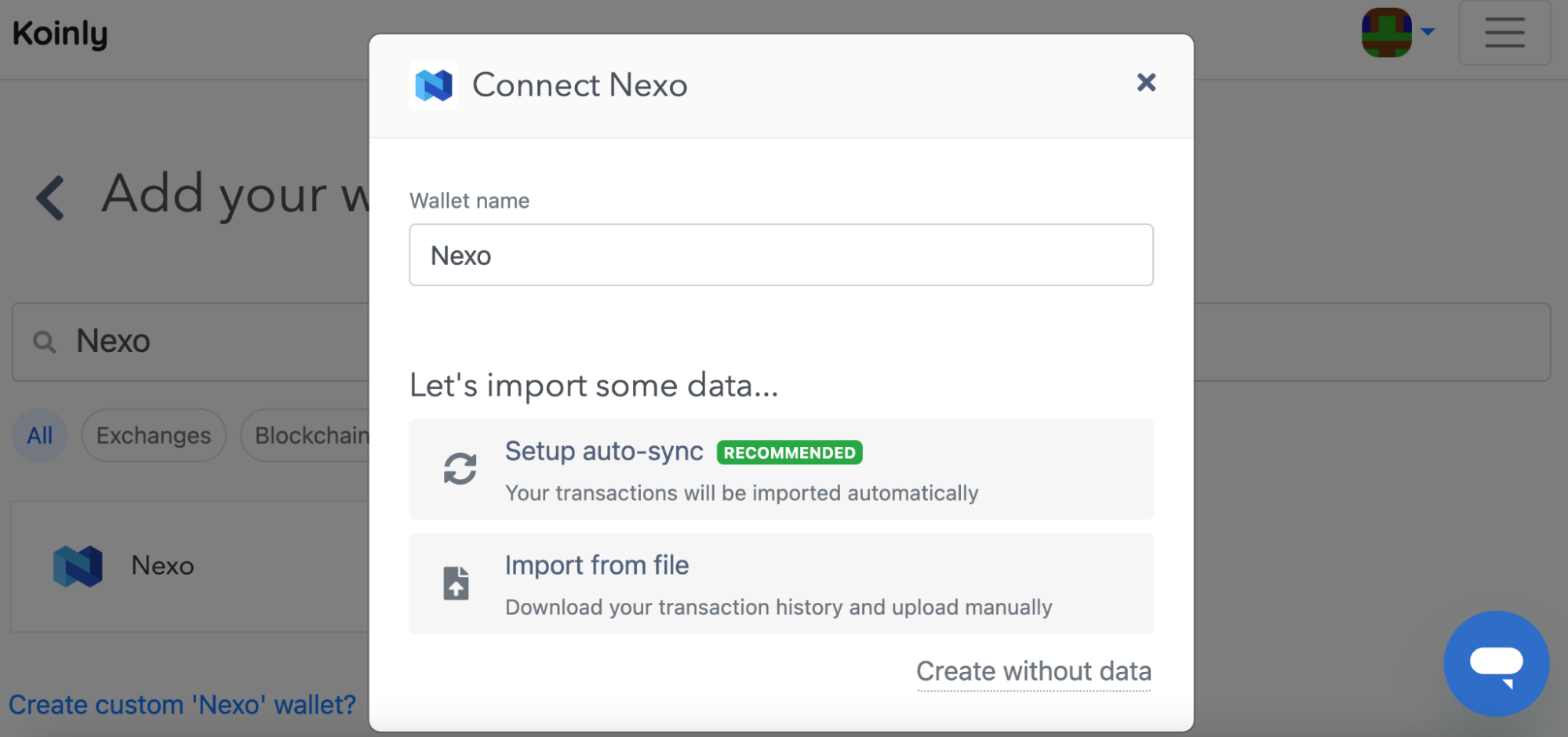

From here, select set up auto-sync and then continue to Nexo.

You’ll be taken to the Nexo site to grant read-only permissions for Koinly, and Koinly will automatically import your Nexo transaction data via API.

