Dispatch #267: Bitcoin and gold — two paths to the ultimate hedge

Oct 22, 2025•6 min read

In this patch of your weekly Dispatch:

A big Ethereum upgrade

A crucial inflation report

Bitcoin’s realized volatility

Market cast

BTC: Navigating in a tight range

On the weekly chart, Bitcoin is testing the middle Bollinger Band, a key volatility-based indicator that often acts as a pivot for trend confirmation. A close below this level could invite further downside, while a successful hold would keep the broader bullish structure intact. The RSI and Stochastic oscillators, both momentum indicators, are neutral but trending lower, hinting at early signs of weakening buying pressure. Meanwhile, the MACD histogram, a measure of trend strength and direction, remains below the zero line, reinforcing a cautious tone. The daily chart mirrors this setup, with momentum indicators drifting lower and the MACD still in negative territory. In the near term, support sits around 112,000 and 110,000, while resistance remains capped near 115,000 and 117,000.

The big idea

A tale of two stores of value

Gold has reclaimed the spotlight. Trading within a few percent of its all-time high of $4,370 per ounce and boasting a market capitalization close to $30 trillion, the yellow metal has become the market’s ultimate refuge amid tariffs, inflation fears, and geopolitical tension. Central banks have added more than 1,000 tonnes to their reserves this year, while gold ETFs recorded an unprecedented $26 billion in inflows. From Asia’s bullion counters to Western investment desks, the gold rush is global.

But the higher the line at the gold dealer, the nearer we may be to the cycle’s top. Gold’s 63% year-to-date rally has pushed it deep into overbought territory across every timeframe — prompting calls that a pullback may be due. The BTC-to-gold ratio has fallen to its lowest level since 2018—a zone that has historically marked turning points for Bitcoin, preceding rallies between 100% and 600%, as gold saw its biggest one-day tumble since 2013.

Gold’s dominance reflects trust in history; Bitcoin’s resilience reflects trust in mathematics. The metal’s scarcity is geological; Bitcoin’s is algorithmic—fixed at 21 million coins, immune to politics, printing, or policy pivots. Amid geopolitical tensions and monetary shifts, gold tends to lead. But when liquidity and confidence return, Bitcoin often follows with force. Standard Chartered sees that path widening, with its digital assets chief forecasting Bitcoin could climb to $200,000 by year-end.

Interestingly, gold’s latest rally is also fueling its digital evolution. The market for tokenized gold—digital assets backed by physical reserves—has surged to nearly $3.4 billion in 2025, up from just $500 million early in the year. Products like PAX Gold (PAXG) allow investors to hold verifiable, fractional ownership of physical bullion, combining the reliability of gold with the flexibility of blockchain. Average daily trading in tokenized gold has doubled year-over-year, showing that the boundary between traditional and digital value is fast dissolving.

This convergence between gold and crypto underscores a deeper truth: value itself is being redefined. Gold’s appeal endures because it’s tangible and time-tested; Bitcoin’s grows because it’s borderless and self-sovereign. Together, they represent a spectrum of hard assets for an uncertain world.

And for those seeking balance between the two—both timeless and tokenized—Nexo offers access to gold and Bitcoin alike, where the old hedge meets the new.

Ethereum

ETH’s biggest upgrade in years

Ethereum is priming for its biggest leap since the Merge. The Fusaka upgrade, now live on testnets, promises to make the network faster, cheaper, and massively more scalable. By raising the block gas limit to 60 million and rolling out PeerDAS, a new data-sharing system, Ethereum could process far more transactions while slashing costs — giving rollups like Arbitrum and Base “room to breathe.”

Developers say the changes could unlock 100x scaling, with a mainnet launch expected by December. If the Merge made Ethereum greener, Fusaka could make it unstoppable — the backbone for global finance and next-gen fintech.

Meanwhile, ETH is up 15% from recent lows, bouncing into a bull-flag pattern that points toward $4,500 if momentum holds.

Fusaka might be about scaling code — but traders are asking the real question: will it scale the price too?

TradFi trends

Could this be Bitcoin’s biggest move in TradFi?

Florida is back with a serious bid to put Bitcoin on the state’s books. A new bill, HB 183, would let the state invest up to 10% of its public and pension funds — including the $218 billion Florida Retirement System — in digital assets and crypto ETFs.

Unlike last year’s symbolic effort, this version reads like a playbook. It details custody rules, security standards, and audit protocols, even spelling out what happens if the state loses control of its private keys. The move follows a wave of state-level Bitcoin reserve bills across the U.S., as policymakers explore BTC as a hedge against inflation and a complement to traditional reserves.

It’s not a mandate yet, but even a 1% pilot allocation would mean $2.2 billion in new demand (larger than daily ETF flows) — and a landmark moment for crypto’s march into state finance.

Macroeconomic roundup

How big will be the Fed’s next cut?

The Federal Reserve looks poised to ease up — both on rates and its balance-sheet runoff. Speaking in Philadelphia, Jerome Powell hinted that the Fed is nearing the end of its quantitative tightening cycle, saying reserves are now “somewhat above ample” levels. Translation: liquidity is about to loosen.

Markets are betting on more cuts after September’s 25 bps move, with the Fed now split between another 25 or 50 basis-point reduction at its next meeting. Powell acknowledged the growing risks, warning that if the Fed moves “too slowly, there may be unnecessary, painful losses in the employment market.”

