Przejmij kontrolę nad doświadczeniem. Zachowaj swoje krypto.

Kupuj, sprzedawaj lub czarteruj luksusowe jednostki światowej klasy bezpośrednio za pomocą krypto.

od 2018 roku

obsługa klienta 24/7

ponad 11 miliardów USD

Kupuj, sprzedawaj lub czarteruj luksusowe jednostki światowej klasy bezpośrednio za pomocą krypto.

Zakupy o wysokiej wartości, takie jak superjachty, zwykle oznaczają długie procesy zatwierdzania, opóźnienia i całą masę formalności.

Nexo wypełnia tę lukę. Kup lub wyczarteruj luksusowy jacht bez sprzedawania krypto. Pożyczaj pod zastaw swoich aktywów i utrzymaj potencjał wzrostu portfolio.

Dla brokerów luksusowych podróży, agentów czarterowych i stoczni Nexo umożliwia sprzedaż od ręki dzięki automatycznym konwersjom z kryptowalut na waluty fiat.

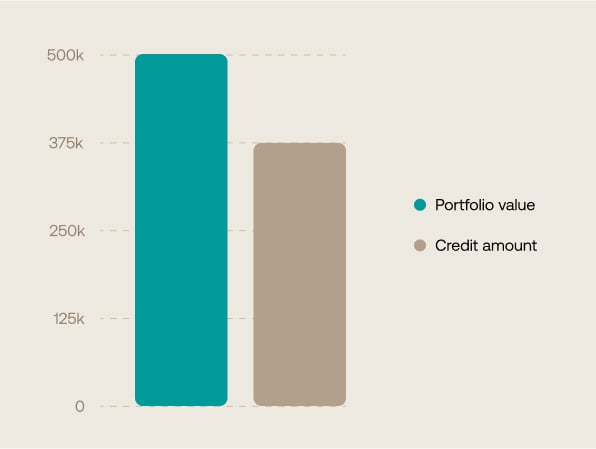

Uzyskaj płynność potrzebną, aby kupić lub wyczarterować wymarzony superjacht.

Pożycz do 100 milionów USD, używając BTC lub ETH jako zabezpieczenia.

Skaluj płynność na własnych warunkach dzięki pojedynczej linii kredytowej obejmującej całe Twoje portfolio.

Stocznie, specjaliści ds. czarteru i kupujący dobrze wiedzą, jak powolne i złożone potrafi być tradycyjne finansowanie jachtów. Zamiast tego, dzięki Zero-interest Crypto Credit od Nexo, zyskujesz dostęp do płynności bez długich procesów zatwierdzania i papierologii.

1. Trzymaj kwalifikujące się aktywa, takie jak ETH, BTC, XRP i SOL, na koncie Nexo.

2. Poproś swojego doradcę klienta o ofertę Zero-interest Crypto Credit (ZICC) i podpisz aneks ZICC.

3. Otrzymaj do 100 milionów USD w aktywach cyfrowych. Zostaną Ci dostarczone w ciągu 24 godzin.

4. Przelej fundusze na swoje konto bankowe. Czas realizacji może się różnić w zależności od kwoty i jurysdykcji.

5. Możesz kupić lub wyczarterować luksusowy jacht.

Efekt

Finansowanie jest dostarczane tego samego dnia i zabezpieczane Twoimi aktywami cyfrowymi. Cały proces jest dyskretny, osobisty i oparty na zaufaniu.1. Wstępnie zakwalifikuj się do finansowania u kredytodawcy specjalizującego się w finansowaniu jachtów. Wymaga sprawozdań finansowych poddanych audytowi, weryfikacji kredytowej i ujawnienia dochodów.

2. Przejdź proces oceny kredytowej i szczegółowy przegląd aktywów (1–2 tyg.).

3. Przeprowadź inspekcję, wycenę i weryfikacje prawne (1-3 tyg.).

4. Utwórz spółkę celową (SPV) lub podmiot korporacyjny do celów własności, uzyskaj ubezpieczenie i zarejestruj hipotekę w rejestrze okrętów.

5. Poczekaj na zgody bankowe i prawne, aby sfinalizować transakcję.

Efekt

Przewidywany czas to 3–6 tygodni, choć często może to ulec wydłużeniu. Proces obejmuje ustanowienie zabezpieczenia na aktywach, koordynację z podmiotami trzecimi i obszerną dokumentację.Korzystaj z szeregu ekskluzywnych korzyści i rozwiązań zarezerwowanych dla klientów prywatnych.

Jako główny punkt kontaktu, osobisty doradca klienta przedstawi analizę wszelkich nadarzających się okazji lub związanych z nimi wymagań. Wiedza ekspertów zawsze na wyciągnięcie ręki, wystarczy, że do nas zadzwonisz.

Upraszczamy zarządzanie aktywami cyfrowymi dzięki spersonalizowanemu wdrażaniu. Nasz zespół zapewnia narzędzia niezbędne do utrzymania przewagi konkurencyjnej na rynku.

Każde Twoje zlecenie będzie priorytetowe, więc nigdy nie będziesz czekać w kolejce. W razie pytań skontaktuj się z nami – zapewniamy sprawną i profesjonalną pomoc.

Bądź na bieżąco z najważniejszymi wydarzeniami branżowymi i spotkaniami organizowanymi przez Nexo. Twój osobisty doradca klienta poinformuje Cię o możliwości wzięcia udziału w wydarzeniu.