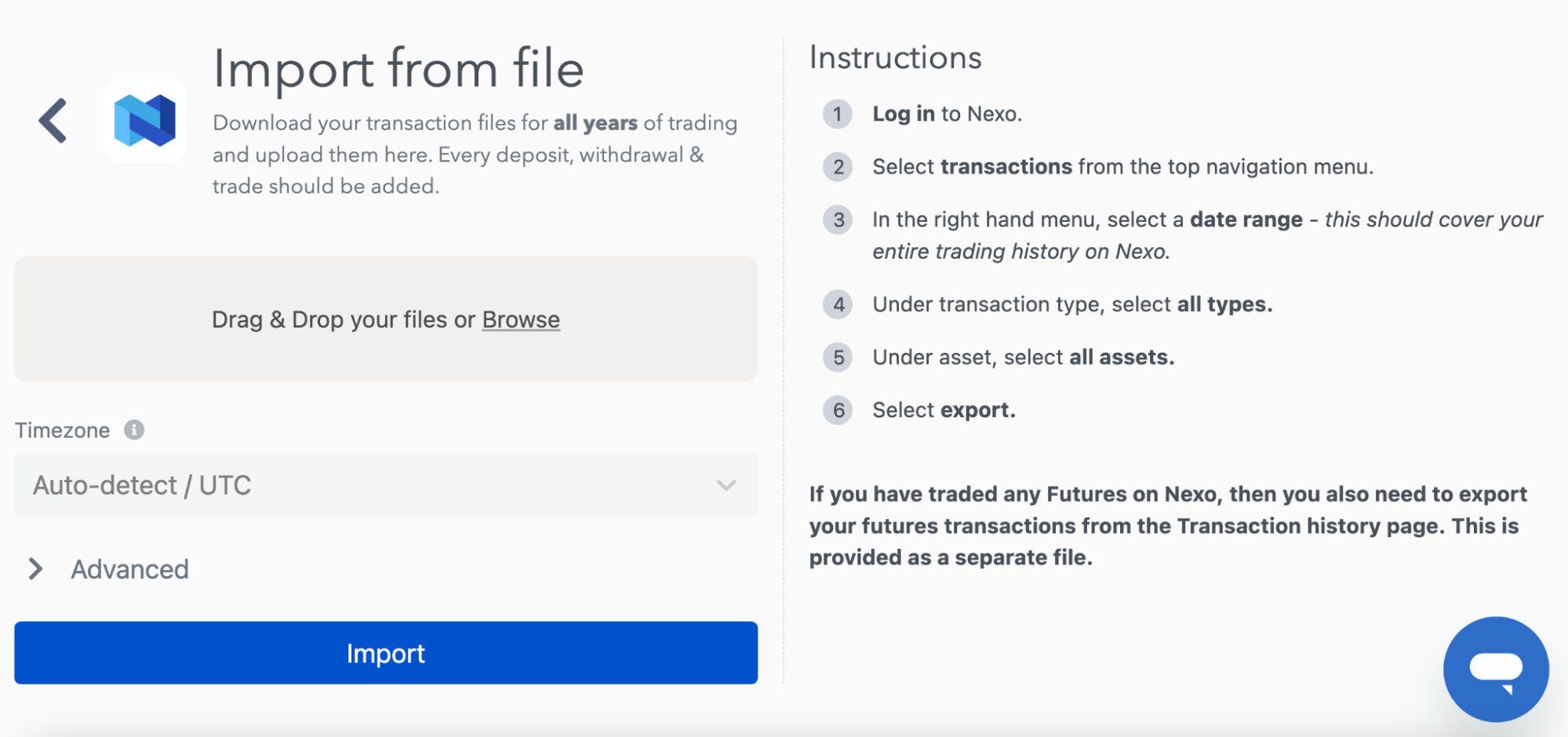

If you'd rather manually import your transactions via CSV, you can export a CSV file of your transaction history from Nexo. Just log in to Nexo, and select transactions in the top menu. In the menu on the right, select a date range that covers your entire Nexo trading history. Under transaction type and assets, make sure all types and all assets are selected. Once you’ve done all this, hit export and you’ll export your Nexo transaction history file. Once you have your file, head into Koinly, search for Nexo on the wallets page, and select import from file to upload your CSV.

Remember, you’ll need to do this for Nexo and every other exchange, wallet, or blockchain you use to ensure Koinly can calculate your crypto taxes correctly.