Now, all eyes are on Friday’s Consumer Price Index, the first major data release since the U.S. government shutdown. Consensus expects inflation to tick up to 3.1% from 2.9%, though alternative data from Truflation points to a lower 2.3%

The week’s most interesting data story

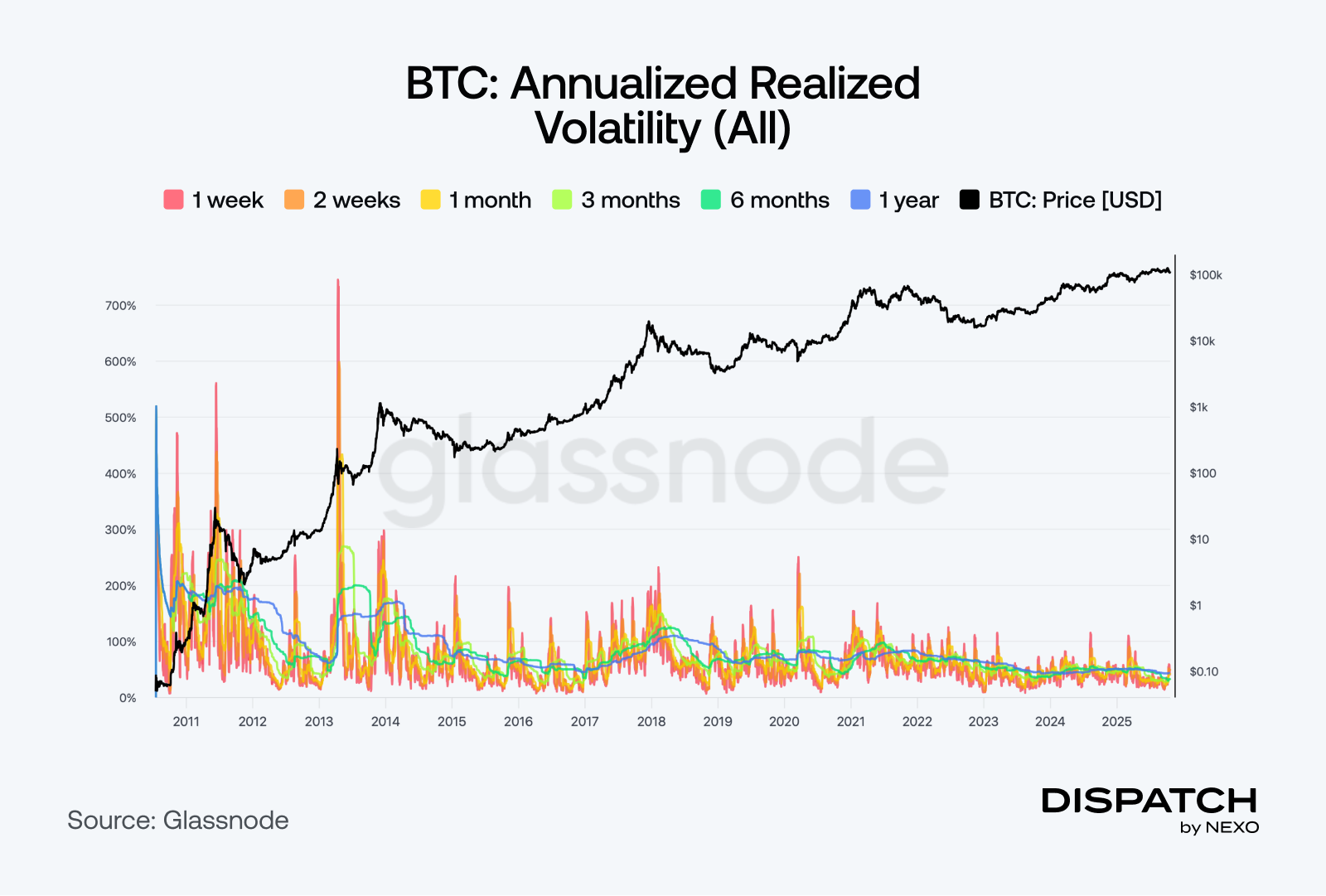

Bitcoin’s true sign of maturity

Volatility might be Bitcoin’s oldest stereotype, especially with the latest price moves — but when viewed technically, it’s starting to look outdated. While gold grabs headlines for stability, Bitcoin’s realized volatility has been quietly falling across all time frames, now trending toward its lowest levels on record. That’s not just a technical note; it’s a narrative shift. The world’s most famously volatile asset is behaving less like a roller coaster and more like a reserve — perhaps the clearest sign yet that Bitcoin is maturing into the asset it was meant to rival.

The numbers

The week’s most interesting numbers

- $110 billion — The combined value of Bitcoin held by public companies, totaling 1,045,887 BTC.

- $7 billion — Solana’s total ecosystem fees generated over the past 12 months, ranking second behind Ethereum’s $20 billion.

- 500% — Grok 4’s one-day gain after flipping from shorts to longs at the market’s bottom, topping rival bots in a trading contest.

- $1.5 billion — The amount of Ether bought by BitMine Immersion Technologies after the market crash, boosting its holdings to 2.5% of total supply.

- $300 trillion — The amount of PYUSD Paxos accidentally minted on Ethereum before burning it within minutes.

Hot topic

What the community is discussing

Can we call it a market reset?

A more measured look at gold’s recent performance.

We’d like to think we are simply still early.

Dispatch is a weekly publication by Nexo, designed to help you navigate and take action in the evolving world of digital assets. To share your Dispatch suggestions and comments, email us at [email protected].