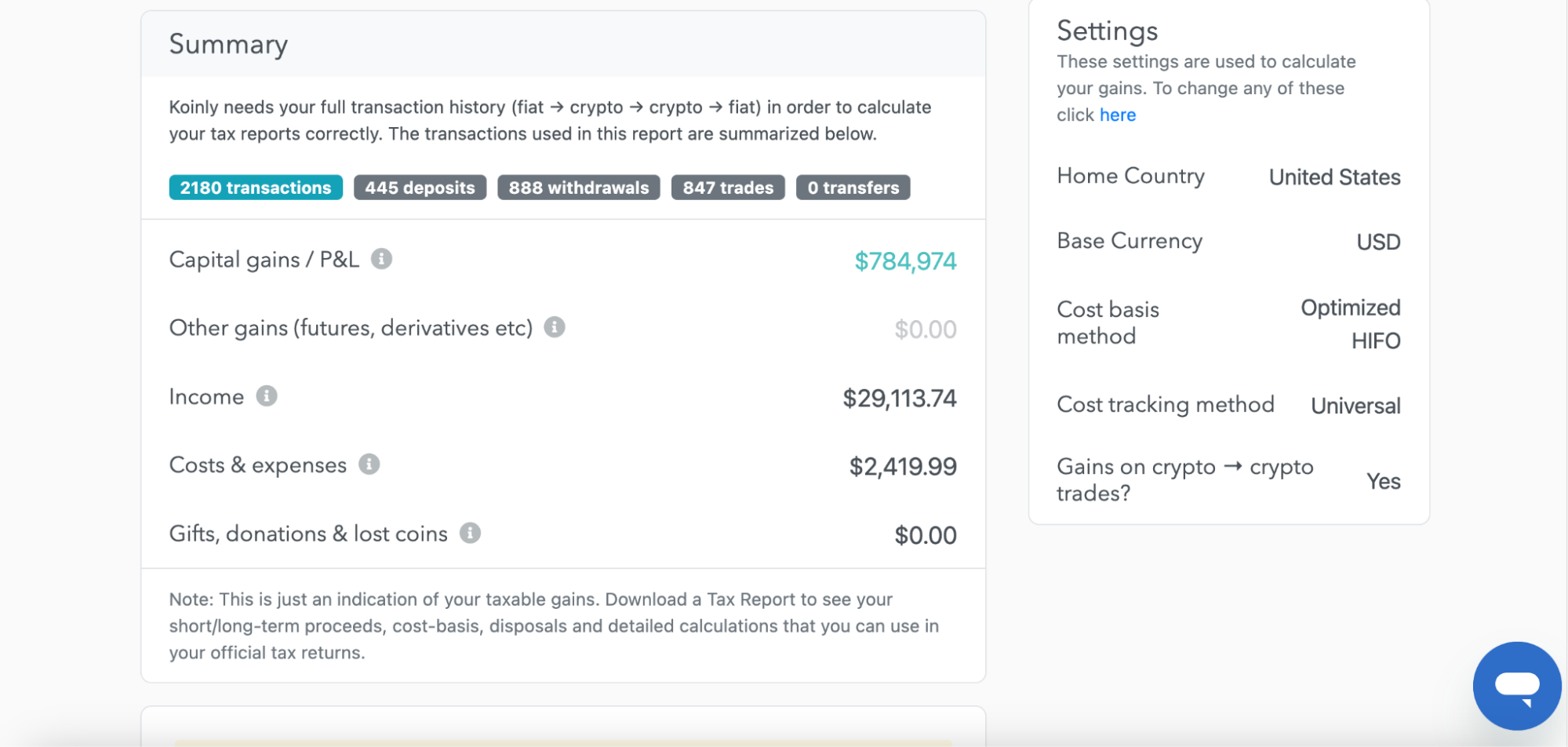

2. Let Koinly calculate your capital gains, losses, and income

Once it's got your transaction data, Koinly will get to work calculating your crypto taxes. Here’s what goes on under the hood:

- Koinly identifies the cost basis of your crypto assets, or the fair market value of assets on the day you received them.

- Koinly identifies your taxable transactions and categorizes your transactions into different types of income based on your location and settings.

- Koinly calculates your capital gains or losses throughout the financial year using the approved cost basis method for your country, as well as separates your short and long-term capital gains and losses if applicable.

- For crypto income, Koinly identifies the fair market value of any tokens in your chosen fiat currency on the day you received them.

All this information gets compiled into one, simple tax summary available free of charge on the tax reports page.

3. Download your crypto tax report

Once you've checked your tax summary and are happy with it, just download the tax report you want when you need it – have in mind that you will need to upgrade your plan to do this. A list of Koinly’s paid plans and pricing is available here. Koinly offers a variety of crypto tax reports for investors around the world including the ATO myTax Report, HMRC Capital Gains Tax Summary, and the Complete Tax Report that can help you file in multiple European countries.

(cta-block: If you want to sign up for Koinly, Nexo users receive an exclusive discount on all Koinly plans. When using the automated integration on Nexo, users get their first 800 transactions FREE. title: Tip button: Sign up link: https://app.koinly.io/signup?utm_source=nexo&utm_medium=guest_blog)